- Location

- Stoneleigh

Tonight, the USDA will release the annual US prospective plantings report and the quarterly US stocks report. Markets are relatively quiet at the moment, with the exception of soyabeans yesterday. As a result, these reports could be key to market sentiment in the short term.

What is the expectation for tonight’s reports?

Looking forward to the release tonight, Refinitiv trade estimates peg stocks for all three commodities lower than at the same point in 2020. The average trade estimate for maize is currently,197Mt compared to 202Mt in the previous season and a drawdown of 91Mt since December 2020.

The average trade estimate for wheat is 35Mt, versus 39Mt this time last year. Soyabean estimates are sharply lower, at 42Mt compared to last year’s figure of 61Mt.

With large cuts to stocks expected by trade, if cuts are less severe we could see further pressure on prices in the short term.

The prospective plantings of maize, wheat and soyabeans are estimated by trade to be up on the year, and on the early suggestions from February’s USDA outlook. Maize is estimated at 37.7Mha, compared to 36.8Mha last year and February’s estimate of 37.2Mha.

All wheat acreage is estimated to be slightly higher than the 17.96Mha estimated in 2020, pegged at an average of 18.2Mha. Soyabeans are sharply up year-on-year, with average trade estimates at 36.4Mha, compared with the March 2020 estimate of 33.62Mha. However, trade estimates are broadly in line with figures given at February’s USDA outlook conference.

Should we see increased acreage for maize, above what is expected by the trade, we could see increased pressure on prices. New crop Chicago maize futures have been tracking down over the past month.

What have previous reports meant for markets?

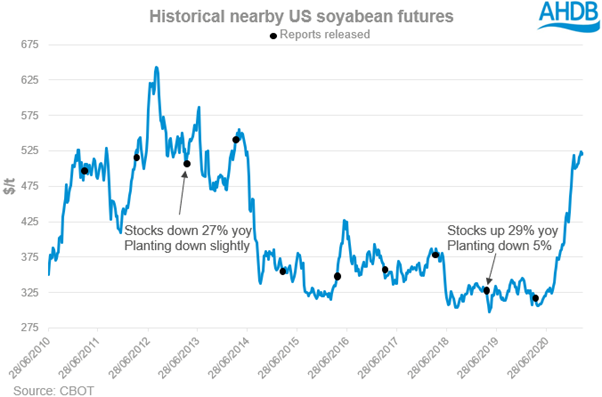

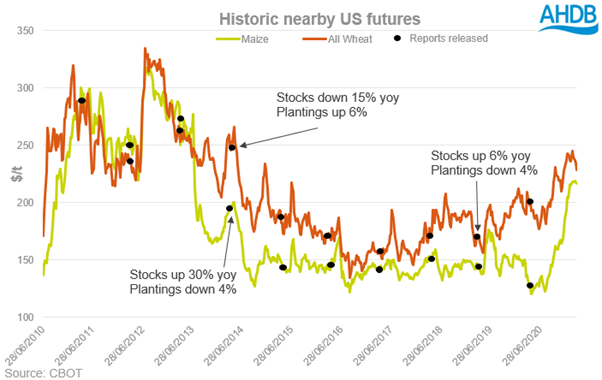

I have looked at the outcome of USDA stocks and acreage reports since 2010 to see how they have affected the price movement of nearby Chicago futures for wheat, maize and soyabeans.

The March release often brings some surprises and can cause markets to move in a big way. Looking at soyabeans and maize, apart from last year, in the previous 14 years at least one of the contracts had moved 2% or more on the day of the release.

In 2013, soyabeans rallied hard after the March stocks report showed stocks down 27% year–on-year, with predicted plantings roughly the same as the previous season.

The opposite happened in 2019, when soyabean stocks were forecast up 29%. However, in 2019 plantings were expected to be down 5%, which could have played a part in preventing prices falling too low.

These reports have also played a part in reversing market sentiment. In 2014, wheat enjoyed a strong rally from the end of January to mid-March. However, this rally ran out of steam and prices started backing off. Then, the stocks report pegged wheat stocks down 15%, which led to a rise in prices in the short term.

In some years, it would seem that there is very little impact after the release of these reports. This could be because the information wasn’t a surprise and was already priced in, or there were other fundamentals already underpinning the market. For instance, in 2015, soyabean stocks were estimated at 34% higher year-on-year with a similar acreage forecast, and yet the market did not really seem to respond to this news.

Another reason could be that one report was bullish, and the other bearish, effectively cancelling each other out. An example of this, would be in 2016 for wheat. The acreage was predicted to be 9% lower year-on-year; stocks were up 20%. Because of this, prices were relatively unchanged in the following weeks.

https://ahdb.org.uk/news/how-has-th...rices-over-the-last-decade-grain-market-daily

Join the 3.5K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch

What is the expectation for tonight’s reports?

Looking forward to the release tonight, Refinitiv trade estimates peg stocks for all three commodities lower than at the same point in 2020. The average trade estimate for maize is currently,197Mt compared to 202Mt in the previous season and a drawdown of 91Mt since December 2020.

The average trade estimate for wheat is 35Mt, versus 39Mt this time last year. Soyabean estimates are sharply lower, at 42Mt compared to last year’s figure of 61Mt.

With large cuts to stocks expected by trade, if cuts are less severe we could see further pressure on prices in the short term.

The prospective plantings of maize, wheat and soyabeans are estimated by trade to be up on the year, and on the early suggestions from February’s USDA outlook. Maize is estimated at 37.7Mha, compared to 36.8Mha last year and February’s estimate of 37.2Mha.

All wheat acreage is estimated to be slightly higher than the 17.96Mha estimated in 2020, pegged at an average of 18.2Mha. Soyabeans are sharply up year-on-year, with average trade estimates at 36.4Mha, compared with the March 2020 estimate of 33.62Mha. However, trade estimates are broadly in line with figures given at February’s USDA outlook conference.

Should we see increased acreage for maize, above what is expected by the trade, we could see increased pressure on prices. New crop Chicago maize futures have been tracking down over the past month.

What have previous reports meant for markets?

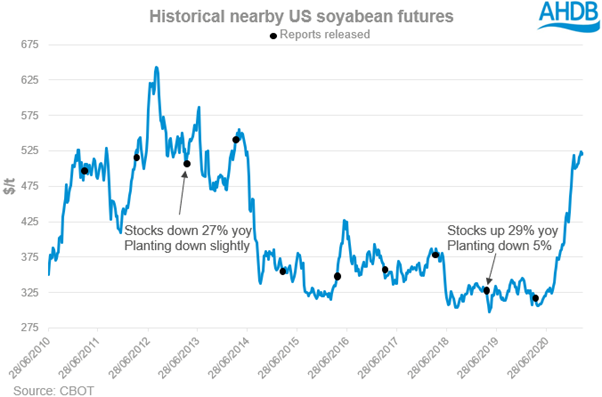

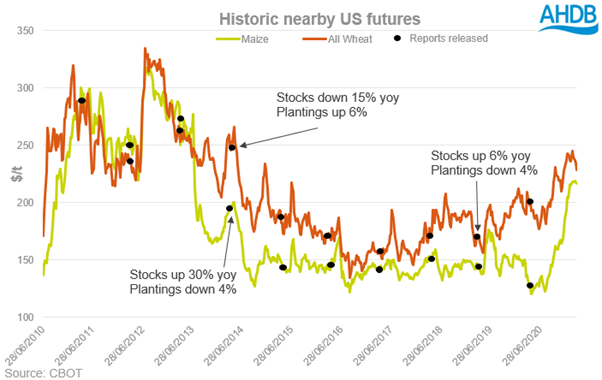

I have looked at the outcome of USDA stocks and acreage reports since 2010 to see how they have affected the price movement of nearby Chicago futures for wheat, maize and soyabeans.

The March release often brings some surprises and can cause markets to move in a big way. Looking at soyabeans and maize, apart from last year, in the previous 14 years at least one of the contracts had moved 2% or more on the day of the release.

In 2013, soyabeans rallied hard after the March stocks report showed stocks down 27% year–on-year, with predicted plantings roughly the same as the previous season.

The opposite happened in 2019, when soyabean stocks were forecast up 29%. However, in 2019 plantings were expected to be down 5%, which could have played a part in preventing prices falling too low.

These reports have also played a part in reversing market sentiment. In 2014, wheat enjoyed a strong rally from the end of January to mid-March. However, this rally ran out of steam and prices started backing off. Then, the stocks report pegged wheat stocks down 15%, which led to a rise in prices in the short term.

In some years, it would seem that there is very little impact after the release of these reports. This could be because the information wasn’t a surprise and was already priced in, or there were other fundamentals already underpinning the market. For instance, in 2015, soyabean stocks were estimated at 34% higher year-on-year with a similar acreage forecast, and yet the market did not really seem to respond to this news.

Another reason could be that one report was bullish, and the other bearish, effectively cancelling each other out. An example of this, would be in 2016 for wheat. The acreage was predicted to be 9% lower year-on-year; stocks were up 20%. Because of this, prices were relatively unchanged in the following weeks.

https://ahdb.org.uk/news/how-has-th...rices-over-the-last-decade-grain-market-daily

Join the 3.5K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch