- Location

- Stoneleigh

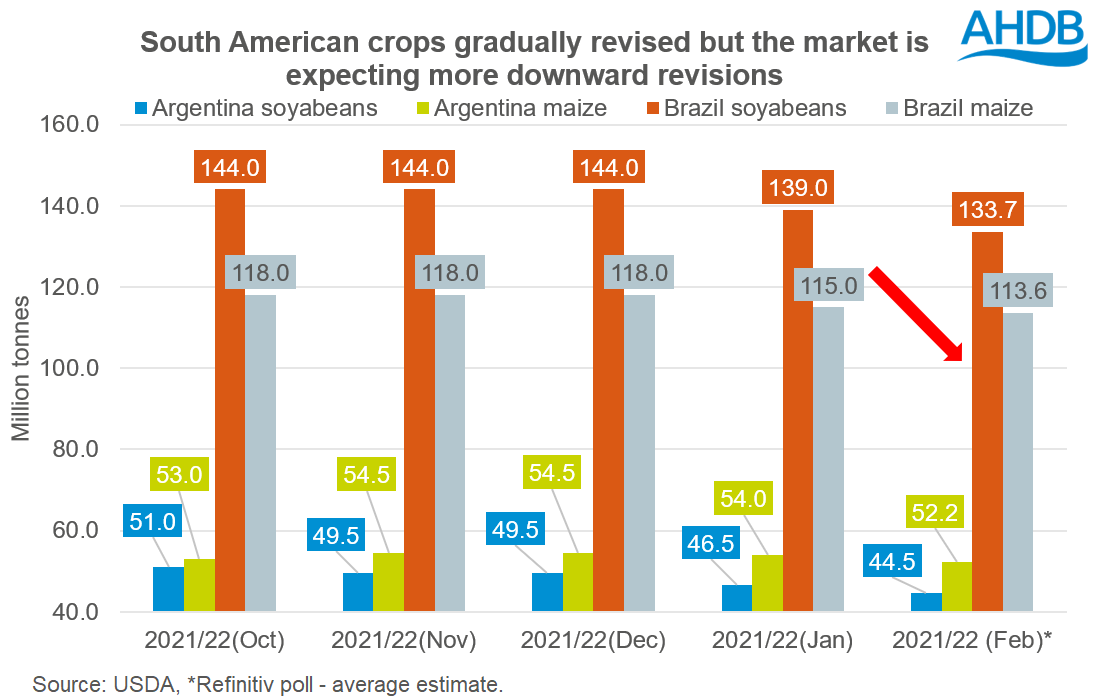

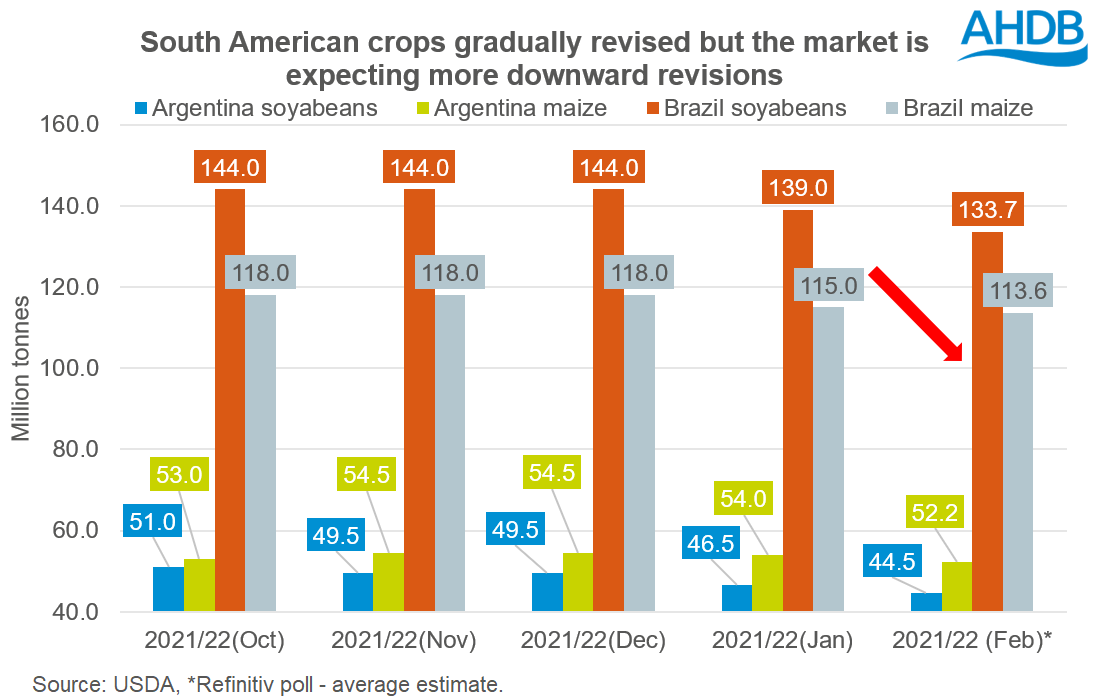

Some market drivers over the last month have been due to South American weather. With Argentina and Brazil forecast to produce either record or near-record maize & soyabean crops this year, the market is very reactive to weather developments in these regions. Being large global producers of grains and oilseeds, this can easily filter into driving domestic growers ex-farm prices.

Off the back of dry weather in Argentina and Southern Parts of Brazil we have seen Chicago soya & maize futures prices climb 15.2% & 7.28% respectively since the start of 2022.

In this last report, supply of soyabeans and maize was revised down a combination of 8Mt and 3.5Mt, respectively.

Tonight, the February WASDE will be released at 17:00GMT. The trade is expecting further reductions to these South American crops.

The trade is still anticipating sizable reductions to these South American crops. Based on trade average estimates, a further 3.2Mt of maize and 7.3Mt of soybeans could be trimmed from global supplies.

The most notable anticipated cut will be to the Brazilian soyabean crop, which was estimated in the January WASDE report to stand at 133.7Mt, down from 139Mt. This is still way off AgRural and AgResources sizable trims who estimate the crop at 128.5Mt and 125Mt, respectively, further information on this analysis from Helen can be found here.

Going forward, harvest progression of the Brazil soyabeans will be the key focus point (currently 16.8% complete, ahead of the same point last year which was 3.6%, Conab), as this will impact the plantings of the second maize crop.

Brazil is still anticipated to produce a record maize crop of 115Mt. Currently planting progression is at 22.4% of the second maize crop, significantly ahead of the same point last year, which was 4.1%.

The optimum window for this crop is before the 3rd week in February for many regions in Brazil, as beyond this there is increased risk of frost before the maize matures (Soy Corn Advisor).

This again could be a further driver of global, and domestic, prices if problems arise going forward.

Today's Grain Market Daily on our website: South America in focus for WASDE

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.

Off the back of dry weather in Argentina and Southern Parts of Brazil we have seen Chicago soya & maize futures prices climb 15.2% & 7.28% respectively since the start of 2022.

Will South American crops be revised further?

Recent dry weather has impacted both Argentine and Brazilian crops. Since initial estimates, the USDA World Agricultural Supply & Demand Estimate (WASDE) have gradually been revising down their forecasts for both their soya and maize crops.In this last report, supply of soyabeans and maize was revised down a combination of 8Mt and 3.5Mt, respectively.

Tonight, the February WASDE will be released at 17:00GMT. The trade is expecting further reductions to these South American crops.

The trade is still anticipating sizable reductions to these South American crops. Based on trade average estimates, a further 3.2Mt of maize and 7.3Mt of soybeans could be trimmed from global supplies.

The most notable anticipated cut will be to the Brazilian soyabean crop, which was estimated in the January WASDE report to stand at 133.7Mt, down from 139Mt. This is still way off AgRural and AgResources sizable trims who estimate the crop at 128.5Mt and 125Mt, respectively, further information on this analysis from Helen can be found here.

Information is priced in?

All the past weather that has impacted these South American crops is priced into the market. However, if the USDA WASDE released tonight deviates away from what the trade is expecting we could see markets move accordingly.Going forward, harvest progression of the Brazil soyabeans will be the key focus point (currently 16.8% complete, ahead of the same point last year which was 3.6%, Conab), as this will impact the plantings of the second maize crop.

Brazil is still anticipated to produce a record maize crop of 115Mt. Currently planting progression is at 22.4% of the second maize crop, significantly ahead of the same point last year, which was 4.1%.

The optimum window for this crop is before the 3rd week in February for many regions in Brazil, as beyond this there is increased risk of frost before the maize matures (Soy Corn Advisor).

This again could be a further driver of global, and domestic, prices if problems arise going forward.

Today's Grain Market Daily on our website: South America in focus for WASDE

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.

Last edited: