- Location

- Stoneleigh

Attention turned towards the US soyabean and maize planting forecasts for harvest 2021 at the USDA Outlook Forum last week.

These US crops can shape global market sentiment for all grains and oilseeds. To put this into context, this marketing year the US is expected to produce 360.3Mt of maize and 112.6Mt of soyabeans. As a result, the US is expected to account for 36% of global exports for both commodities. Therefore, markets reacted to the 2021 planting news.

However, how do past Outlook Forum estimates compare to the final area figures?

What is the intended area?

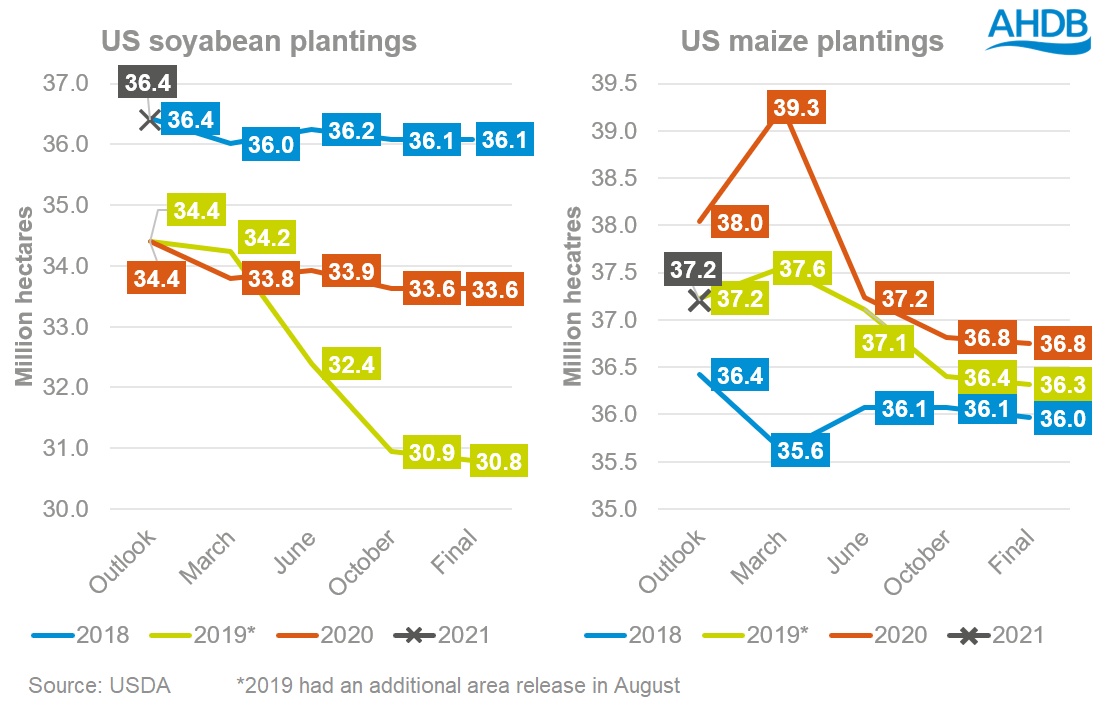

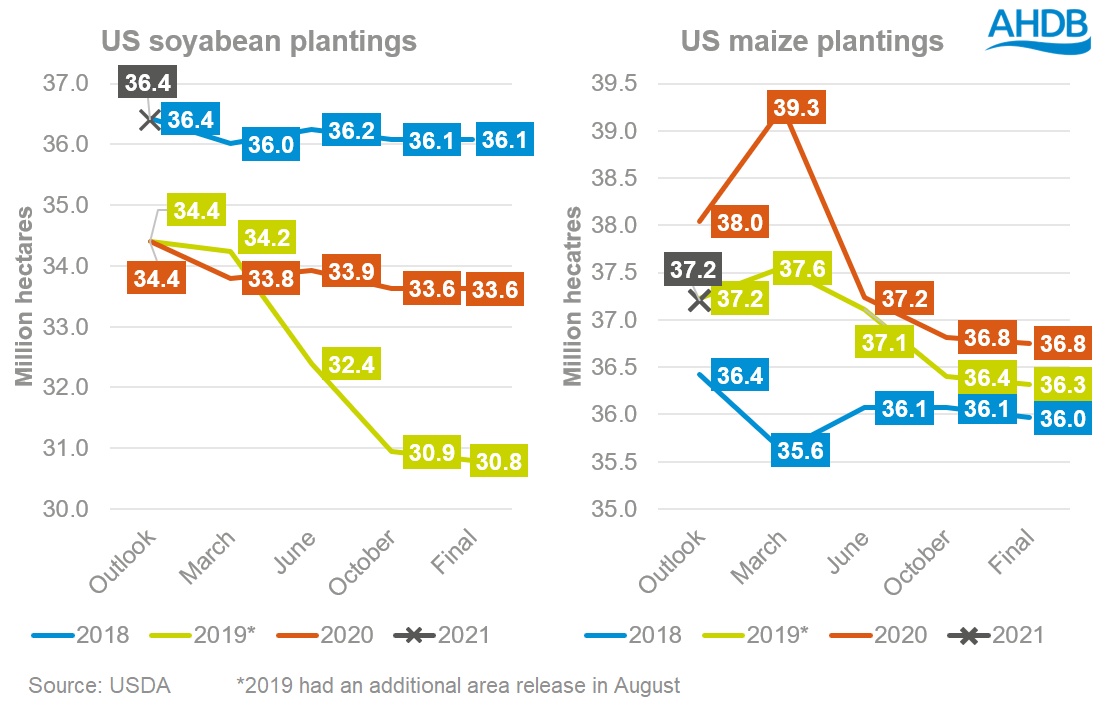

At the Outlook Forum the preliminary estimate for the US maize area is 37.2Mha, increasing from 36.8Mha in 2020. Although the USDA forecast an increase in area and so production, it expects high domestic demand and high exports.

For soyabeans, the area may increase significantly to 36.4Mha, from 33.6Mha in 2020. Despite a large area increase, US stocks for next season may only slightly increase from 3.27Mt to 3.95Mt. This is because of low opening stocks and strong demand.

How accurate are previous outlooks?

The USDA releases area estimates throughout the season (usually March, June, October) and then a final figure. Comparing the outlook estimates to these figures shows there is scope for change.

Changes to estimates could impact prices

These outlooks are only preliminary estimates of the US soyabean and maize areas and are likely to change. Up until planting, the prices for both crops will impact planting intentions. But once planting commences, weather will dictate what is planted. Maize planting usually starts in April, and soyabean planting usually starts in May.

If areas for both commodities increase in the next estimates released by the USDA on Wednesday 31 March, we could see global prices pressured. However, if areas decrease, we could see further support for global prices, as US stocks next year could get even tighter.

US plantings will drive the sentiment for global markets, thus filtering down to what you receive at the farm gate for your crops.

https://ahdb.org.uk/news/market-con...nge-us-cropping-intentions-grain-market-daily

Join the 3.4K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch

These US crops can shape global market sentiment for all grains and oilseeds. To put this into context, this marketing year the US is expected to produce 360.3Mt of maize and 112.6Mt of soyabeans. As a result, the US is expected to account for 36% of global exports for both commodities. Therefore, markets reacted to the 2021 planting news.

However, how do past Outlook Forum estimates compare to the final area figures?

What is the intended area?

At the Outlook Forum the preliminary estimate for the US maize area is 37.2Mha, increasing from 36.8Mha in 2020. Although the USDA forecast an increase in area and so production, it expects high domestic demand and high exports.

For soyabeans, the area may increase significantly to 36.4Mha, from 33.6Mha in 2020. Despite a large area increase, US stocks for next season may only slightly increase from 3.27Mt to 3.95Mt. This is because of low opening stocks and strong demand.

How accurate are previous outlooks?

The USDA releases area estimates throughout the season (usually March, June, October) and then a final figure. Comparing the outlook estimates to these figures shows there is scope for change.

Changes to estimates could impact prices

These outlooks are only preliminary estimates of the US soyabean and maize areas and are likely to change. Up until planting, the prices for both crops will impact planting intentions. But once planting commences, weather will dictate what is planted. Maize planting usually starts in April, and soyabean planting usually starts in May.

If areas for both commodities increase in the next estimates released by the USDA on Wednesday 31 March, we could see global prices pressured. However, if areas decrease, we could see further support for global prices, as US stocks next year could get even tighter.

US plantings will drive the sentiment for global markets, thus filtering down to what you receive at the farm gate for your crops.

https://ahdb.org.uk/news/market-con...nge-us-cropping-intentions-grain-market-daily

Join the 3.4K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch