Written by Iain Hoey

During the first 12 weeks of lockdown, British shoppers spent an extra £45m at butchers’ shops than in the same period last year, according to the latest Kantar data.

The number of independent butchers in the UK has reduced dramatically over the last 25 years, as people moved away from the high street to large supermarkets. Lockdown has reversed that trend to some extent as people have rediscovered their local butchers’ shop, AHDB retail insights manager Rebecca Gladman reported.

This increase, equating to a volume uplift of 39% during the 12 weeks ending 14 June, came as people adapted to social-distancing rules by shopping locally and visiting large supermarkets less often.

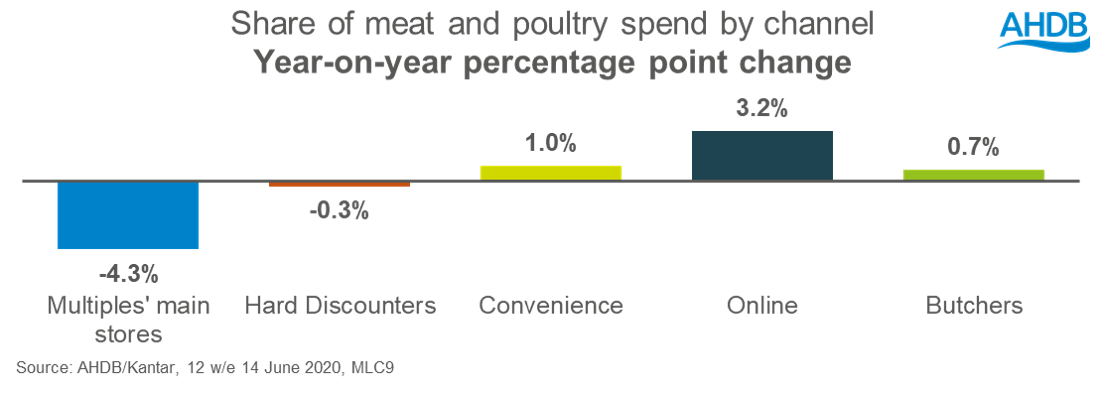

While the online channel has made big gains under lockdown, butchers have also experienced consistent growth within the meat and poultry category. This allowed their share of spend on meat and poultry to increase to 3.7%, a rise of 0.7 percentage points when compared to last year.

Historically, visitors to butchers’ shops are likely to be more affluent and aged between 45 and 64. However, shoppers aged under 45 were the most likely age group to have visited a butcher when they normally wouldn’t under lockdown. In the 12 weeks to 14 June, both age groups made a similar contribution to the growth in meat and poultry sales through butchers’ shops during the lockdown period (Kantar).

The initial rise in sales was triggered by panic buying at supermarkets which saw shelves stripped bare, driving more consumers to seek meat and poultry products from elsewhere. As more people began utilising their local butchers, the reason for visiting shifted, with more saying they want to support local businesses and being impressed by the range of products on offer.

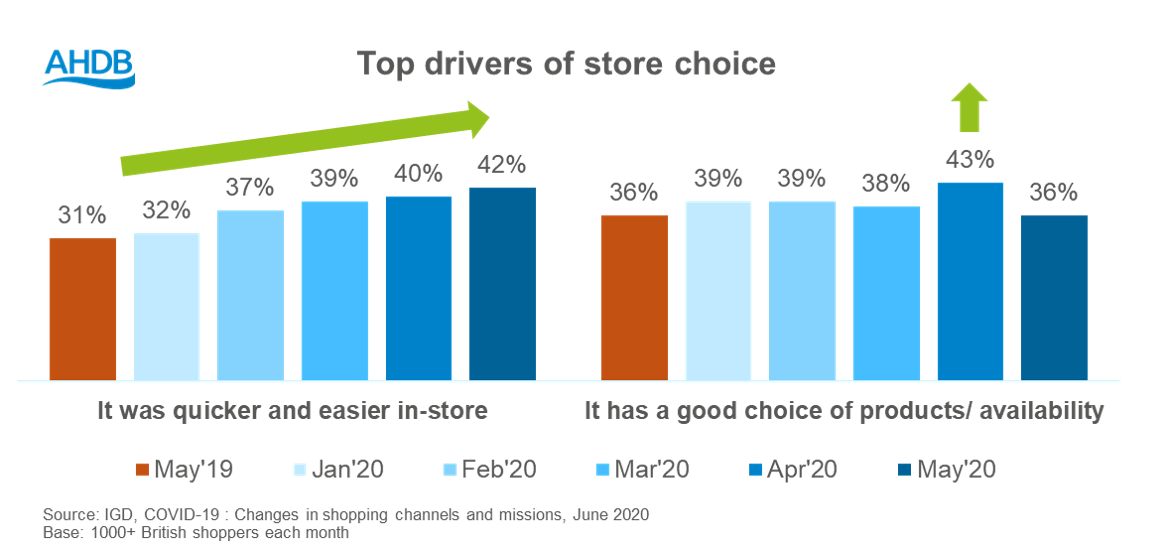

In addition, IGD research shows that concern about availability and lax social distancing from other shoppers has increased stress and anxiety among shoppers, and the personal service from butchers, along with the fact that they usually have a fully visible shop interior to see who else is there, make them well placed to help minimise the level of stress.

Butchers saw almost every single cut of meat and poultry grow ahead of the market average for all retailers. At butchers shops, beef burger volumes were up 74% and pork sausages rose 51%. Chicken breasts proved most popular, with volumes up 87% year on year, compared to the market backdrop of +24%.

Although volumes of beef steaks were up 24% at butchers’ shops, this was behind the market average of 27% (Kantar, 12 w/e 14 June). This may be explained by data showing that beef steaks sold at butchers’ shops were 20% more expensive than the market average.

Rebecca Gladman commented: “Promoting British and local credentials is one way to maximise the perception of quality that might encourage shoppers to continue shopping at butchers’ shops. The AHDB/YouGov Consumer Tracker, conducted in April, showed that half of consumers say they will proactively seek out British produce once restrictions are eased.

“While responses to a survey don’t always translate to behaviour change, even a small proportion of shoppers making a conscious switch to British produce could be a sizeable movement. However, the trade-off between value and provenance will increase as financial worries impact household spending power and is therefore something to be monitored closely over the next few months.

“The influence of national and personal financial worries won’t be the only influence on spending power. If restrictions are brought back in to manage the impact of COVID-19, this will also influence the fortunes of the category. “

Get Our E-Newsletter - breaking news to your in-box twice a week

See e-newsletter example

Will be used in accordance with our Privacy Policy

Continue reading on the Farm Business Website...