- Location

- Stoneleigh

Over the course of at least the last six months, China has been if not the main, then unquestionably one of, the most dominant factors in commodity market inflation. The vast buying of commodities to shore up stocks and feed livestock drove considerable increases in prices.

The uncertainty that has surrounded Chinese data for so long, has resulted in China often being excluded from statistics around global grain supply and demand. However, that is a challenging precedent to continue to follow now.

While US weather has been a base for the recent fall in maize prices, data around Chinese maize import demand may also be softening the global demand picture, and so prices.

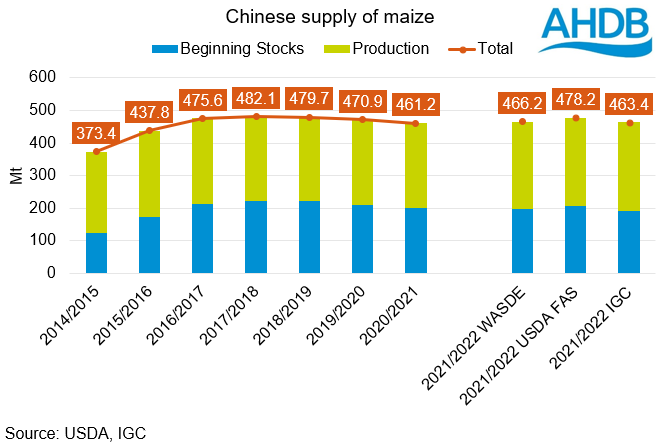

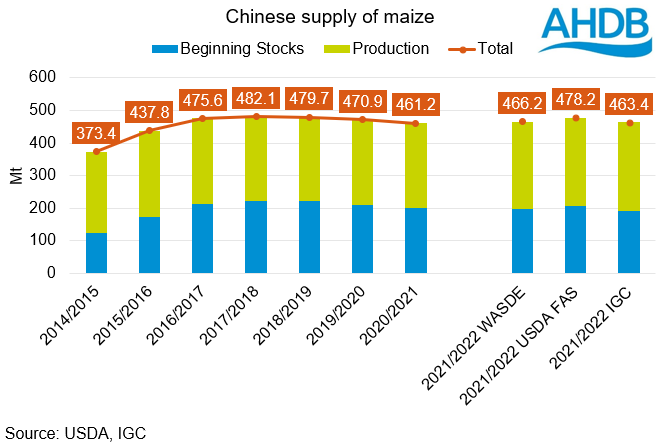

As yesterday’s market commentary highlighted the USDA Foreign Agriculture Service has pegged its estimate of Chinese maize production 4Mt higher than the USDA official figures, at 272Mt. Following a 3% rise in planted acreage, Chinese maize production is expected to increase by 11.4Mt year-on-year.

Opening stocks are also seen rising after a 28Mt import campaign in 2020/21, to 206Mt, taking total availability to 498Mt, almost 9Mt up year-on-year.

The rise in maize availability in China may not be capped at these levels either, a report from Refinitiv suggests that high Chinese maize prices could have driven an increase in maize acreage of 4% to 6%.

Of course, we still cannot take figures from China as read. However, we equally cannot factor them out of the global supply and demand picture altogether. Chinese imports will continue to play a dominant role in global grain supply and demand. Revisions to estimates from a variety of forecasters will need watching just as closely as data from the West over the next 12 months.

If Chinese maize production does increase, nullifying import requirements to an extent, and US weather continues to be favourable, are we in the early throes of a move to a more bearish market?

Read our previous article on Chinese maize acreage here.

Chinese maize supply to weigh on prices?

Join the 3.6K people who subscribe to our Grain Market Daily publication here

The uncertainty that has surrounded Chinese data for so long, has resulted in China often being excluded from statistics around global grain supply and demand. However, that is a challenging precedent to continue to follow now.

While US weather has been a base for the recent fall in maize prices, data around Chinese maize import demand may also be softening the global demand picture, and so prices.

As yesterday’s market commentary highlighted the USDA Foreign Agriculture Service has pegged its estimate of Chinese maize production 4Mt higher than the USDA official figures, at 272Mt. Following a 3% rise in planted acreage, Chinese maize production is expected to increase by 11.4Mt year-on-year.

Opening stocks are also seen rising after a 28Mt import campaign in 2020/21, to 206Mt, taking total availability to 498Mt, almost 9Mt up year-on-year.

The rise in maize availability in China may not be capped at these levels either, a report from Refinitiv suggests that high Chinese maize prices could have driven an increase in maize acreage of 4% to 6%.

Of course, we still cannot take figures from China as read. However, we equally cannot factor them out of the global supply and demand picture altogether. Chinese imports will continue to play a dominant role in global grain supply and demand. Revisions to estimates from a variety of forecasters will need watching just as closely as data from the West over the next 12 months.

If Chinese maize production does increase, nullifying import requirements to an extent, and US weather continues to be favourable, are we in the early throes of a move to a more bearish market?

Read our previous article on Chinese maize acreage here.

Chinese maize supply to weigh on prices?

Join the 3.6K people who subscribe to our Grain Market Daily publication here