- Location

- Stoneleigh

After attending a crop trials open day yesterday, I was pleased to hear from fellow attendees that the domestic rapeseed crops they’d seen were faring a little better than last season. Cabbage stem flea beetle reports suggest, whilst still present, damage has been lesser somewhat. This isn’t to say we are expected a bumper crop, far from it, with the planted area lower than last season. But how could the import programme pan out with EU and the UK both in production deficits versus demand?

41% of the GB winter OSR crop was in ‘Good’ to ‘Excellent’ condition back in March. This was much better than the 2020 crop rating of 26% back in March 2020. Reportedly, frosts in early April may have affected the early maturing crops, though we await the next crop condition report in a couple weeks for the final picture.

A range of 1.015Mt – 1.045Mt is a rough estimate for a production figure based on a 2%-5% rise to the estimated five year average yield of 3.25t/ha. This is based on a harvested area of 307.3Kha (using the USDA FAS forecast of a 1.88% cut then applied to the EBS area estimate of 312Kha). Stratégie Grains expect UK demand at 1.7Mt, requiring c.640Kt to be imported this season.

A range of 1.015Mt – 1.045Mt is a rough estimate for a production figure based on a 2%-5% rise to the estimated five year average yield of 3.25t/ha. This is based on a harvested area of 307.3Kha, using the USDA FAS forecast of a 1.88% cut to the EBS area estimate of 312Kha. Stratégie Grains expect UK demand at 1.7Mt, requiring c.640Kt to be imported this season.

Stratégie Grains raised its forecast to 17.0Mt for the EU-27 rapeseed crop in its monthly report, owing to a better Romanian crop. Imports were unchanged and are expected at 6.4Mt. The surplus is expected at 0.1Mt suggesting a very tight balance to European rapeseed markets next season.

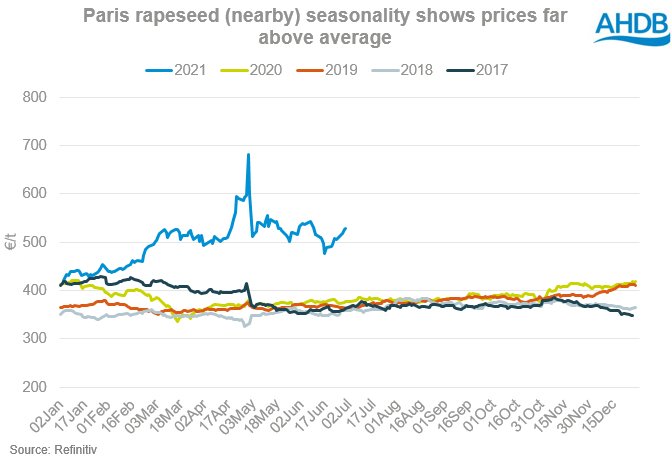

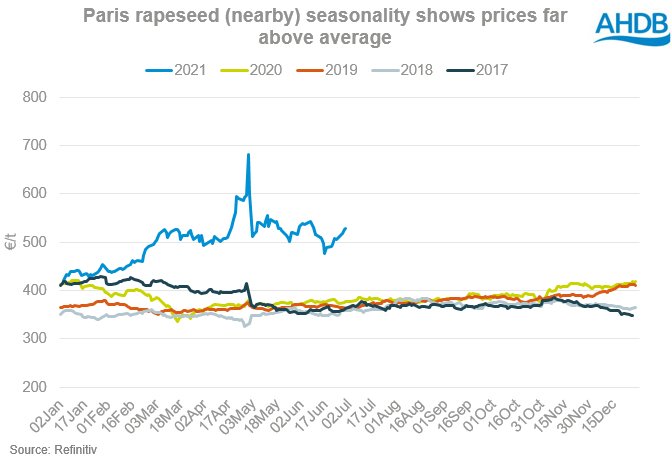

Weather conditions in the next few weeks will contribute considerably to sentiment for rapeseed prices, especially with harvest imminent for European countries. Forecast rains for the Black Sea over the next couple weeks if realised, will aid Ukrainian and Romanian rapeseed yields, adding a degree of pressure to prices. Support for prices will, in part, come from Canadian crop conditions. The current record-breaking heatwave in Western Canada is a key watch point, with fears of a detrimental water deficit for the canola crop.

2021/22 UK rapeseed imports – what could be coming home?

Join the 3.6K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch

41% of the GB winter OSR crop was in ‘Good’ to ‘Excellent’ condition back in March. This was much better than the 2020 crop rating of 26% back in March 2020. Reportedly, frosts in early April may have affected the early maturing crops, though we await the next crop condition report in a couple weeks for the final picture.

A range of 1.015Mt – 1.045Mt is a rough estimate for a production figure based on a 2%-5% rise to the estimated five year average yield of 3.25t/ha. This is based on a harvested area of 307.3Kha (using the USDA FAS forecast of a 1.88% cut then applied to the EBS area estimate of 312Kha). Stratégie Grains expect UK demand at 1.7Mt, requiring c.640Kt to be imported this season.

A range of 1.015Mt – 1.045Mt is a rough estimate for a production figure based on a 2%-5% rise to the estimated five year average yield of 3.25t/ha. This is based on a harvested area of 307.3Kha, using the USDA FAS forecast of a 1.88% cut to the EBS area estimate of 312Kha. Stratégie Grains expect UK demand at 1.7Mt, requiring c.640Kt to be imported this season.

Stratégie Grains raised its forecast to 17.0Mt for the EU-27 rapeseed crop in its monthly report, owing to a better Romanian crop. Imports were unchanged and are expected at 6.4Mt. The surplus is expected at 0.1Mt suggesting a very tight balance to European rapeseed markets next season.

Weather conditions in the next few weeks will contribute considerably to sentiment for rapeseed prices, especially with harvest imminent for European countries. Forecast rains for the Black Sea over the next couple weeks if realised, will aid Ukrainian and Romanian rapeseed yields, adding a degree of pressure to prices. Support for prices will, in part, come from Canadian crop conditions. The current record-breaking heatwave in Western Canada is a key watch point, with fears of a detrimental water deficit for the canola crop.

2021/22 UK rapeseed imports – what could be coming home?

Join the 3.6K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch