- Location

- Stoneleigh

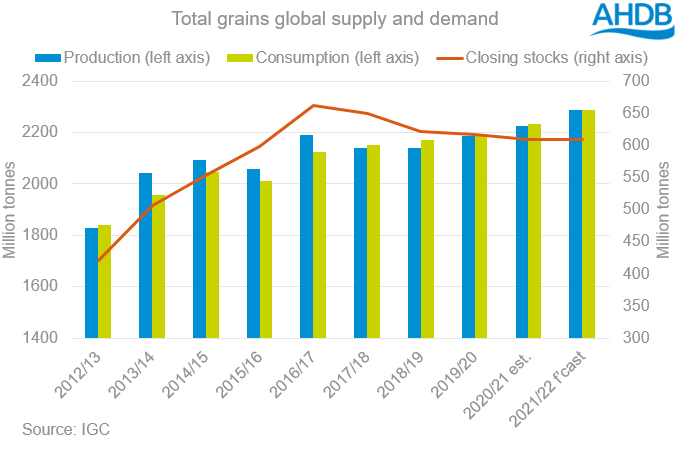

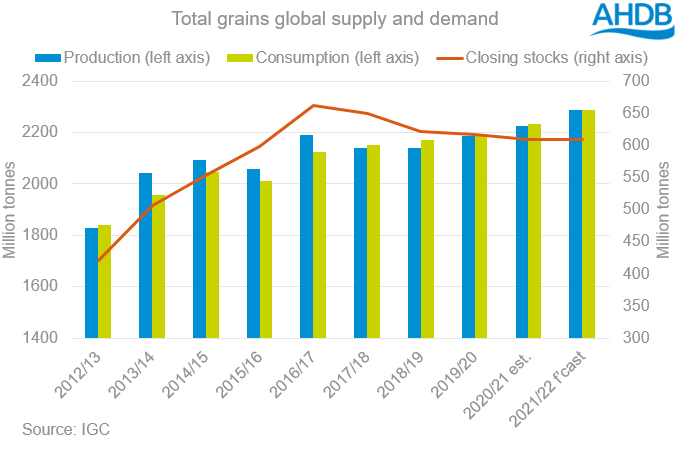

Last week, the International Grains Council (IGC) released their latest global supply and demand forecasts.

2020/21

Total grains production for 2020/21 has been increased by 2Mt compared to last month’s release and is now forecast at 2,226Mt. This increase was largely driven by higher maize production. However, this is entirely absorbed by a 2Mt increase in estimated consumption, to 2,235Mt. This is due to forecast increases in demand for wheat in animal feed, and increased industrial consumption of maize.

Wheat ending stocks have been cut by 3Mt to 289Mt. This is still 11MT higher year-on-year and close to record levels. This has been balanced by a 3Mt increase to maize ending stocks, which now stand at 271Mt. This is 26Mt lower than in 2019/20, and the smallest since 2013/14. Therefore, total grains ending stocks are unchanged at 609Mt, 8Mt lower than last season.

The low levels of US maize ending stocks, could leave the US maize balance sheet in a precarious situation, as we near the end of the season. With maize prices currently a key factor in the global grains complex rally, maize stocks are certainly an important watch point.

2021/22

Total grains ending stocks for 2021/22 are forecast to be in line with the current season, at 609Mt. This is despite total production being forecast to hit a record 2,287Mt, up 61Mt on the year. This been driven by production increases in Argentina, Ukraine, the US and the EU, offsetting reductions in Australia and Russia. These increases in production are offset by increased global consumption.

Global maize stocks are forecast up 6Mt on last month’s report, at 264Mt. The tight maize balance is driving prices at present. As such, it should be noted that maize ending stocks in 2021/22 are still forecast to decline year-on-year, by 7Mt.

Although both seasons are currently forecast to have similar ending stocks at 609Mt, in 2020/21, 322Mt of this is thought to be tied up in China. However, in 2021/22, just 312Mt is estimated to be Chinese. Further, it is anticipated that Chinese grain imports will reach 43Mt, down 8.5Mt year-on-year, but 17.4Mt up on 2019/20.

This would suggest Chinese supply is set to remain tight throughout next season. Therefore Chinese demand could continue to underpin global prices, despite record global production levels.

The IGC increases total grains production for 2020/21 but stocks remain tight.

Join the 3.5K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch

2020/21

Total grains production for 2020/21 has been increased by 2Mt compared to last month’s release and is now forecast at 2,226Mt. This increase was largely driven by higher maize production. However, this is entirely absorbed by a 2Mt increase in estimated consumption, to 2,235Mt. This is due to forecast increases in demand for wheat in animal feed, and increased industrial consumption of maize.

Wheat ending stocks have been cut by 3Mt to 289Mt. This is still 11MT higher year-on-year and close to record levels. This has been balanced by a 3Mt increase to maize ending stocks, which now stand at 271Mt. This is 26Mt lower than in 2019/20, and the smallest since 2013/14. Therefore, total grains ending stocks are unchanged at 609Mt, 8Mt lower than last season.

The low levels of US maize ending stocks, could leave the US maize balance sheet in a precarious situation, as we near the end of the season. With maize prices currently a key factor in the global grains complex rally, maize stocks are certainly an important watch point.

2021/22

Total grains ending stocks for 2021/22 are forecast to be in line with the current season, at 609Mt. This is despite total production being forecast to hit a record 2,287Mt, up 61Mt on the year. This been driven by production increases in Argentina, Ukraine, the US and the EU, offsetting reductions in Australia and Russia. These increases in production are offset by increased global consumption.

Global maize stocks are forecast up 6Mt on last month’s report, at 264Mt. The tight maize balance is driving prices at present. As such, it should be noted that maize ending stocks in 2021/22 are still forecast to decline year-on-year, by 7Mt.

Although both seasons are currently forecast to have similar ending stocks at 609Mt, in 2020/21, 322Mt of this is thought to be tied up in China. However, in 2021/22, just 312Mt is estimated to be Chinese. Further, it is anticipated that Chinese grain imports will reach 43Mt, down 8.5Mt year-on-year, but 17.4Mt up on 2019/20.

This would suggest Chinese supply is set to remain tight throughout next season. Therefore Chinese demand could continue to underpin global prices, despite record global production levels.

The IGC increases total grains production for 2020/21 but stocks remain tight.

Join the 3.5K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch