- Location

- Stoneleigh

Following on from James's article yesterday, we now look in more detail at the state of the Canadian crop.

The reduction in wheat in last week’s bullish USDA World Agricultural Supply and Demand Estimates (WASDE) report took the spotlight. However, this August update gave insight into the tightening rapeseed (OSR) stocks and a first estimate into the cuts to the Canadian canola crop.

This North American drought has supported global rapeseed values and therefore our domestic values.

Last week delivered rapeseed (into Erith, Nov-21) at £485.00/t, the highest quoted this marketing year so far.

Global stock-to-use ratios (ending stocks/domestic consumption) of OSR now stand at 6.4%, down from 7.6% on the previous month. This is the tightest stock-to-use since 2016/17, when the stocks-to-use was at 7.3%.

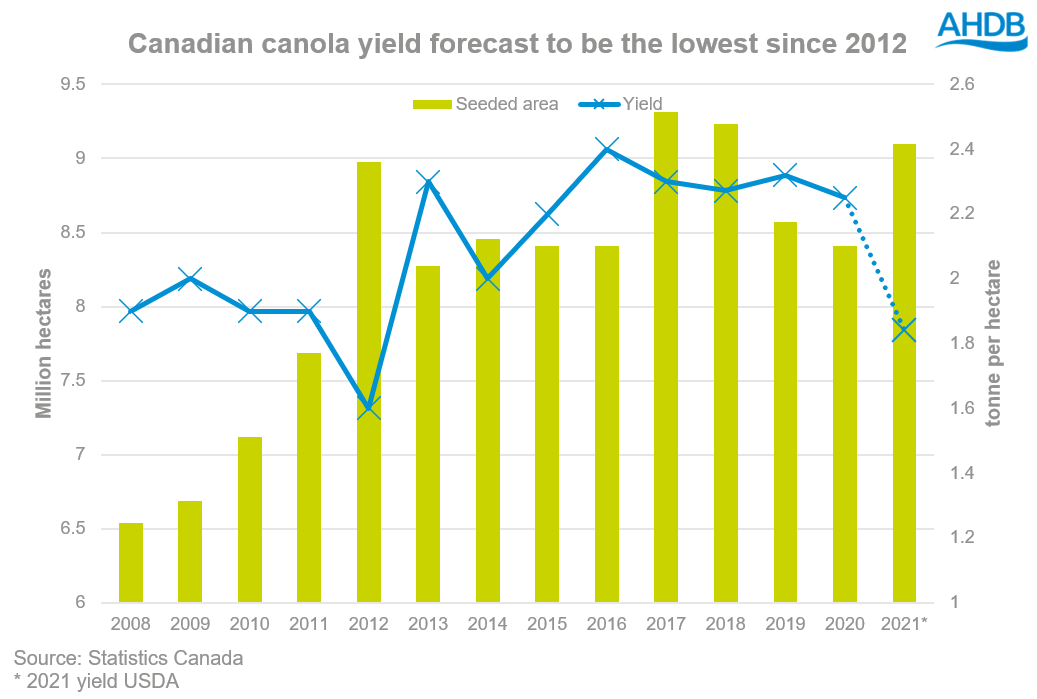

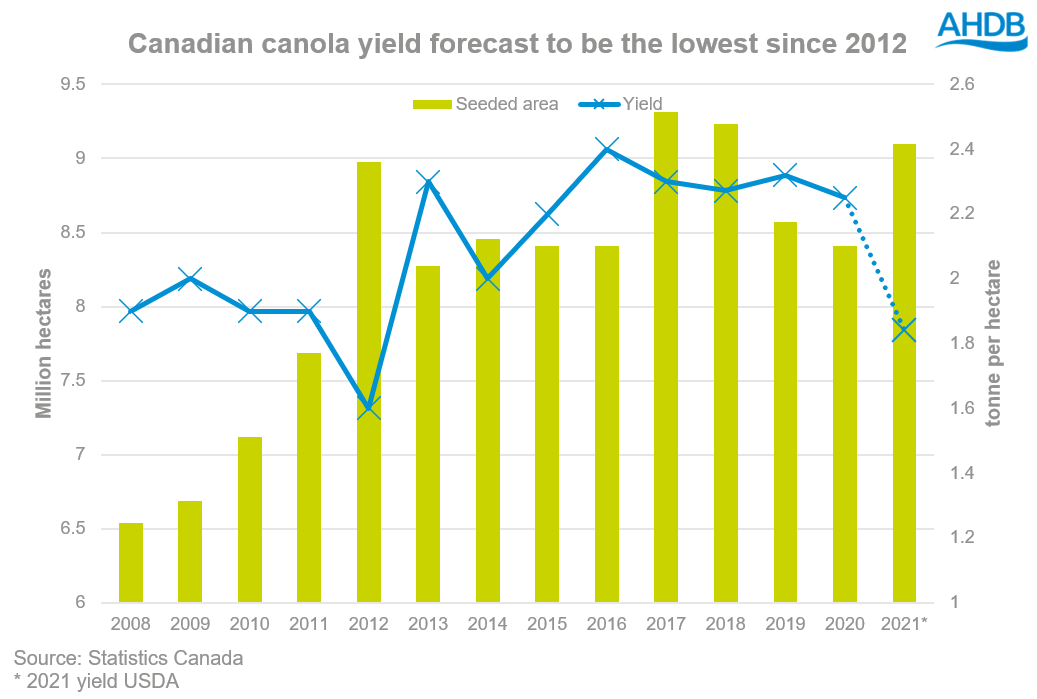

The Canadian crop was revised down 4.2Mt on the month with production now estimated at 16Mt. This figure was based on a lower (-300Kha, on the month) harvest area and the reduction in yields which now were revised from 2.24t/ha in July to 1.84t/ha in August.

With drought affecting much of Canada canola crop, it does not come as a surprise that when comparing this USDA yields to Statistics Canada this is potentially the lowest yield since 2012.

Exports forecasts are reduced significantly, to 6.9Mt for the 2021/22 marketing year, the lowest since 2007/08.

Interestingly Canada’s exports will account for c.49% of global OSR exports when on 5-year-averages they have averaged near 65% of global exports.

However, it is critical to look at the forward market as Nov-22 closed yesterday at £405.28/t significantly lower. Although the Canadian crop is short for 2021/22, there is nothing to stop a large rebound for 2022/23 which would pressure futures values.

If prices seem economically viable for OSR in 2022, it would be wise to take advantage of them now, as outlined in yesterday's Grain Market Daily.

For information on price direction for crops too, make sure to subscribe to Grain Market Daily’s and Market Report from our team.

The reduction in wheat in last week’s bullish USDA World Agricultural Supply and Demand Estimates (WASDE) report took the spotlight. However, this August update gave insight into the tightening rapeseed (OSR) stocks and a first estimate into the cuts to the Canadian canola crop.

This North American drought has supported global rapeseed values and therefore our domestic values.

Last week delivered rapeseed (into Erith, Nov-21) at £485.00/t, the highest quoted this marketing year so far.

Global tightness

Despite recent high prices contributing to demand destruction. In the latest USDA report global production cuts (-4.2Mt) largely outweighed global consumption cuts on the month (-2.9Mt).Global stock-to-use ratios (ending stocks/domestic consumption) of OSR now stand at 6.4%, down from 7.6% on the previous month. This is the tightest stock-to-use since 2016/17, when the stocks-to-use was at 7.3%.

Canadian tightness

With Statistics Canada production data not expected until 30 August this meant that this WADSE was the first insight into the drought damage.The Canadian crop was revised down 4.2Mt on the month with production now estimated at 16Mt. This figure was based on a lower (-300Kha, on the month) harvest area and the reduction in yields which now were revised from 2.24t/ha in July to 1.84t/ha in August.

With drought affecting much of Canada canola crop, it does not come as a surprise that when comparing this USDA yields to Statistics Canada this is potentially the lowest yield since 2012.

Exports forecasts are reduced significantly, to 6.9Mt for the 2021/22 marketing year, the lowest since 2007/08.

Interestingly Canada’s exports will account for c.49% of global OSR exports when on 5-year-averages they have averaged near 65% of global exports.

Growing OSR for 2022 harvest?

With prices currently elevated and Paris rapeseed futures (Nov-21) closing yesterday at £490.39/t, growers may be tempted to grow OSR for 2022 harvest.However, it is critical to look at the forward market as Nov-22 closed yesterday at £405.28/t significantly lower. Although the Canadian crop is short for 2021/22, there is nothing to stop a large rebound for 2022/23 which would pressure futures values.

If prices seem economically viable for OSR in 2022, it would be wise to take advantage of them now, as outlined in yesterday's Grain Market Daily.

For information on price direction for crops too, make sure to subscribe to Grain Market Daily’s and Market Report from our team.