- Location

- Stoneleigh

As harvest progresses in the US, the price of both maize and soyabeans have waned. As of 26 September, the US maize harvest was 18% complete, three percentage points ahead of the five-year average. The soyabean harvest was 16% complete as of Sunday, also three percentage points ahead of the average.

In the case of both maize and soyabeans, markets appear to be lacking a little inspiration to move higher at present. One possible source of direction this week will be the publication of US grain and oilseed stock figures this evening, at 5PM.

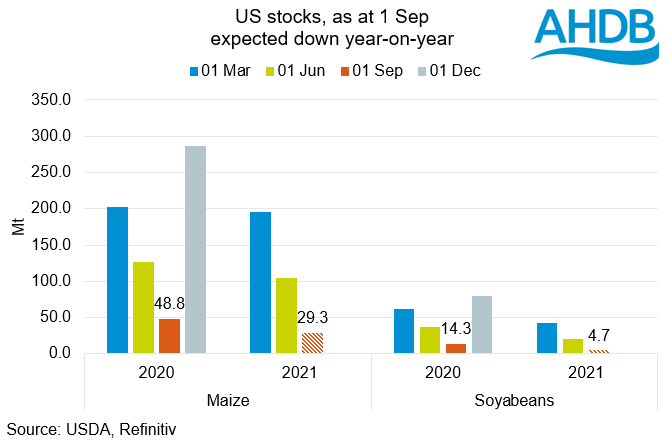

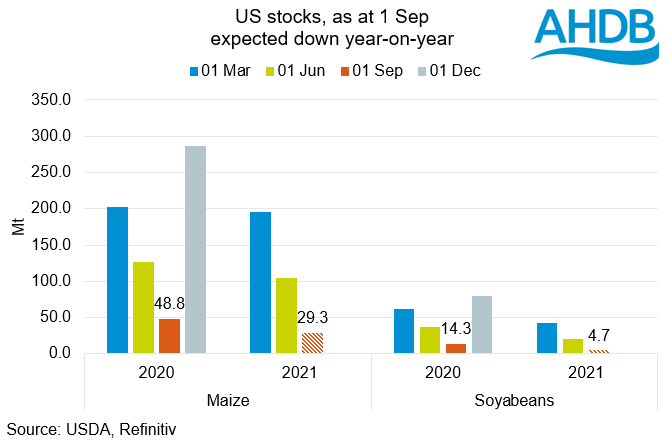

Stocks are expected to be tight. In a pre-report poll by Refinitiv, stocks of maize are expected to be 29.3Mt, down some 42% year-on-year. Soyabean stocks are seen at 4.7Mt, down 67% on the year.

With expectations of stocks so tight, it would require a significant drop on the June 2021 stock level to offer any fresh inspiration to pricing.

With inspiration seemingly lacking we need to look elsewhere for further support. As Ant highlighted yesterday, with La Niña currently on a “watch”, any developments could hamper Southern Hemisphere production.

Further, demand levels for both crops from China are a significant watch point. Margins for pig producers in China are negative at present, this could ration demand for grains and pull further support from grain and oilseed markets.

This jump in English area, would add an additional 250Kt to 2021/22 production, using the average yield of 8.2t/ha from the AHDB harvest survey. The census had a 60% response rate, capturing data from more than 64,000 respondents.

The barley area was seen higher than in the previous release, pegged at 816Kha, up from 803Kha in the June Survey.

The AHDB Planting and Variety Survey pegged the wheat area in England at 1.63Kha and barley at 845Kha.

The oilseed rape figure in the Census, further highlights the challenge of growing the crop. The area was reduced by a further 5Kha from the June Survey to 268Kha.

The first official production estimates for wheat and barley, from Defra, will be published on 11 October.

Markets await US stock figures

For information on price direction make sure to subscribe to Grain Market Daily’s and Market Report from our team.

In the case of both maize and soyabeans, markets appear to be lacking a little inspiration to move higher at present. One possible source of direction this week will be the publication of US grain and oilseed stock figures this evening, at 5PM.

Stocks are expected to be tight. In a pre-report poll by Refinitiv, stocks of maize are expected to be 29.3Mt, down some 42% year-on-year. Soyabean stocks are seen at 4.7Mt, down 67% on the year.

With expectations of stocks so tight, it would require a significant drop on the June 2021 stock level to offer any fresh inspiration to pricing.

With inspiration seemingly lacking we need to look elsewhere for further support. As Ant highlighted yesterday, with La Niña currently on a “watch”, any developments could hamper Southern Hemisphere production.

Further, demand levels for both crops from China are a significant watch point. Margins for pig producers in China are negative at present, this could ration demand for grains and pull further support from grain and oilseed markets.

Adjustments made to English arable areas for 2021 harvest

This morning Defra has published the first results from it’s 2021 census of English agriculture. The latest results show a further increase in English wheat area, year-on-year, from 1.62Mha in the Defra June Survey, to 1.66Mha in the census.This jump in English area, would add an additional 250Kt to 2021/22 production, using the average yield of 8.2t/ha from the AHDB harvest survey. The census had a 60% response rate, capturing data from more than 64,000 respondents.

The barley area was seen higher than in the previous release, pegged at 816Kha, up from 803Kha in the June Survey.

The AHDB Planting and Variety Survey pegged the wheat area in England at 1.63Kha and barley at 845Kha.

The oilseed rape figure in the Census, further highlights the challenge of growing the crop. The area was reduced by a further 5Kha from the June Survey to 268Kha.

The first official production estimates for wheat and barley, from Defra, will be published on 11 October.

Markets await US stock figures

For information on price direction make sure to subscribe to Grain Market Daily’s and Market Report from our team.