- Location

- Stoneleigh

Oilseed rape (OSR) production in the UK in 2020 reached just 1.04Mt. This was the lowest production this century. As a result, we have imported 564.8Kt of OSR so far this season (July 20 – April 21).

Over 75% of these imports have been from outside the EU, due to the tightness in the continental market for rapeseed. In 2020/21, the EU produced 16.1Mt of OSR and is forecast to import over 6Mt.

As the UK rapeseed crop has got smaller in recent years, UK delivered prices have traded at import parity. This has changed our relationship to Paris rapeseed futures (Euronext). Our domestic market will trade from the continental values, with currency determining prices too.

The large domestic deficit this year has altered the basis of UK physical prices to Paris futures. Both the UK and EU are set to see similar production in 2021/22, with both markets set to be in a deficit. As such, the 2020/21 basis could indicate our basis for the 2021/22 marketing year.

Understanding the domestic basis from the AHDB delivered survey, helps provide regular insight into our domestic market. With no domestic futures market for rapeseed, understanding the relationship of domestic prices to Paris rapeseed futures, can give a quick, daily indication of pricing.

Delivered domestic rapeseed prices

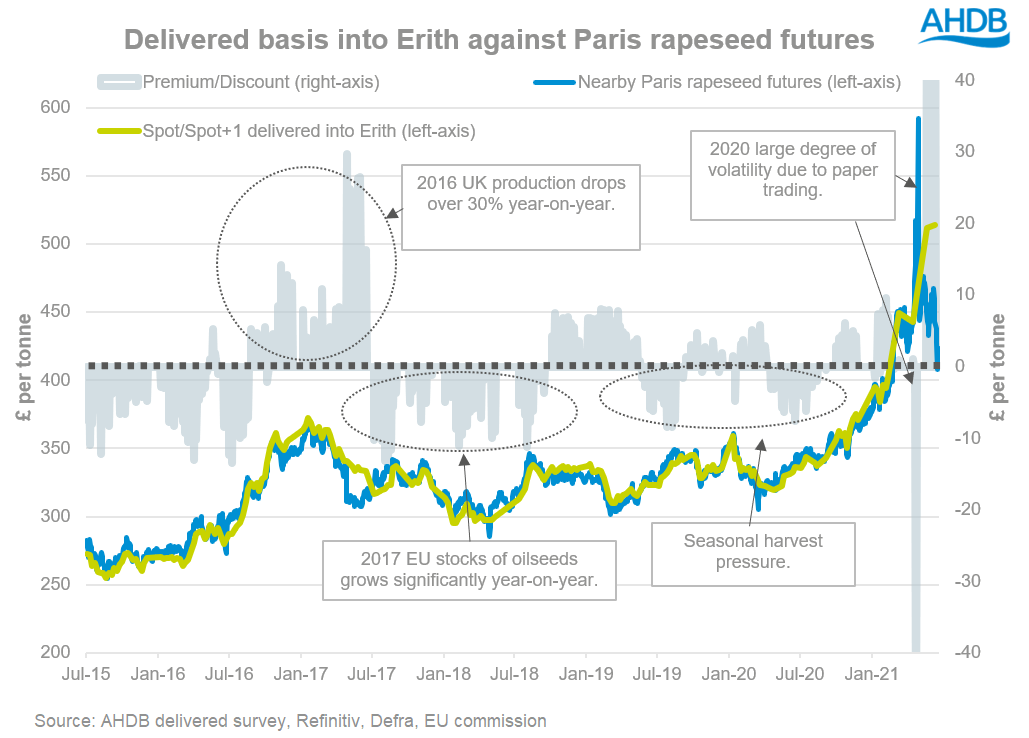

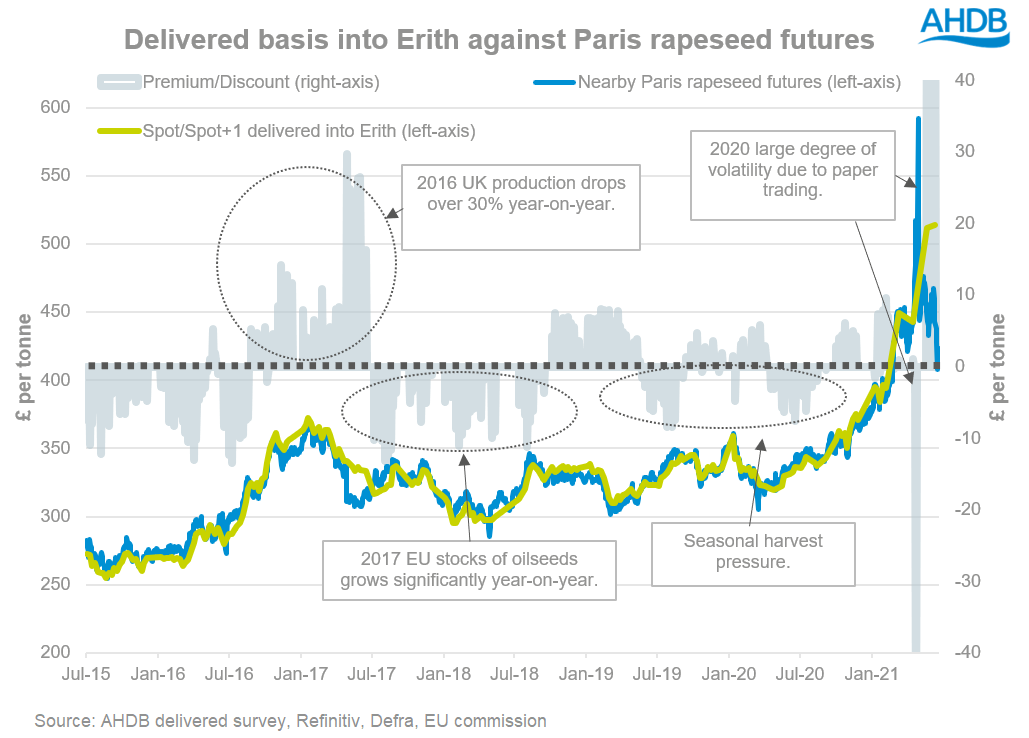

On the graph below, the left axis shows UK spot delivered prices (Erith) and nearby Paris Rapeseed futures in sterling.

The right axis shows the basis of the spot delivered price (into Erith) to nearby Paris rapeseed futures in sterling.

The UK basis to futures can change year-on-year. There are a variety of factors, both domestically and globally, that can indicate whether UK delivered prices trade at a premium or discount to Paris rapeseed futures.

Rapeseed supply shifting delivered basis

Domestic

For example, for much of the 2015/16 marketing year, the UK delivered rapeseed price traded at a discount of c.£5.00/t to Paris rapeseed futures. In 2015/16, the UK produced 2.54Mt of rapeseed, and as such prices had to trade at a price to encourage exports.

In contrast, for the 2016/17 marketing year, domestic delivered prices were a premium of c.£6.00/t to rapeseed futures. Domestic production reduced drastically year-on-year, to 1.78Mt, and imports increased over 300%, to 233.1Kt.

Continental

There are continental factors that can shift our domestic basis too, such as the EU’s supply of oilseeds. In 2017/18 the EU produced 19.9Mt of rapeseed, ending stocks on the continent increased by 821Kt, to 2.1Mt.

This meant that for that marketing year the UK’s delivered values traded at a discount to Paris rapeseed futures as supplies for oilseeds were in surplus in the EU.

Seasonal basis pressure

Another factor that can change the basis, is the time of the year. In 2018/19 and 2019/20, the UK delivered basis to Paris was at a discount from May to October. This reflected the seasonal pressure of when rapeseed is harvested in the UK.

Concluding thoughts

Preliminary forecasts from the USDA show that the UK production will marginally increase, to 1.08Mt, in 2021/22. Additionally, beginning stocks are forecast down 31%, at 79Kt. As a result of low production, the USDA is estimating 650Kt of rapeseed imports in 2021/22. Therefore, this will result in a firm premium of UK rapeseed over Paris futures to attract more imports.

In the EU the outlook remains tight, the EU Commission estimate that OSR production is going to marginally recover in 2021, to 16.7Mt. However, they will still require large imports of 5.8Mt. Further, their ending stocks for 2021/22 are going to remain tight, at 600Kt. This will cap increases in domestic basis.

Based on this and historic delivered basis we can expect that UK prices will trade at a premium to Paris Rapeseed futures for the 2021/22 marketing year. But this will not exclusively mean inflated prices as Helen explained in last week’s analysis.

Domestic premium for rapeseed in 2021/22?

Join the 3.6K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch

Over 75% of these imports have been from outside the EU, due to the tightness in the continental market for rapeseed. In 2020/21, the EU produced 16.1Mt of OSR and is forecast to import over 6Mt.

As the UK rapeseed crop has got smaller in recent years, UK delivered prices have traded at import parity. This has changed our relationship to Paris rapeseed futures (Euronext). Our domestic market will trade from the continental values, with currency determining prices too.

The large domestic deficit this year has altered the basis of UK physical prices to Paris futures. Both the UK and EU are set to see similar production in 2021/22, with both markets set to be in a deficit. As such, the 2020/21 basis could indicate our basis for the 2021/22 marketing year.

Understanding the domestic basis from the AHDB delivered survey, helps provide regular insight into our domestic market. With no domestic futures market for rapeseed, understanding the relationship of domestic prices to Paris rapeseed futures, can give a quick, daily indication of pricing.

Delivered domestic rapeseed prices

On the graph below, the left axis shows UK spot delivered prices (Erith) and nearby Paris Rapeseed futures in sterling.

The right axis shows the basis of the spot delivered price (into Erith) to nearby Paris rapeseed futures in sterling.

The UK basis to futures can change year-on-year. There are a variety of factors, both domestically and globally, that can indicate whether UK delivered prices trade at a premium or discount to Paris rapeseed futures.

Rapeseed supply shifting delivered basis

Domestic

For example, for much of the 2015/16 marketing year, the UK delivered rapeseed price traded at a discount of c.£5.00/t to Paris rapeseed futures. In 2015/16, the UK produced 2.54Mt of rapeseed, and as such prices had to trade at a price to encourage exports.

In contrast, for the 2016/17 marketing year, domestic delivered prices were a premium of c.£6.00/t to rapeseed futures. Domestic production reduced drastically year-on-year, to 1.78Mt, and imports increased over 300%, to 233.1Kt.

Continental

There are continental factors that can shift our domestic basis too, such as the EU’s supply of oilseeds. In 2017/18 the EU produced 19.9Mt of rapeseed, ending stocks on the continent increased by 821Kt, to 2.1Mt.

This meant that for that marketing year the UK’s delivered values traded at a discount to Paris rapeseed futures as supplies for oilseeds were in surplus in the EU.

Seasonal basis pressure

Another factor that can change the basis, is the time of the year. In 2018/19 and 2019/20, the UK delivered basis to Paris was at a discount from May to October. This reflected the seasonal pressure of when rapeseed is harvested in the UK.

Concluding thoughts

Preliminary forecasts from the USDA show that the UK production will marginally increase, to 1.08Mt, in 2021/22. Additionally, beginning stocks are forecast down 31%, at 79Kt. As a result of low production, the USDA is estimating 650Kt of rapeseed imports in 2021/22. Therefore, this will result in a firm premium of UK rapeseed over Paris futures to attract more imports.

In the EU the outlook remains tight, the EU Commission estimate that OSR production is going to marginally recover in 2021, to 16.7Mt. However, they will still require large imports of 5.8Mt. Further, their ending stocks for 2021/22 are going to remain tight, at 600Kt. This will cap increases in domestic basis.

Based on this and historic delivered basis we can expect that UK prices will trade at a premium to Paris Rapeseed futures for the 2021/22 marketing year. But this will not exclusively mean inflated prices as Helen explained in last week’s analysis.

Domestic premium for rapeseed in 2021/22?

Join the 3.6K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch