- Location

- Stoneleigh

UK feed wheat Nov-21 futures discount to Jul-21 futures closed last night as £22.00/t. This is the largest the old crop to new crop discount since 2012, when this discount at the close on 19 April was £23.25/t. On the same day in 2011, there was an even larger discount of £38.05/t at the close.

In 2011 and 2012, how the two contracts acted up until the July contract went off the board were very different. These could provide some insight in what could happen to wheat prices for the remainder of the 2020/21 season.

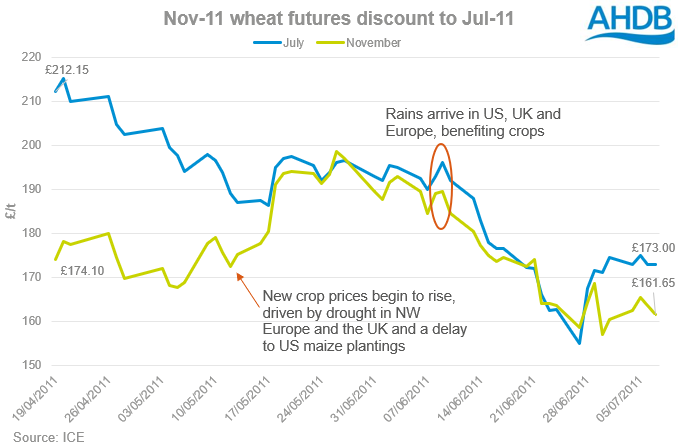

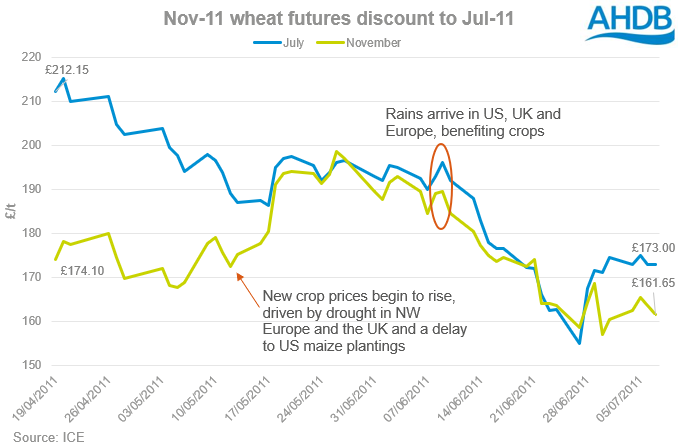

2011

On 19 April 2011, the Jul-11 contract closed at £212.15/t, a premium of £38.05/t over the Nov-11 contract. In the months that followed until the July contract expired, the two contracts converged, and Jul-11 ended up at just an £11.35/t premium. This was mainly due to the July contract moving down to the Nov. The July contract lost almost £40.00/t over this time, whereas the November contract lost just £12.45/t.

Harvest 2010 was reasonably average with production at 14.8Mt. Although area for harvest 2011 was only marginally larger than in 2010, conditions were considerably better, with total production for 2011 at 15.3Mt. As the end of the 2010/11 season drew closer, supply worries for new crop were alleviated, causing both contracts to drift lower.

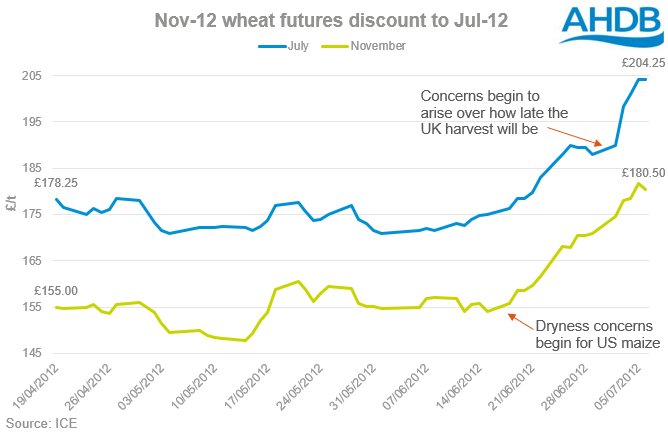

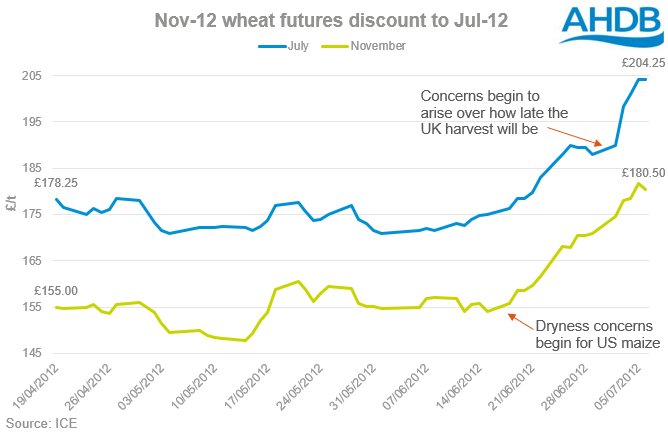

2012

On April 19 2012, the Jul-12 contract closed at £178.25/t, a £23.25/t premium over Nov-12. From then, until the July contract expired, the premium was between £14.50/t and £24.55/t. The two contracts never closed the gap, and Jul-12 was at a £23.75/t premium when the contract expired.

Despite a large harvest in 2011, supply and demand was tightened by low opening stocks and robust demand. This, combined with a delayed harvest in 2012, due to cold, wet weather pushed up both old and new crop contracts at the end of the 2011/12 season. In June and July 2012, there were also maize production concerns in the US caused by dry weather, which supported global prices.

2021

For harvest 2021, we are looking at a situation more similar to harvest 2011; a smaller production year, moving into a larger production year. This would suggest that if the crop potential looks good, and demand remains stable, the futures contracts may behave in a similar way as during 2011. I.e. old crop futures moving down to narrow the spread, as opposed to new crop moving up.

Wheat values for new crop are currently still representing a historically good level, and crop conditions are currently looking mostly good. Unless there is serious evidence of crop damage in the run up to harvest, then it is unlikely that prices next season will reach the highs that have been achievable this season.

https://ahdb.org.uk/news/new-crop-discount-to-old-crop-largest-in-almost-a-decade-grain-market-daily

https://ahdb.org.uk/news/new-crop-discount-to-old-crop-largest-in-almost-a-decade-grain-market-daily

Join the 3.5K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch

In 2011 and 2012, how the two contracts acted up until the July contract went off the board were very different. These could provide some insight in what could happen to wheat prices for the remainder of the 2020/21 season.

2011

On 19 April 2011, the Jul-11 contract closed at £212.15/t, a premium of £38.05/t over the Nov-11 contract. In the months that followed until the July contract expired, the two contracts converged, and Jul-11 ended up at just an £11.35/t premium. This was mainly due to the July contract moving down to the Nov. The July contract lost almost £40.00/t over this time, whereas the November contract lost just £12.45/t.

Harvest 2010 was reasonably average with production at 14.8Mt. Although area for harvest 2011 was only marginally larger than in 2010, conditions were considerably better, with total production for 2011 at 15.3Mt. As the end of the 2010/11 season drew closer, supply worries for new crop were alleviated, causing both contracts to drift lower.

2012

On April 19 2012, the Jul-12 contract closed at £178.25/t, a £23.25/t premium over Nov-12. From then, until the July contract expired, the premium was between £14.50/t and £24.55/t. The two contracts never closed the gap, and Jul-12 was at a £23.75/t premium when the contract expired.

Despite a large harvest in 2011, supply and demand was tightened by low opening stocks and robust demand. This, combined with a delayed harvest in 2012, due to cold, wet weather pushed up both old and new crop contracts at the end of the 2011/12 season. In June and July 2012, there were also maize production concerns in the US caused by dry weather, which supported global prices.

2021

For harvest 2021, we are looking at a situation more similar to harvest 2011; a smaller production year, moving into a larger production year. This would suggest that if the crop potential looks good, and demand remains stable, the futures contracts may behave in a similar way as during 2011. I.e. old crop futures moving down to narrow the spread, as opposed to new crop moving up.

Wheat values for new crop are currently still representing a historically good level, and crop conditions are currently looking mostly good. Unless there is serious evidence of crop damage in the run up to harvest, then it is unlikely that prices next season will reach the highs that have been achievable this season.

https://ahdb.org.uk/news/new-crop-discount-to-old-crop-largest-in-almost-a-decade-grain-market-daily

https://ahdb.org.uk/news/new-crop-discount-to-old-crop-largest-in-almost-a-decade-grain-market-daily

Join the 3.5K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch