- Location

- Stoneleigh

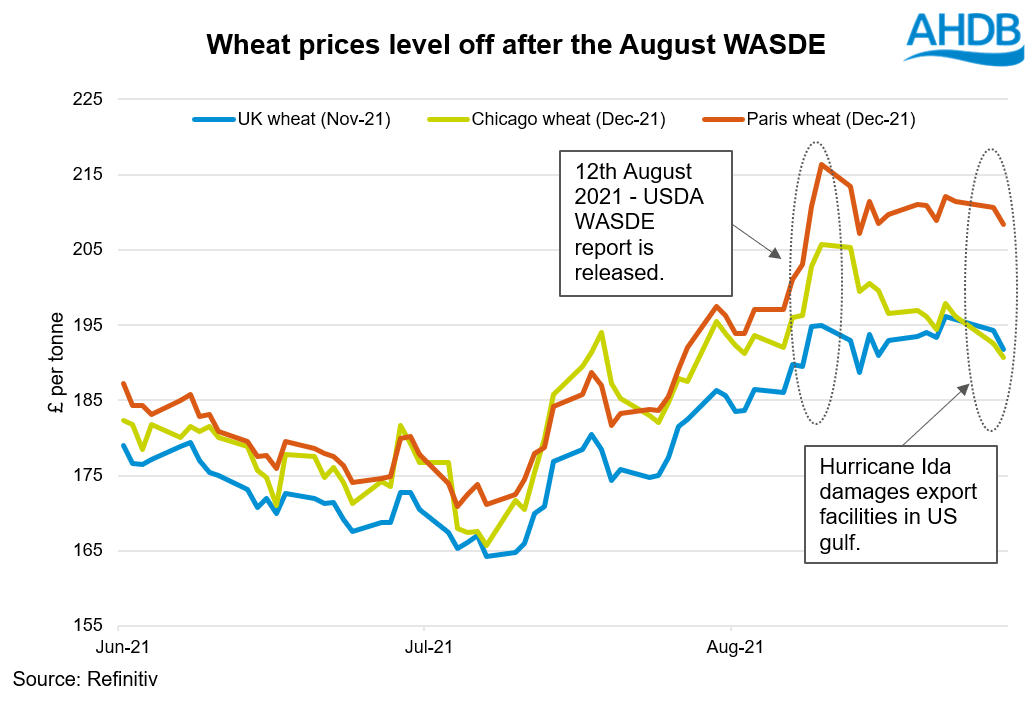

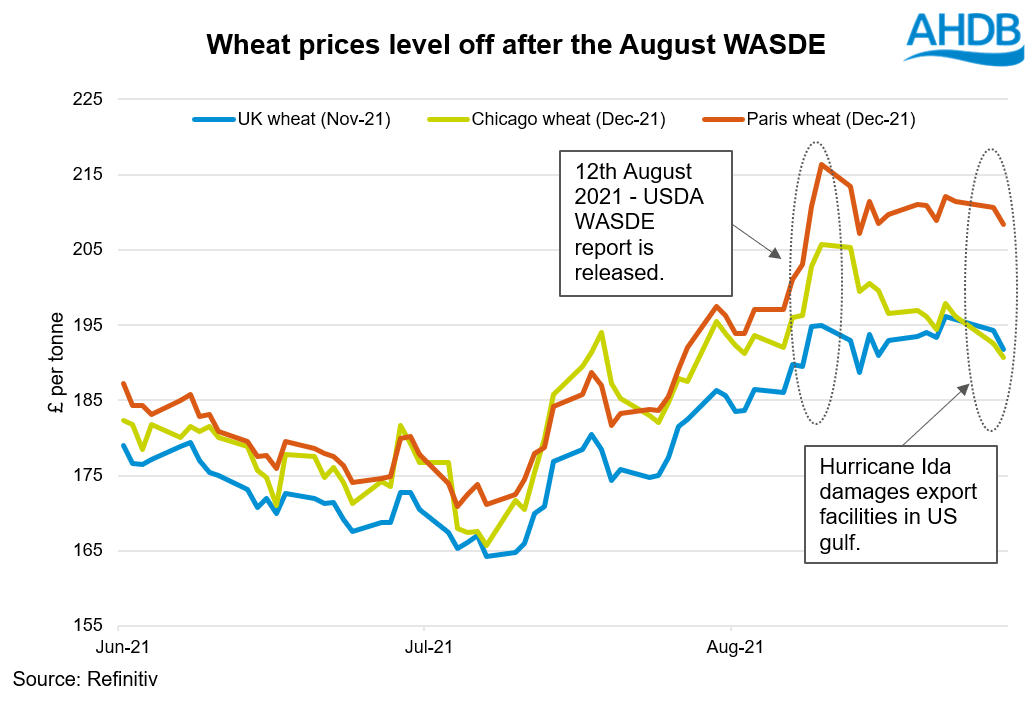

The month of August captured continued growth in wheat markets, as bullish market news such as the August USDA World Agriculture Supply & Demand (WASDE) report spurred the market. The domestic market followed this trend, with the Nov-21 contract starting the month closing at £186.35/t (02 Aug) and peaking at £196.10/t towards the end of the period (26 Aug).

This damage has meant that Chicago maize (Dec-21), wheat (Dec-21) and soyabeans (Nov-21) are down 5.1%, 2.1% & 3% in USD terms respectively since last Friday, based on yesterday’s close.

This has subsequently resulted in domestic pressure, with UK wheat futures (Nov-21) closing yesterday at £191.40/t, losing £4.35/t over the same period.

The next main piece of news will be the September USDA WASDE. This report is highly anticipated as the maize and soyabeans acreage will be reviewed, a month earlier than usual.

Moreover, the latest FAO cereal supply and demand brief, released yesterday, shadowed the global cuts to wheat. It pegged global wheat production at 769.5Mt and world stocks-to-use at 36.2%, down 15.2Mt and 1.6 percentage points respectively on July’s report.

Interestingly, the header of the report stated that ‘world cereal production and stocks revised down.’ However, following this statement with ‘…but overall supplies in 2021/22 remain adequate.’

Despite these reductions to wheat, coarse grain output for 2021/22 is still 19.4Mt (1.3%) higher than the previous year.

However, it’s still early days with a lot of information yet to come, such as US spring crop data and South American plantings of maize/soyabeans this autumn, with the potential impacts of a successive La Niña.

A weak week for wheat?

For information on price direction make sure to subscribe to Grain Market Daily’s and Market Report from our team.

A week of slight pressure?

However, the aftermath of Hurricane Ida has resulted in market pressure, following the damage caused to export terminal facilities in the US Gulf Coast. A disconnect in the supply chain, with grains and oilseeds being delayed to their respective markets, is now apparent and pressurising prices. How long this damage will be impactful is yet unknown, as assessments are ongoing. With US Gulf Coast ports responsible for over half (54%) of US grain and oilseed exports this year to date, a speedy return to full operational capacity is needed.This damage has meant that Chicago maize (Dec-21), wheat (Dec-21) and soyabeans (Nov-21) are down 5.1%, 2.1% & 3% in USD terms respectively since last Friday, based on yesterday’s close.

This has subsequently resulted in domestic pressure, with UK wheat futures (Nov-21) closing yesterday at £191.40/t, losing £4.35/t over the same period.

Where could it all go now?

With much of the bullish wheat news now priced into the market this means that fresh news will drive the short-term sentiment.The next main piece of news will be the September USDA WASDE. This report is highly anticipated as the maize and soyabeans acreage will be reviewed, a month earlier than usual.

Moreover, the latest FAO cereal supply and demand brief, released yesterday, shadowed the global cuts to wheat. It pegged global wheat production at 769.5Mt and world stocks-to-use at 36.2%, down 15.2Mt and 1.6 percentage points respectively on July’s report.

Interestingly, the header of the report stated that ‘world cereal production and stocks revised down.’ However, following this statement with ‘…but overall supplies in 2021/22 remain adequate.’

Despite these reductions to wheat, coarse grain output for 2021/22 is still 19.4Mt (1.3%) higher than the previous year.

However, it’s still early days with a lot of information yet to come, such as US spring crop data and South American plantings of maize/soyabeans this autumn, with the potential impacts of a successive La Niña.

A weak week for wheat?

For information on price direction make sure to subscribe to Grain Market Daily’s and Market Report from our team.