- Location

- Stoneleigh

The Black Sea region is vital to global wheat supply, hence the market reaction to the current situation. Between Russia and Ukraine, they account for 29% of global exports.

In Ukraine, over 73% (23.5Mt) of their 2021/22 wheat crop (32.0Mt) was expected to be exported (UkrAgroConsult). That equates to 12% of global wheat exports (USDA). According to UkrAgroConsult data, Jul-Feb 21st wheat exports total 18.5Mt. Ukrainian ports are currently closed, and Ukraine’s Maritime Administration said they will remain closed until the Russian invasion ends. Therefore, whether the final 5.0Mt will be exported is under question.

This will directly affect Indonesia and Egypt, the top 2 buyers of Ukrainian wheat. However, they will now be looking to source wheat from elsewhere when global stocks are already tight.

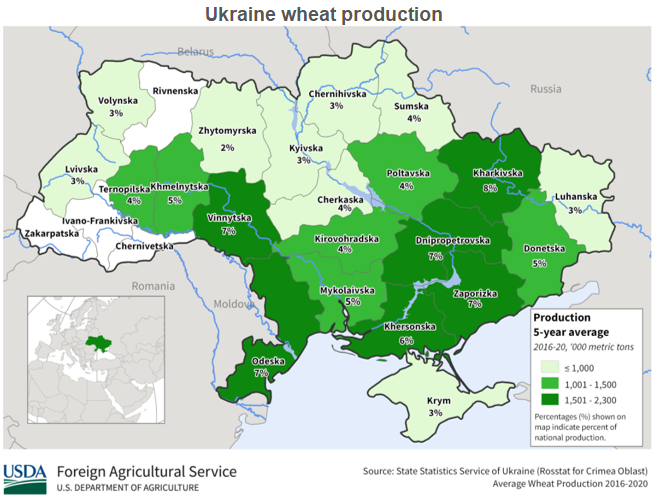

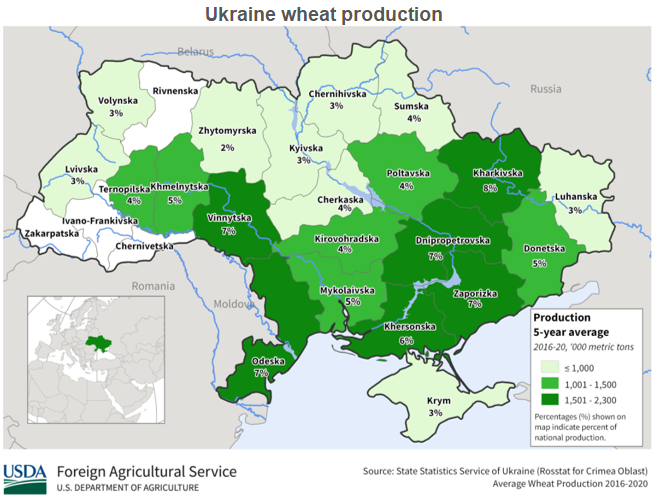

The map below shows where wheat is grown throughout Ukraine. Whilst Russian invasions are targeting cities, the knock-on effect is currently unquantifiable.

There could be limitations to fieldwork. Rightly so, farmers may well have bigger priorities. Availability of inputs (namely fuel and fertiliser) is also under question. Not only availability but cost too, which could impact farmers decisions. Therefore, crop potential could be hampered.

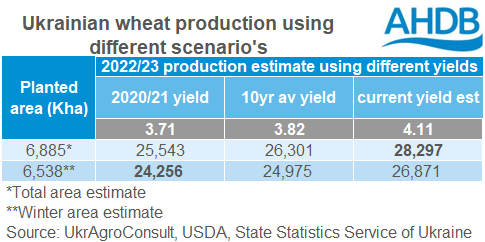

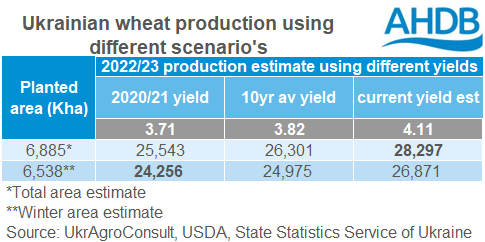

UkrAgroConsult estimated 2022/23 wheat production at 28.30Mt, already 11.6% down year-on-year (Feb-22, pre-invasion). Minimal inputs could knock yields back significantly. The table below demonstrates what differences could be seen in Ukrainian wheat production and therefore global supply in 2022/23. If only the winter wheat area (estimated by the State Statistics Service) makes it to harvest, and yields drop to 2020/21 levels, production would be cut by 4Mt.

If there is ongoing disruption in the Black Sea region it will inevitably continue to support UK prices into the new marketing year (2022/23).

Today's Grain Market Daily on our website: Bull run continues into 2022/23

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.

In Ukraine, over 73% (23.5Mt) of their 2021/22 wheat crop (32.0Mt) was expected to be exported (UkrAgroConsult). That equates to 12% of global wheat exports (USDA). According to UkrAgroConsult data, Jul-Feb 21st wheat exports total 18.5Mt. Ukrainian ports are currently closed, and Ukraine’s Maritime Administration said they will remain closed until the Russian invasion ends. Therefore, whether the final 5.0Mt will be exported is under question.

This will directly affect Indonesia and Egypt, the top 2 buyers of Ukrainian wheat. However, they will now be looking to source wheat from elsewhere when global stocks are already tight.

2022/23 wheat crop concerns

The Ukrainian State Statistics Service’s winter wheat plantings forecast is 6.54Mha, down 5.3% year-on-year. Although historically they have often underestimated plantings in February versus final estimates, these were made pre-invasion. This means they may not be revised up like they usually are. The winter crop makes up most of the Ukraine’s wheat area, so planting of the spring crop is less of a concern but maximising winter crop potential is.The map below shows where wheat is grown throughout Ukraine. Whilst Russian invasions are targeting cities, the knock-on effect is currently unquantifiable.

There could be limitations to fieldwork. Rightly so, farmers may well have bigger priorities. Availability of inputs (namely fuel and fertiliser) is also under question. Not only availability but cost too, which could impact farmers decisions. Therefore, crop potential could be hampered.

UkrAgroConsult estimated 2022/23 wheat production at 28.30Mt, already 11.6% down year-on-year (Feb-22, pre-invasion). Minimal inputs could knock yields back significantly. The table below demonstrates what differences could be seen in Ukrainian wheat production and therefore global supply in 2022/23. If only the winter wheat area (estimated by the State Statistics Service) makes it to harvest, and yields drop to 2020/21 levels, production would be cut by 4Mt.

What does this mean for the UK?

Linking back to the start, the Black Sea region is vital to global wheat supply, which will have a ripple effect. Yesterday, new-crop UK wheat futures (Nov-22) closed at £229.00/t, the highest close price ever for this contract. This morning, it has gained more ground, trading as high as £238.00/t (12.30pm).If there is ongoing disruption in the Black Sea region it will inevitably continue to support UK prices into the new marketing year (2022/23).

Today's Grain Market Daily on our website: Bull run continues into 2022/23

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.