- Location

- Stoneleigh

Yesterday, the value of sterling closed against the US dollar at £1=$1.3844. This is up on last week’s close (£1 = $1.3780) due to easing concerns over vaccine supply from the European Union (EU).

This steadying in values is not a surprise, as we have seen an overall strengthening of the pound in recent months. Since the start of this season, the pound has strengthened 6.2% against the euro and 11.8% against the US dollar. In the past three months alone, the pound has strengthened 5.9% against the euro.

%2030%2003%202021.PNG)

Why have we seen this? In the most part, rises can be attributed to the vaccine rollout success against other nations. Back in February (25 Feb), the pound hit £1 = US$1.4148 to make it the best performing G10 currency at the time. The plans for easing restrictions give optimism that the UK economy will reopen quickly. This is contributing to positive economic outlooks and stronger sterling.

Can we expect this to continue?

Relative strength against the euro could continue in the short term but this depends on many factors including progress tackling Covid-19, the domestic economy, and global relations. This month (March), the euro is forecasted to record the biggest monthly drop (2.3%) since July 2019. The EU is facing another wave of infections leading to further lockdowns, and a comparatively slow vaccine rollout.

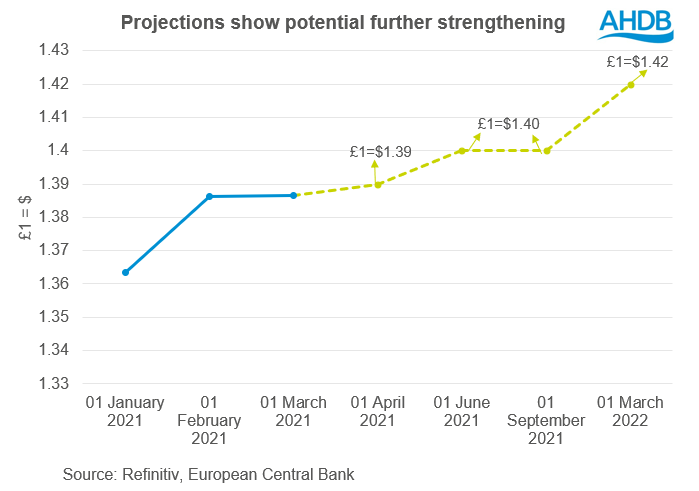

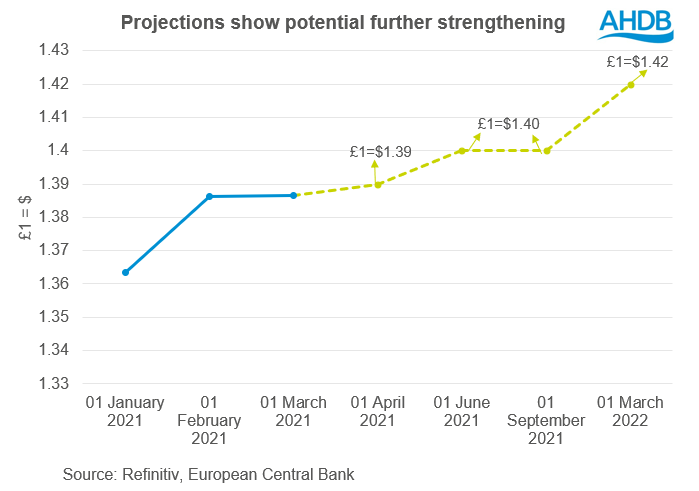

The US dollar is regaining strength from the vaccine program and positive economic data. Yet, sterling is forecasted in a Refinitiv poll to continue rising against the US dollar in the short and long term. Current projections peg the pound to strengthen to £1=$1.40 in three months’ time outlook (a further rise of 1.1%), taking us to the start of the 2021/22 season. But again, this could change should new factors take shape.

What could this mean for new crop price?

A stronger sterling means exports become less price competitive and imports more price competitive. As a result, we could see pressure on UK prices for crops we need to export, such as barley. There would also be less support for the prices of any crops we need import.

Heading into the new crop year, there looks to be another year of tight wheat supply versus demand. For new-crop wheat values, there are early signs of pricing towards import parity. Nov-21 UK wheat futures closed yesterday at £161.95/t, just £4.03/t below Paris’ milling wheat Dec-21 contract.

Global supply and demand are going to be crucial to UK wheat prices in the new season. The highly anticipated US reports on prospective plantings and quarterly grain stocks are due on 31 March which will tell more around global supply into new season.

https://ahdb.org.uk/news/sterling-has-been-strengthening-but-what-could-the-future-hold-grain-market-daily

Join the 3.5K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch

This steadying in values is not a surprise, as we have seen an overall strengthening of the pound in recent months. Since the start of this season, the pound has strengthened 6.2% against the euro and 11.8% against the US dollar. In the past three months alone, the pound has strengthened 5.9% against the euro.

%2030%2003%202021.PNG)

Why have we seen this? In the most part, rises can be attributed to the vaccine rollout success against other nations. Back in February (25 Feb), the pound hit £1 = US$1.4148 to make it the best performing G10 currency at the time. The plans for easing restrictions give optimism that the UK economy will reopen quickly. This is contributing to positive economic outlooks and stronger sterling.

Can we expect this to continue?

Relative strength against the euro could continue in the short term but this depends on many factors including progress tackling Covid-19, the domestic economy, and global relations. This month (March), the euro is forecasted to record the biggest monthly drop (2.3%) since July 2019. The EU is facing another wave of infections leading to further lockdowns, and a comparatively slow vaccine rollout.

The US dollar is regaining strength from the vaccine program and positive economic data. Yet, sterling is forecasted in a Refinitiv poll to continue rising against the US dollar in the short and long term. Current projections peg the pound to strengthen to £1=$1.40 in three months’ time outlook (a further rise of 1.1%), taking us to the start of the 2021/22 season. But again, this could change should new factors take shape.

What could this mean for new crop price?

A stronger sterling means exports become less price competitive and imports more price competitive. As a result, we could see pressure on UK prices for crops we need to export, such as barley. There would also be less support for the prices of any crops we need import.

Heading into the new crop year, there looks to be another year of tight wheat supply versus demand. For new-crop wheat values, there are early signs of pricing towards import parity. Nov-21 UK wheat futures closed yesterday at £161.95/t, just £4.03/t below Paris’ milling wheat Dec-21 contract.

Global supply and demand are going to be crucial to UK wheat prices in the new season. The highly anticipated US reports on prospective plantings and quarterly grain stocks are due on 31 March which will tell more around global supply into new season.

https://ahdb.org.uk/news/sterling-has-been-strengthening-but-what-could-the-future-hold-grain-market-daily

Join the 3.5K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch