- Location

- Stoneleigh

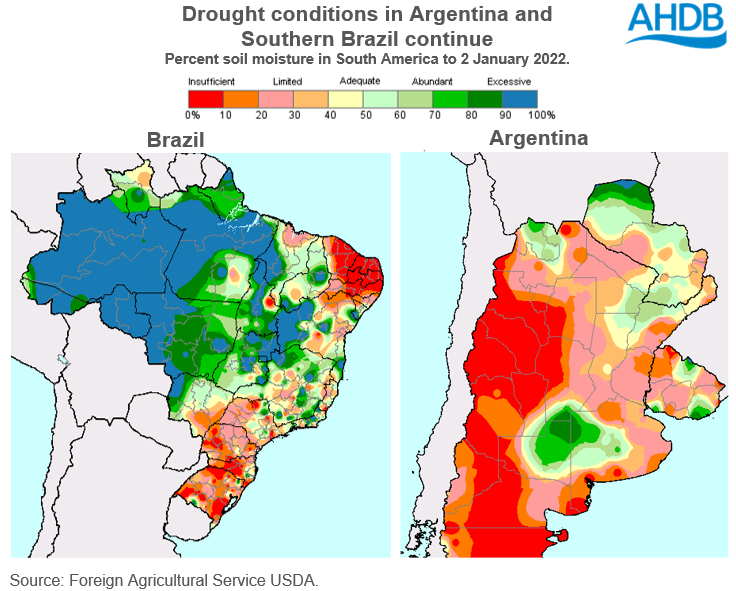

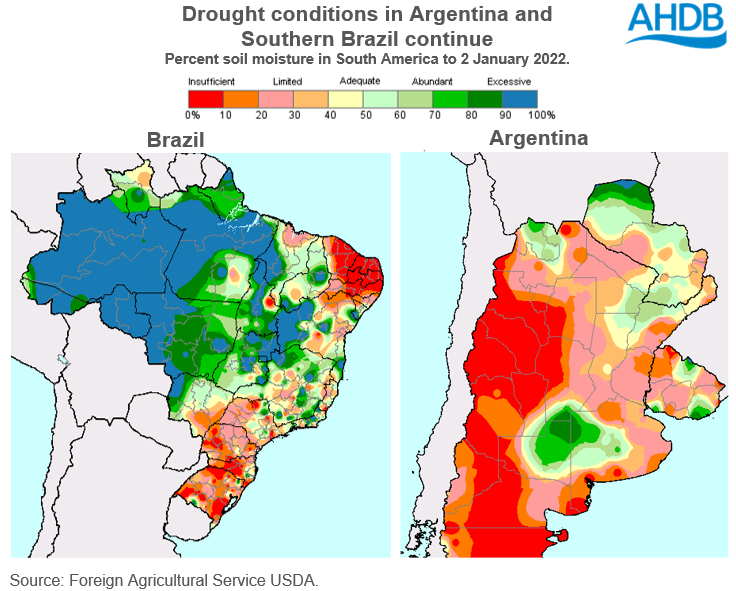

In December we mentioned that dry weather in parts of Brazil and Argentina, caused by the La Niña event, was having an impact on soil moisture.

These concerns are growing due to recent weather in Brazil and Argentina, which has in turn been supporting markets.

On 27 December, Chicago maize (May-22) futures reached $242.81/t the highest price since June 2021 on this contract. Prices have since pulled back slightly, capped by falling wheat prices. Whereas Chicago soyabeans (May-22) futures continue to gain. Yesterday, this contract closed at $515.46/t, the highest close since June 2021.

In Argentina, the latest Bolsa de Cereales crop condition report to 30 December showed 56% of soyabeans and 58% of maize as rated ‘Excellent/Good’. This is down from 71% and 76% respectively, for the previous week.

In Southern Brazil, the Parana region and Rio Grande do Sul have declared a state of emergency due to prolonged drought. In Parana, 30% of soyabeans are considered in good condition this week (Refinitiv). This is down from 57%, 2 weeks earlier.

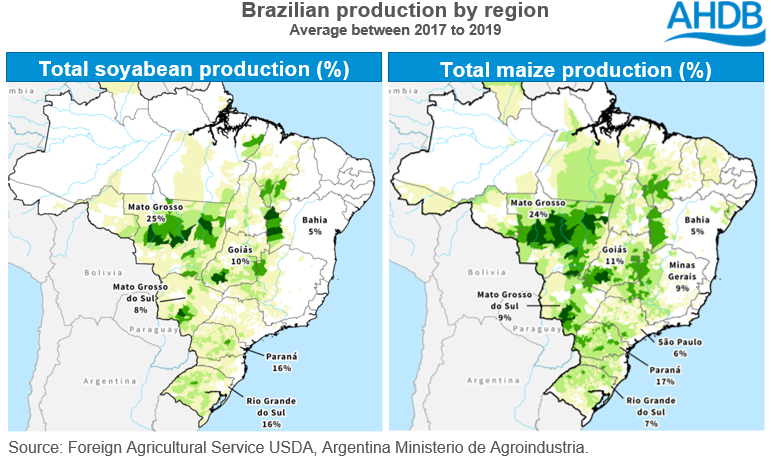

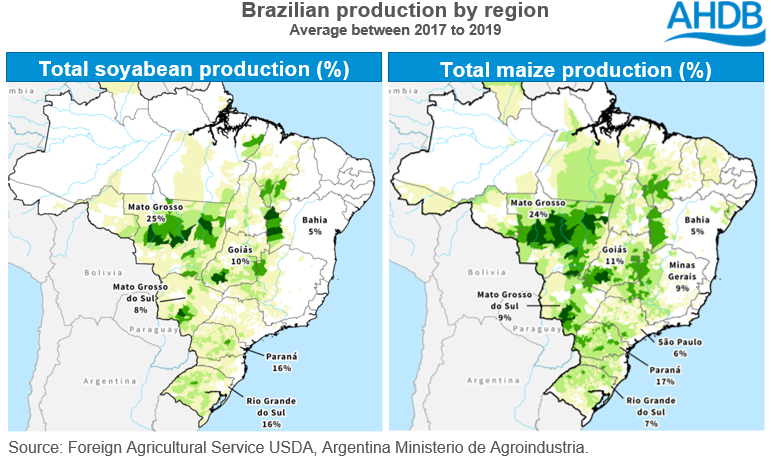

Whereas, in Northeastern and Central Brazil, overcast conditions and heavy rain persist. In Bahia, a state of emergency has been called due to widespread flooding. This rainfall increases the concern for disease pressure. As a key state impacted, Mato Grosso is especially important given it is the largest producing region in Brazil. On average between 2017 to 2019, Mato Grosso produced 25% of Brazilian soyabeans.

Rain looks to be delaying early Brazilian soyabean harvest in the North, though traders await early yield estimates to understand potential production.

Argentina is due small amounts of rain in the South, although most areas are expected to stay relatively dry, according to Refinitiv.

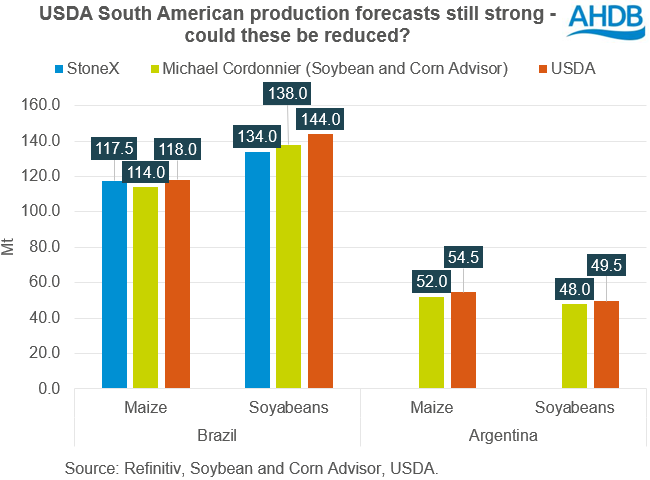

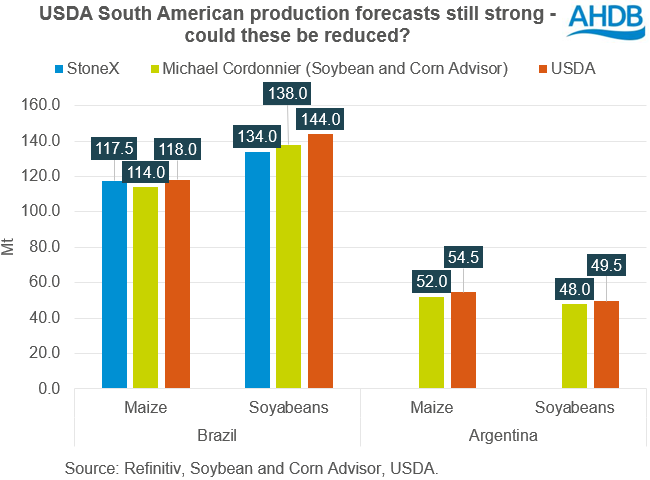

Forecaster Michael Cordonnier also reduced his Brazilian maize (-1.0Mt) and soyabean (-2.0Mt) production forecasts, at the end of December. This forecaster also reduced Argentinian production estimates for maize (-1.0Mt) and soyabeans (-1.0Mt).

In the December world supply and demand estimates (WASDE) report, the USDA forecast strong Brazilian and Argentinian maize and soyabean crops. However, with recent weather we will be watching to see if there are any trims to these forecasts in the next WASDE on 12 January. In Brazil, soyabeans are especially important given planting is nearing completion. Whereas Brazilian second crop maize should begin planting soon.

Consequently, any trims to forecasts could tighten the global supply and demand picture.

Should conditions impact production potential, this could further support both global and domestic prices.

South American weather supporting markets

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.

These concerns are growing due to recent weather in Brazil and Argentina, which has in turn been supporting markets.

On 27 December, Chicago maize (May-22) futures reached $242.81/t the highest price since June 2021 on this contract. Prices have since pulled back slightly, capped by falling wheat prices. Whereas Chicago soyabeans (May-22) futures continue to gain. Yesterday, this contract closed at $515.46/t, the highest close since June 2021.

Argentina and Southern Brazil remain very dry, despite recent rains.

In Argentina, the latest Bolsa de Cereales crop condition report to 30 December showed 56% of soyabeans and 58% of maize as rated ‘Excellent/Good’. This is down from 71% and 76% respectively, for the previous week.

In Southern Brazil, the Parana region and Rio Grande do Sul have declared a state of emergency due to prolonged drought. In Parana, 30% of soyabeans are considered in good condition this week (Refinitiv). This is down from 57%, 2 weeks earlier.

Whereas, in Northeastern and Central Brazil, overcast conditions and heavy rain persist. In Bahia, a state of emergency has been called due to widespread flooding. This rainfall increases the concern for disease pressure. As a key state impacted, Mato Grosso is especially important given it is the largest producing region in Brazil. On average between 2017 to 2019, Mato Grosso produced 25% of Brazilian soyabeans.

Rain looks to be delaying early Brazilian soyabean harvest in the North, though traders await early yield estimates to understand potential production.

What does the forecast look like ahead?

Weather forecasted for the next 10 days looks mixed. Northern and Central Brazil are forecast normal rainfall, with rain heading south. Rio Grande do Sul continues to look dry but slightly cooler this week (Refinitiv).Argentina is due small amounts of rain in the South, although most areas are expected to stay relatively dry, according to Refinitiv.

How is this impacting on the supply and demand outlook?

Private forecasters are now starting to scale back production forecasts. On Monday, the StoneX consultancy reduced Brazilian maize (-2.6Mt) and soyabean (-11.1Mt) forecasts for this season.Forecaster Michael Cordonnier also reduced his Brazilian maize (-1.0Mt) and soyabean (-2.0Mt) production forecasts, at the end of December. This forecaster also reduced Argentinian production estimates for maize (-1.0Mt) and soyabeans (-1.0Mt).

In the December world supply and demand estimates (WASDE) report, the USDA forecast strong Brazilian and Argentinian maize and soyabean crops. However, with recent weather we will be watching to see if there are any trims to these forecasts in the next WASDE on 12 January. In Brazil, soyabeans are especially important given planting is nearing completion. Whereas Brazilian second crop maize should begin planting soon.

Consequently, any trims to forecasts could tighten the global supply and demand picture.

Conclusion

How much rain falls this month, and where, will be key to understand South American maize and soyabean production potential. Early yield indications for Brazilian soyabeans will be awaited closely by trade, to assess production forecasts. Though before then, all eyes will be on the WASDE report due on Wednesday.Should conditions impact production potential, this could further support both global and domestic prices.

South American weather supporting markets

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.