- Location

- Stoneleigh

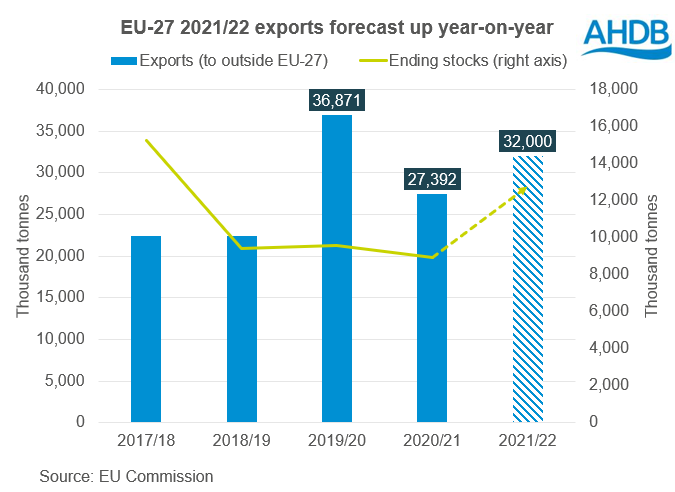

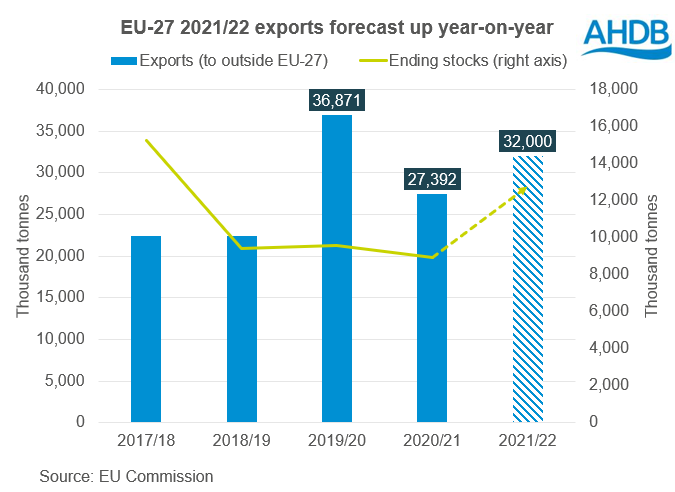

The EU Commission estimates the EU-27 will export 32.0Mt of soft (common) wheat in 2021/22. This is up 2.0Mt from last month’s estimate, and 4.6Mt more than last season. However, it is still below 2019/20 exports totalling 36.8Mt.

The total EU Commission projection for total wheat (32.8Mt) still sits behind USDA forecasts for 2021/22 at 36.5Mt.

Why is this important? Well, higher EU exports may further tighten an already finely balanced EU wheat supply and demand. EU closing stocks still do not look as tight as last season. But an increase in exports is something to watch going forward.

Could we see EU exports even higher with an increasing Russian export price?

Russia and the EU are two of the world’s top wheat exporters. Though after dry conditions cut this season’s crop, Russia has imposed a floating export tax in an attempt to reduce exports.

Last week, we saw Russian wheat prices rise for the sixth consecutive week. This is due to strong export demand. At the end of last week, Russian wheat (12.5% protein, loading from Black Sea ports, Dec delivery) was $340.00/t (approx. £255.00/t) free on board (FOB). This is up $6.00/t (£4.00/t) from the previous week, according to the IKAR consultancy and Refinitiv.

The Russian wheat export duty is set to rise from $78.30/t to $80.80/t from 1 December, according to the Agriculture Ministry. This new duty will be in effect until 7 December.

The Russian Ministry for Agriculture are yet to forecast wheat exports for 2021/22. Though at the Global Grains Geneva 2021 conference, the CEO of the United Grain Company forecast Russian wheat exports at 31-32Mt. The USDA estimate 36.0Mt for 2021/22 exports, compared to 38.5Mt last season.

Currently, SovEcon estimate Russian wheat exports in the season so far (Jul-Nov) as 18.1Mt. Since the start of the marketing season, Russian wheat export pace has on average been 26% slower than last season (SovEcon).

This is especially important given the recent GASC (Egyptian state) tender, in which Romanian wheat was the most competitive pricing. This means pricing for Romanian wheat was comparatively cheaper to other origins, specifically Russia. This is laying the groundwork for strong EU exports to continue should competitive pricing remain.

Strong demand for European wheat is one of the factors supporting UK prices, which may continue as we progress through the season.

EU exports strong as Russian prices rise

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.

The total EU Commission projection for total wheat (32.8Mt) still sits behind USDA forecasts for 2021/22 at 36.5Mt.

Why is this important? Well, higher EU exports may further tighten an already finely balanced EU wheat supply and demand. EU closing stocks still do not look as tight as last season. But an increase in exports is something to watch going forward.

Could we see EU exports even higher with an increasing Russian export price?

Russia and the EU are two of the world’s top wheat exporters. Though after dry conditions cut this season’s crop, Russia has imposed a floating export tax in an attempt to reduce exports.

Last week, we saw Russian wheat prices rise for the sixth consecutive week. This is due to strong export demand. At the end of last week, Russian wheat (12.5% protein, loading from Black Sea ports, Dec delivery) was $340.00/t (approx. £255.00/t) free on board (FOB). This is up $6.00/t (£4.00/t) from the previous week, according to the IKAR consultancy and Refinitiv.

The Russian wheat export duty is set to rise from $78.30/t to $80.80/t from 1 December, according to the Agriculture Ministry. This new duty will be in effect until 7 December.

The Russian Ministry for Agriculture are yet to forecast wheat exports for 2021/22. Though at the Global Grains Geneva 2021 conference, the CEO of the United Grain Company forecast Russian wheat exports at 31-32Mt. The USDA estimate 36.0Mt for 2021/22 exports, compared to 38.5Mt last season.

Currently, SovEcon estimate Russian wheat exports in the season so far (Jul-Nov) as 18.1Mt. Since the start of the marketing season, Russian wheat export pace has on average been 26% slower than last season (SovEcon).

Why is this important to the UK?

If Russian export prices continue to rise, we could see further increases to EU exports. This could result in possible tightening of EU ending stocks.This is especially important given the recent GASC (Egyptian state) tender, in which Romanian wheat was the most competitive pricing. This means pricing for Romanian wheat was comparatively cheaper to other origins, specifically Russia. This is laying the groundwork for strong EU exports to continue should competitive pricing remain.

Strong demand for European wheat is one of the factors supporting UK prices, which may continue as we progress through the season.

EU exports strong as Russian prices rise

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.