- Location

- Stoneleigh

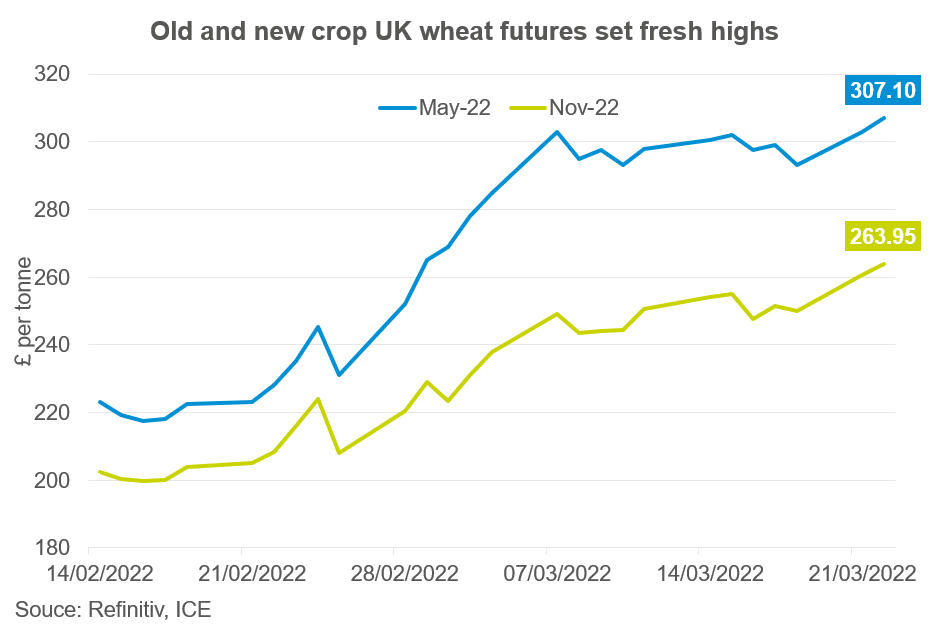

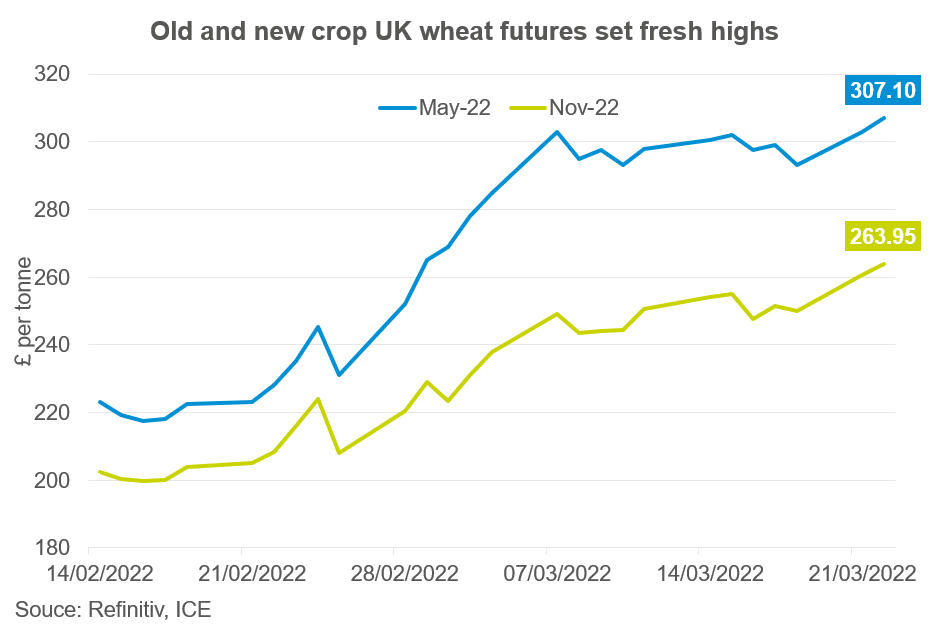

Ongoing issues within the Black Sea brought fresh highs to UK wheat futures yesterday.

There are still a lot of unknowns around how long the war between Russia and Ukraine will last. However, the longer this conflict continues, the longer volatility will continue for global grains and oilseeds.

Chicago wheat futures (May-22) near enough tracked sideways ending down 0.09% yesterday at $410.85/t, while the Paris milling wheat futures contract (May-22) gained 0.6%, closing at €379.00/t.

Domestic markets encapsulated greater gains, with May-22 and Nov-22 up 1.39% and 1.32% respectively. This is despite sterling strengthening against both the Euro (+0.64%) and US Dollar (+0.74%), closing yesterday at £1 = €1.2022 and $1.3263, respectively.

With tight ending stocks for the 2021/22, the old and new crop domestic market are now pricing even closer to import parity with the continent.

By now, it’s well known that Black Sea supplies are now limited to the global market. Net-importers of wheat, such as Egypt, Turkey and Yemen will have to look for alternative origins. Due to the geographical location of these countries, the EU would be the next closest supplier.

Latest data (up until 20 March) shows that the soft wheat exports from the EU are estimated 19.6Mt for the 2021/22 marketing year (EU commission). The latest Stratégie Grains report pegs exports at 32.5Mt, up 2.1Mt from the February report. This revision was off the back of shifting demand due to the Ukraine war.

With demand for EU origin wheat forecast to increase, and if this conflict wages on continental prices could well be supported, providing a further drive for domestic prices.

Today's Grain Market Daily on our website: Fresh new highs for UK wheat futures

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.

There are still a lot of unknowns around how long the war between Russia and Ukraine will last. However, the longer this conflict continues, the longer volatility will continue for global grains and oilseeds.

Chicago wheat futures (May-22) near enough tracked sideways ending down 0.09% yesterday at $410.85/t, while the Paris milling wheat futures contract (May-22) gained 0.6%, closing at €379.00/t.

Domestic markets encapsulated greater gains, with May-22 and Nov-22 up 1.39% and 1.32% respectively. This is despite sterling strengthening against both the Euro (+0.64%) and US Dollar (+0.74%), closing yesterday at £1 = €1.2022 and $1.3263, respectively.

With tight ending stocks for the 2021/22, the old and new crop domestic market are now pricing even closer to import parity with the continent.

By now, it’s well known that Black Sea supplies are now limited to the global market. Net-importers of wheat, such as Egypt, Turkey and Yemen will have to look for alternative origins. Due to the geographical location of these countries, the EU would be the next closest supplier.

Latest data (up until 20 March) shows that the soft wheat exports from the EU are estimated 19.6Mt for the 2021/22 marketing year (EU commission). The latest Stratégie Grains report pegs exports at 32.5Mt, up 2.1Mt from the February report. This revision was off the back of shifting demand due to the Ukraine war.

With demand for EU origin wheat forecast to increase, and if this conflict wages on continental prices could well be supported, providing a further drive for domestic prices.

Today's Grain Market Daily on our website: Fresh new highs for UK wheat futures

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.