- Location

- Stoneleigh

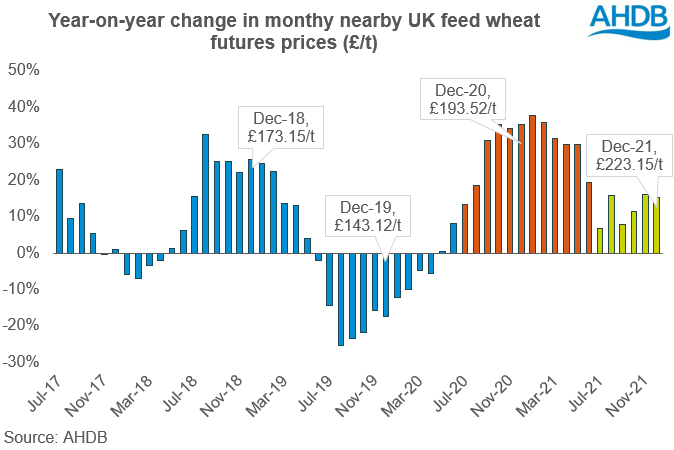

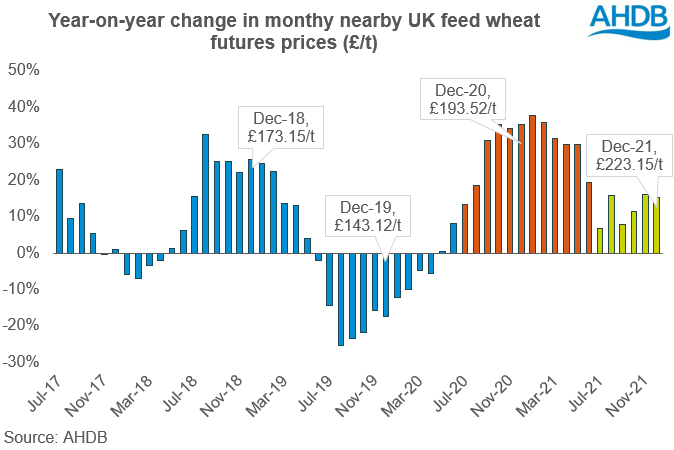

Nearby UK feed wheat futures prices are higher than the same time last year. This is on the back of tighter global stock-to-use. The average price for December 2021 was £223.15/t, 15% above December 2020 (£193.52/t) and 42% above the five-year average.

In the UK, the wheat supply and demand picture looks better than last year, with an increase in total availability for this marketing year (2021/22) from last. However, it remains tighter than previous years.

This year it is anticipated that the UK will have a surplus of wheat, unlike last year (2020/21) when there was a deficit. In the latest AHDB balance sheet (November 2021) the UK is estimated to have a wheat surplus of 557Kt. This is down 59% (816Kt) from the five-year average. UK wheat availability this year is down from averages due to significantly low opening stocks. At 1.42Mt the wheat opening stocks in July 2021 were the lowest since at least July 1999.

UK wheat prices are not only elevated on the back of domestic supply though. Global prices have also been historically high throughout the start of the 2021/22 marketing year, due to tighter supplies.

For this marketing year global demand is anticipated to be 9Mt higher than production. Currently, the stocks-to-use ratio for major wheat exporters is 12.7%, down from the five-year average of 17.5%.

With harvests nearly complete in the Southern hemisphere, the wheat supply picture for 2021/22 is nearly confirmed. We await final figures from Australia and Argentina. With this in mind, prices are likely to remain somewhat elevated both domestically and globally, although there are other factors that may still influence prices.

This could come from maize markets, and demand remains somewhat uncertain with covid-19 restrictions causing concerns. The wider grains complex is awaiting decent maize crops from South America where dryness remains a worry and a major watch point.

Also, new crop plantings and prospects will begin to play a more prominent role in old crop prices. So, although in comparison to last season prices may well remain elevated, they could see pressure (or support) from wider factors.

Good start to the 2021/22 marketing year for UK feed wheat: Grain market daily

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.

In the UK, the wheat supply and demand picture looks better than last year, with an increase in total availability for this marketing year (2021/22) from last. However, it remains tighter than previous years.

This year it is anticipated that the UK will have a surplus of wheat, unlike last year (2020/21) when there was a deficit. In the latest AHDB balance sheet (November 2021) the UK is estimated to have a wheat surplus of 557Kt. This is down 59% (816Kt) from the five-year average. UK wheat availability this year is down from averages due to significantly low opening stocks. At 1.42Mt the wheat opening stocks in July 2021 were the lowest since at least July 1999.

UK wheat prices are not only elevated on the back of domestic supply though. Global prices have also been historically high throughout the start of the 2021/22 marketing year, due to tighter supplies.

For this marketing year global demand is anticipated to be 9Mt higher than production. Currently, the stocks-to-use ratio for major wheat exporters is 12.7%, down from the five-year average of 17.5%.

With harvests nearly complete in the Southern hemisphere, the wheat supply picture for 2021/22 is nearly confirmed. We await final figures from Australia and Argentina. With this in mind, prices are likely to remain somewhat elevated both domestically and globally, although there are other factors that may still influence prices.

This could come from maize markets, and demand remains somewhat uncertain with covid-19 restrictions causing concerns. The wider grains complex is awaiting decent maize crops from South America where dryness remains a worry and a major watch point.

Also, new crop plantings and prospects will begin to play a more prominent role in old crop prices. So, although in comparison to last season prices may well remain elevated, they could see pressure (or support) from wider factors.

Good start to the 2021/22 marketing year for UK feed wheat: Grain market daily

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.