- Location

- Stoneleigh

Forecasts showing less than ideal weather have driven the recent rise in global prices for grains and oilseeds.

Every spring, the market reacts to changing weather reports, due to the potential impact on crop size. We have highlighted a number of key weather watch points:

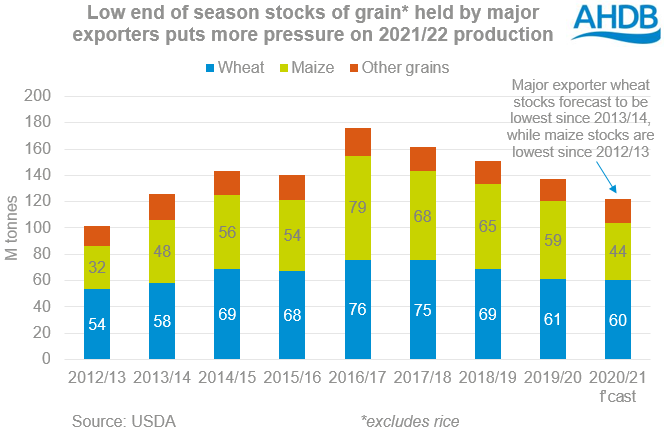

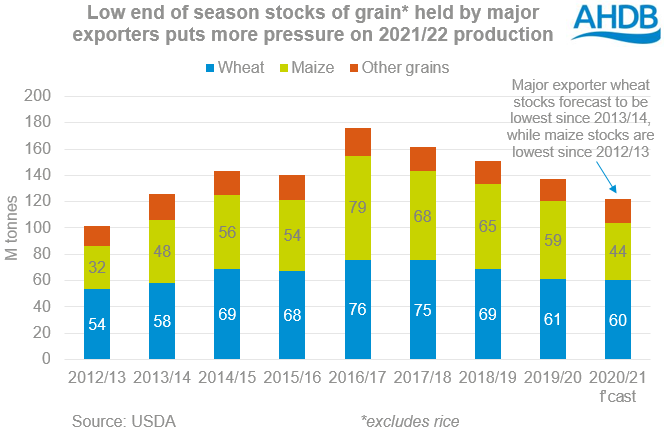

Demand for agricultural commodities has been strong this season, with maize and soyabean stocks in particular depleted. As a result, maize stocks in the major exporting countries are forecast at the lowest level since 2012/13. Further, stocks of wheat held by the major exporters are expected to reach the lowest level since 2013/14.

The low stocks across major exporters could mean increased volatility this spring. With little in reserve, the market is likely to react strongly to any weather-based threat to 2021/22 supplies. This poses both a challenge and an opportunity to anyone marketing grain.

Another reason I feel the market will be more sensitive is that the US area of maize and soyabeans is only expected to be slightly larger than last year, despite strong global demand. This means that yields will be even more important than usual to 2021/22 supplies. However, it is still possible that farmers plant more than they originally intended, updated acreage estimates won’t be confirmed until 30 June.

Weather stories will continue to move markets through spring and into summer. However, one other thing to bear in mind later in the year is the considerable risk premium built into new crop prices. If crops come through the key growing periods over the next couple of months unscathed, new crop prices could fall as the risk premium comes out. However, this is a big ‘if’ and there’s certainly still upward potential, given the expected tightness.

https://ahdb.org.uk/news/low-stocks-driving-increased-volatility-grain-market-daily

Join the 3.5K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch

Every spring, the market reacts to changing weather reports, due to the potential impact on crop size. We have highlighted a number of key weather watch points:

- Dryness in the US maize belt and South America

- The impact of dryness on US spring wheat planting

- Frost impact on French crops (above)

- Dryness risks for EU wheat

Demand for agricultural commodities has been strong this season, with maize and soyabean stocks in particular depleted. As a result, maize stocks in the major exporting countries are forecast at the lowest level since 2012/13. Further, stocks of wheat held by the major exporters are expected to reach the lowest level since 2013/14.

The low stocks across major exporters could mean increased volatility this spring. With little in reserve, the market is likely to react strongly to any weather-based threat to 2021/22 supplies. This poses both a challenge and an opportunity to anyone marketing grain.

Another reason I feel the market will be more sensitive is that the US area of maize and soyabeans is only expected to be slightly larger than last year, despite strong global demand. This means that yields will be even more important than usual to 2021/22 supplies. However, it is still possible that farmers plant more than they originally intended, updated acreage estimates won’t be confirmed until 30 June.

Weather stories will continue to move markets through spring and into summer. However, one other thing to bear in mind later in the year is the considerable risk premium built into new crop prices. If crops come through the key growing periods over the next couple of months unscathed, new crop prices could fall as the risk premium comes out. However, this is a big ‘if’ and there’s certainly still upward potential, given the expected tightness.

https://ahdb.org.uk/news/low-stocks-driving-increased-volatility-grain-market-daily

Join the 3.5K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch