- Location

- Stoneleigh

The bullish tone continues for the oilseed complex

Yesterday, Millie brought you a round up for the outlook for global and domestic grains, following Tuesday’s Spring Grain Market Outlook webinar. Today it’s the turn of oilseeds.The global outlook

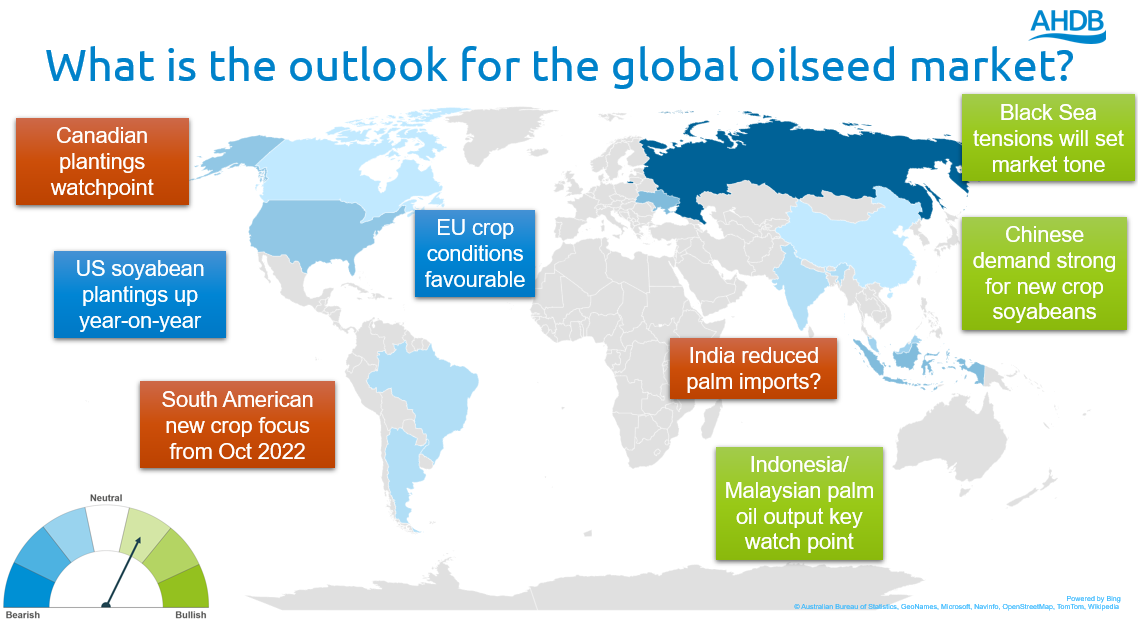

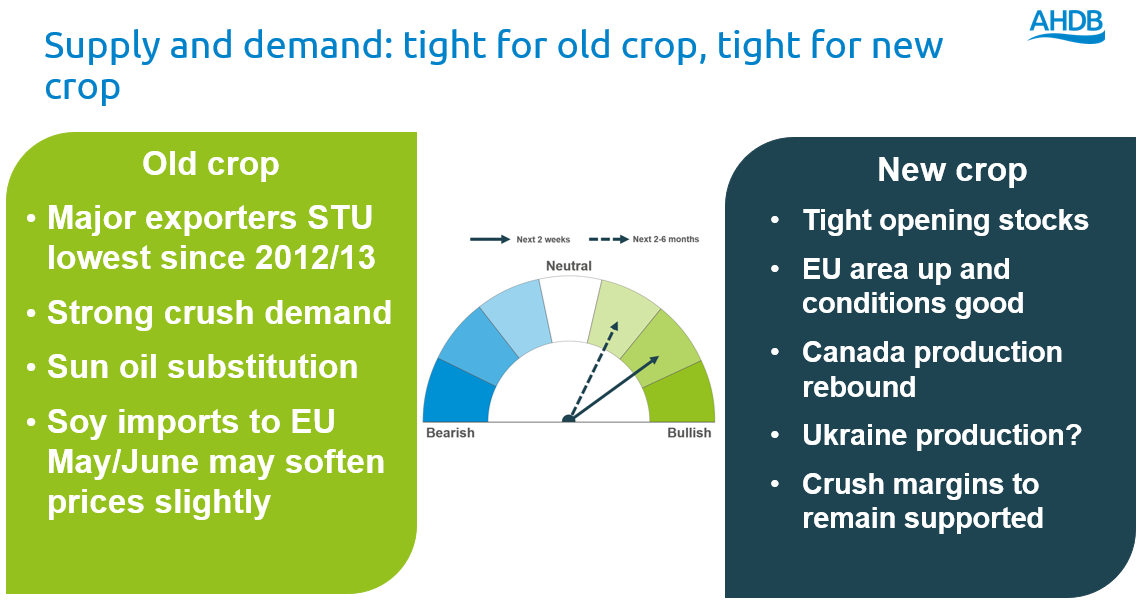

Overall, the picture is pretty bullish. For the short term, palm oil supply on the global market remains a concern. As from midnight on 28 April (yesterday), Indonesia banned crude palm oil and refined product exports, to control their domestic inflation. An Indonesian industry body suggest this could last for up to a month.Adding support is tightness in old crop rapeseed supply. Demand has been exacerbated by a need for substitutions for sun-oil, with global supply significantly restricted by the war in Ukraine. Russia and Ukraine combined account for 76% of global sunflower oil exports (5-year average 2016/17 – 2020/21). South American soyabeans have now entered the market, but this crop was revised downwards throughout the growing season on dry weather conditions. In addition, continued Chinese demand has seen a sustained drawdown on US soyabean stocks, with stocks looking to end the season at their second tightest level since 2015/16.

Looking forward to new crop, global harvests this summer may bring some softening of prices. However, the bullish tone remains.

Canadian canola (rapeseed) planted area is forecast at 8.46Mha. This is back from trade expectations, 7% down on last year and 6% back on the five-year average (Statistics Canada). With high input costs, growers have reportedly been turning to wheat.

New crop US soyabeans may keep a lid on new-crop price increases. Soyabean area is forecasted to increase this year, at the expense of maize. Markets will watch closely how this crop develops, with strong production needed this season to help service global demand.

The EU rapeseed area is up for harvest 2022, and crop conditions look good (albeit a little dry currently). However, with the EU set to end the 2021/22 season with historically low ending stocks, and crush demand sustained, additional production is necessary to try and balance the supply and demand equation.

Crush demand looks to stay strong. Canada is set to add 6.8Mt of processing capacity by 2025, representing a 62% increase on the current 11.0Mt capacity. EU crush demand could be sustained at least in the first half of the season, due to strong margins.

Current government thinking is that the war in Ukraine could be a drawn-out affair. This will see continued demand for alternative oilseeds to fill the gap in the market, sustaining crush demand for rapeseed.

A look closer to home

For the UK, only a modest increase in area for harvest 2022, will mean imports are still required to meet domestic demand (should an average yield be achieved). This will sustain UK prices, being necessary to keep them at import parity, and likely make UK crush margins a little less than those on the continent. The UK will be looking to the EU, for a production rebound, to help meet some import demand.Ukrainian volumes are likely to be significantly constrained. Last month, the Ukrainian Government stated they were looking to harvest c.70% of crops this season. Although they didn’t specify which crops. However, with logistical networks highly compromised due to the conflict, exported volumes will likely be limited and sporadic.

Latest GB crop condition progress

Today sees an updated release of the AHDB crop condition progress report, reporting on conditions up to 27 April. Overall, winter crops are looking well. However, rainfall is needed to maintain prospects for the coming months. For spring crops, their outlook remains dependant on timely rainfall. To read the full report, click here.Today's Grain Market Daily on the AHDB website - The bullish tone continues for the oilseed complex

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.