- Location

- Stoneleigh

We wrap up our week focused on the UK market with oats, the UK’s fourth largest combinable crop. We started with barley on Tuesday, covered rapeseed on Wednesday, and wheat yesterday.

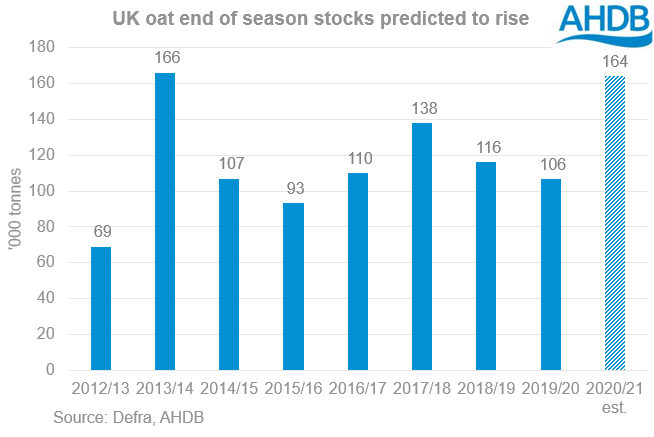

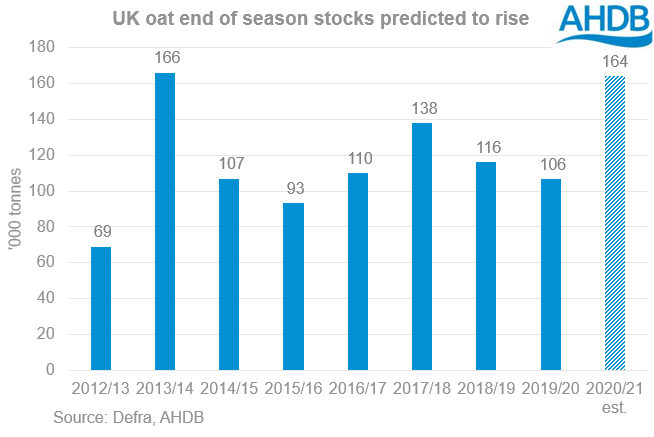

Total oat availability in 2020/21 is estimated at 1.16Mt. This is down 4% from 2019/20 due to smaller opening stocks and a slightly smaller (-45Kt) UK oat crop. Although availability is down year on year, we’re looking at higher carryout stocks. Stocks at the end of 2020/21 are estimated at 164Kt, 54% higher than last year’s low level and the highest since 2013/14.

The rise in stocks is largely because of a drop in exports. The total exportable surplus in 2020/21 is forecast at 40Kt. This is 10Kt less than was forecast in February, and 67% less than last season (120Kt). The reduction in the exportable surplus reflects the export pace to date (Jul-Mar) and larger domestic crops in import markets, such as Spain and Germany.

Mixed picture on demand

Total demand for oats is expected to rise 2% year on year to 954Kt. But, there are differing pictures between the milling and feed sectors.

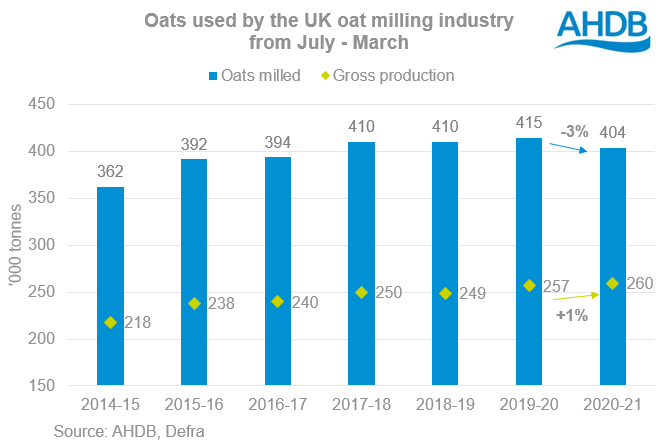

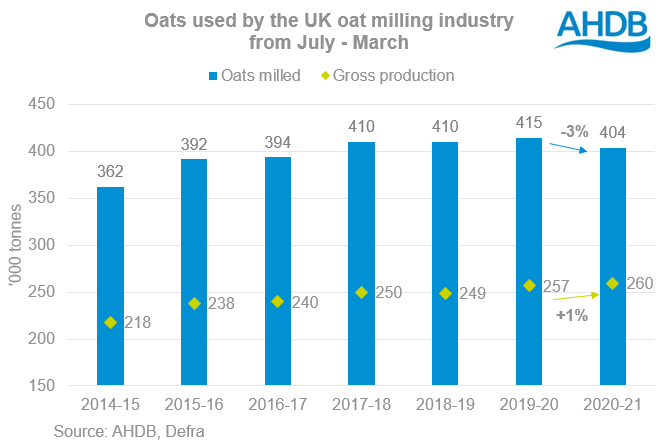

A total of 536Kt of oats are currently expected to be milled by the UK industry this season. This is 3% down year on year but in line with 2018/19.

In the week ending 20 May, the UK average spot ex-farm feed oat price was £131.90/t. This is £50.80/t below the spot feed barley price and £69.80/t below the spot feed wheat price. For wheat, the discount is similar to a month earlier (week ending 15 April). But, the discount to feed barley is far larger than last month’s £32.60/t, due to the rise in feed barley prices.

Higher stocks and a bigger crop in 2021/22?

AHDB’s Early Bird Survey of cropping intentions showed a small (+2%) rise in the UK oat area for harvest 2021. Using this area (214Kha), and the five-year (2016-2020) UK average yield of 5.4t/ha points to a 2021 crop of around 1.16Mt.

The five-year high yield of 5.9t/ha (2019) and five-year low (2020) yield of 4.9t/ha give a range of 1.05-1.27Mt.

With the discount of oats to other grains through spring, it is possible that we will see a reduced area planted. The results of the Planting and Variety survey will give more insight into the final area. They are usually out in July.

But, the information we have at present points to an oat crop in 2021 at least as big as the 2020 crop. If the crop size is similar or larger, the total supply before imports will be higher. So, it’s likely that UK free market oat prices will be under pressure into the new season.

However, it is important to draw a clear distinction between the price of oats for export and animal feed demand and the price of oats going into mills. The milling market, particularly in England, is heavily geared towards contracted supplies. These contracts will have been agreed 12 to 18 months ago, in line with wheat futures markets.

The value of contracted oats will likely be supported in line with the sentiment of the global grain market. So, they will likely see more support than “free market” oats.

More wheat is expected to come back into animal feed rations in place of barley, as the crop rebounds. Oats will need to keep competing for animal feed demand next season, to help to balance the market. Price is likely to be an important part of this competition.

UK oat stocks to rise as exports drop off

Join the 3.6K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch

Total oat availability in 2020/21 is estimated at 1.16Mt. This is down 4% from 2019/20 due to smaller opening stocks and a slightly smaller (-45Kt) UK oat crop. Although availability is down year on year, we’re looking at higher carryout stocks. Stocks at the end of 2020/21 are estimated at 164Kt, 54% higher than last year’s low level and the highest since 2013/14.

The rise in stocks is largely because of a drop in exports. The total exportable surplus in 2020/21 is forecast at 40Kt. This is 10Kt less than was forecast in February, and 67% less than last season (120Kt). The reduction in the exportable surplus reflects the export pace to date (Jul-Mar) and larger domestic crops in import markets, such as Spain and Germany.

Mixed picture on demand

Total demand for oats is expected to rise 2% year on year to 954Kt. But, there are differing pictures between the milling and feed sectors.

- Milling volume eases back a little

A total of 536Kt of oats are currently expected to be milled by the UK industry this season. This is 3% down year on year but in line with 2018/19.

- Animal feed usage remains high

In the week ending 20 May, the UK average spot ex-farm feed oat price was £131.90/t. This is £50.80/t below the spot feed barley price and £69.80/t below the spot feed wheat price. For wheat, the discount is similar to a month earlier (week ending 15 April). But, the discount to feed barley is far larger than last month’s £32.60/t, due to the rise in feed barley prices.

Higher stocks and a bigger crop in 2021/22?

AHDB’s Early Bird Survey of cropping intentions showed a small (+2%) rise in the UK oat area for harvest 2021. Using this area (214Kha), and the five-year (2016-2020) UK average yield of 5.4t/ha points to a 2021 crop of around 1.16Mt.

The five-year high yield of 5.9t/ha (2019) and five-year low (2020) yield of 4.9t/ha give a range of 1.05-1.27Mt.

With the discount of oats to other grains through spring, it is possible that we will see a reduced area planted. The results of the Planting and Variety survey will give more insight into the final area. They are usually out in July.

But, the information we have at present points to an oat crop in 2021 at least as big as the 2020 crop. If the crop size is similar or larger, the total supply before imports will be higher. So, it’s likely that UK free market oat prices will be under pressure into the new season.

However, it is important to draw a clear distinction between the price of oats for export and animal feed demand and the price of oats going into mills. The milling market, particularly in England, is heavily geared towards contracted supplies. These contracts will have been agreed 12 to 18 months ago, in line with wheat futures markets.

The value of contracted oats will likely be supported in line with the sentiment of the global grain market. So, they will likely see more support than “free market” oats.

More wheat is expected to come back into animal feed rations in place of barley, as the crop rebounds. Oats will need to keep competing for animal feed demand next season, to help to balance the market. Price is likely to be an important part of this competition.

UK oat stocks to rise as exports drop off

Join the 3.6K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch