- Location

- Stoneleigh

High input costs are front and foremost of growers minds. UK produced Ammonium Nitrate (AN) increased 182% between Jun-21 and Mar-22, to a price of £839.00/t. With the outlook for natural gas prices (the feed stock for AN) well supported, driven by the war in Ukraine, it is well to assume that fertiliser prices could stay strong for the foreseeable future. With high input costs, we may well see a shift in fertiliser use this season and next, or potentially an impact in planted area for those crops which are more input intensive.

Last Friday, Mark explored different nitrogen application strategies. These highlighted the economic impact to the grower of either applying fertiliser as per the recommended economic amount, or reducing it by either 25% or 50% this season. The results of this can be found here. This week, I look at what these scenario outcomes could equate to for UK production overall.

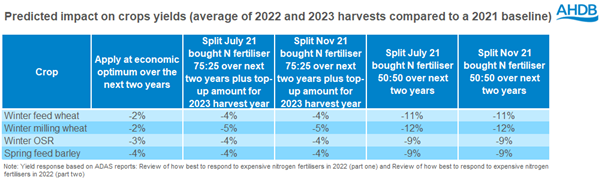

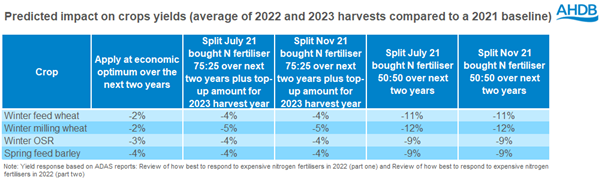

Yields were predicted to fall 2% under the economic optimum for winter feed wheat compared to 11% if AN (ammonium nitrate) fertiliser was applied at half rate. For winter rape this was a decline of 3% under the economic optimum and a fall of 9% if AN applied at 50% of the typical amount.

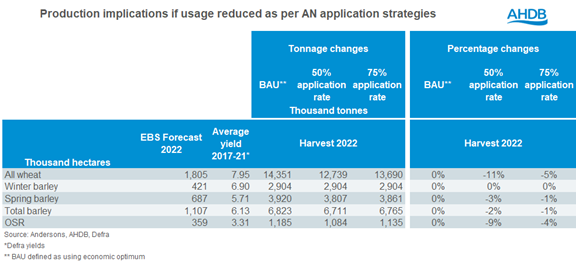

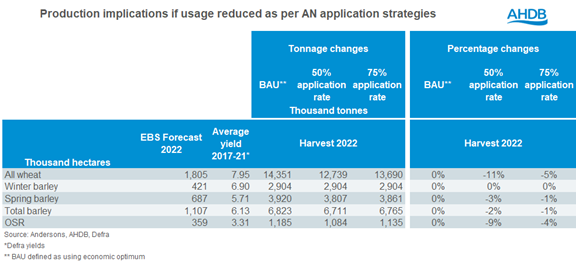

However, should we see nitrogen fertiliser application rates drop by 50%, production could potentially be 11% less than the BAU scenario. This is purely driven by the yield impact as a result of reduced fertiliser application, and does not take into account macro factors, such as weather. By reducing fertiliser applications by only 25%, unsurprisingly the yield impact is less, but potential production could still reduce by 5%.

We know that, as at the end of April, 83% of the winter wheat crop was rated “good-excellent”. However, rain was needed to fulfil it’s full yield potential and May has been dry to date.

A fertiliser reduction strategy has less of an impact on the barley output, with only spring barley crops being affected. Applying nitrogen at 50% BAU levels could see UK spring barley production back 3%, but just reduced by 1% should 75% of intended nitrogen fertiliser be used instead.

Oilseed rape sees a larger fall in potential production if fertiliser is reduced by 50%. Given that the planted area is forecast to be the second lowest this century, and the tight balance sheet both globally and domestically being felt for the crop, any downward revision to production is going to exacerbate this situation.

Next week, I will look ahead to potential impacts for harvest 2023 – providing scenarios that incorporate not only different reduced nitrogen applications but hypothetical area reductions for some crops given the current high input costs.

Winter barley - no N reduction to yields

Assuming EBS area is realised

Spring feed barley yield reduction applied to only proportion of feed barley area. Assuming that minimal applications to malting barley anyway, to keep N levels low for maltsters

BAU = using economic optimum, as defined by AHDB Farmbench

Assume that malting/feed proportion of area is same for winter and spring barley

Total OSR area is all Winter OSR - nothing taken off for (minimal) SOSR area

Today's Grain Market Daily on the AHDB website - Production impacts from reduced nitrogen fertiliser strategies

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.

Last Friday, Mark explored different nitrogen application strategies. These highlighted the economic impact to the grower of either applying fertiliser as per the recommended economic amount, or reducing it by either 25% or 50% this season. The results of this can be found here. This week, I look at what these scenario outcomes could equate to for UK production overall.

The scenarios

The below tables outline the scenarios put forward and the predicted impact on crop yields. For production impacts, I have taken three of these scenario’s:- Applying at the usual recommended amount for 2022

- Applying 75% of the typical application rate for 2022

- Applying 50% of the typical application rate for 2022

Yields were predicted to fall 2% under the economic optimum for winter feed wheat compared to 11% if AN (ammonium nitrate) fertiliser was applied at half rate. For winter rape this was a decline of 3% under the economic optimum and a fall of 9% if AN applied at 50% of the typical amount.

The results

Using the area’s forecast from the AHDB’s Early Bird Survey, against the 5-year average Defra yield, winter wheat production could increase this year to c.14.4Mt. This would be an increase of just under 400Kt on the year.However, should we see nitrogen fertiliser application rates drop by 50%, production could potentially be 11% less than the BAU scenario. This is purely driven by the yield impact as a result of reduced fertiliser application, and does not take into account macro factors, such as weather. By reducing fertiliser applications by only 25%, unsurprisingly the yield impact is less, but potential production could still reduce by 5%.

We know that, as at the end of April, 83% of the winter wheat crop was rated “good-excellent”. However, rain was needed to fulfil it’s full yield potential and May has been dry to date.

A fertiliser reduction strategy has less of an impact on the barley output, with only spring barley crops being affected. Applying nitrogen at 50% BAU levels could see UK spring barley production back 3%, but just reduced by 1% should 75% of intended nitrogen fertiliser be used instead.

Oilseed rape sees a larger fall in potential production if fertiliser is reduced by 50%. Given that the planted area is forecast to be the second lowest this century, and the tight balance sheet both globally and domestically being felt for the crop, any downward revision to production is going to exacerbate this situation.

Conclusion

As outlined last week, there was no significant economic impact to the grower from these different nitrogen fertiliser application approaches. However, both fertiliser and grain prices will change over the next 18 months, especially given their volatility of late. So, a prudent and exacting approach to fertiliser applications is a wise move, whatever application strategy applied.Next week, I will look ahead to potential impacts for harvest 2023 – providing scenarios that incorporate not only different reduced nitrogen applications but hypothetical area reductions for some crops given the current high input costs.

Assumptions

Yield impacts taken from Defra average yield for all wheat, as no official split for milling/feedWinter barley - no N reduction to yields

Assuming EBS area is realised

Spring feed barley yield reduction applied to only proportion of feed barley area. Assuming that minimal applications to malting barley anyway, to keep N levels low for maltsters

BAU = using economic optimum, as defined by AHDB Farmbench

Assume that malting/feed proportion of area is same for winter and spring barley

Total OSR area is all Winter OSR - nothing taken off for (minimal) SOSR area

Today's Grain Market Daily on the AHDB website - Production impacts from reduced nitrogen fertiliser strategies

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.