- Location

- Stoneleigh

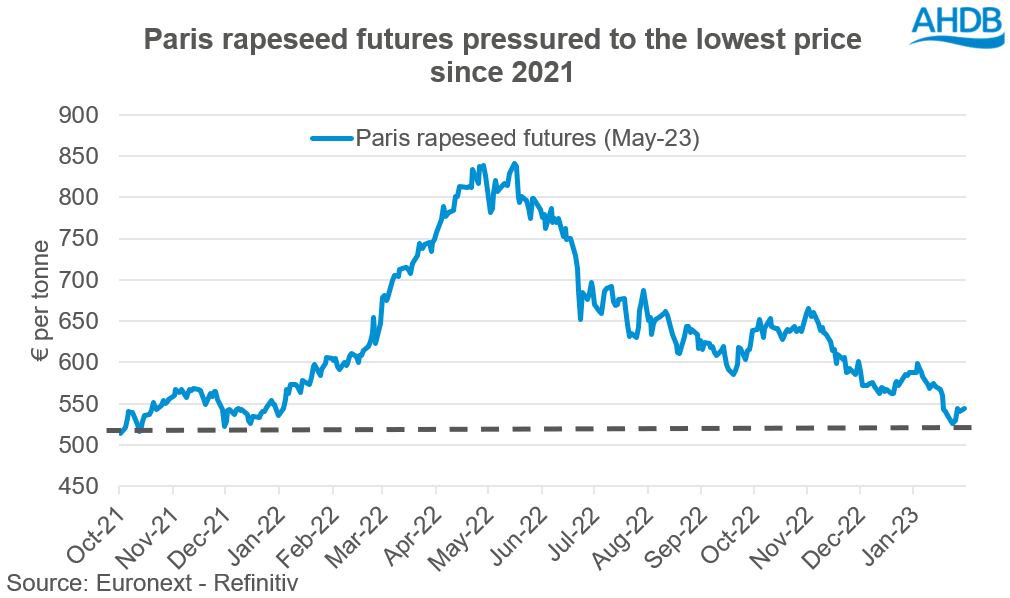

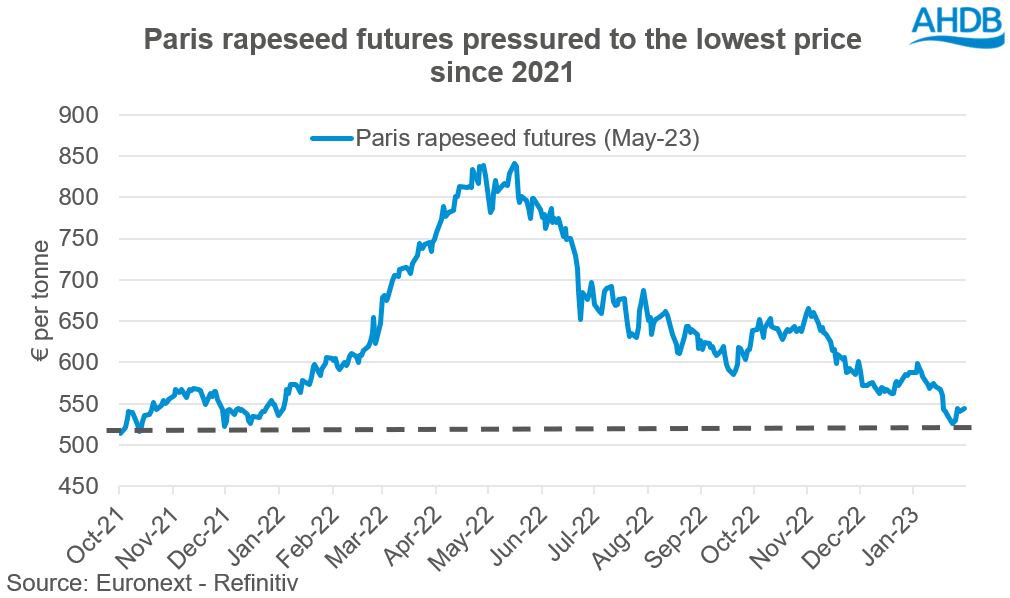

At the beginning of last week Paris rapeseed futures (May-23) closed at their lowest price since the middle of December 2021. As the week progressed, the contract recovered some ground, but remains at levels last seen at the start of 2022. The downward pressure on rapeseed futures has also been seen in UK delivered prices, which have been below the £500/t mark now for the past couple of weeks (spot delivery, Erith).

There has been an array of bearish news which has really weighed on rapeseed prices over these last few months. Some of the main causes of pressure have been downward movements in crude oil prices, the continuation of the Black Sea corridor and the German environment minister proposing an end to production of crop-based biofuels in stages, by 2030.

Since the low recorded last Monday (23 Jan), Paris rapeseed futures have gained 4%, with the May-23 contract closing yesterday at €544.75/t.

Driving this support over recent days is further dry conditions across parts of Argentina’s soyabean growing regions, as well as flooding in parts of Malaysia, which has the potential to impact palm oil yields.

However, what is critical to note and are key watchpoints for domestic rapeseed prices over the next month are:

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.

There has been an array of bearish news which has really weighed on rapeseed prices over these last few months. Some of the main causes of pressure have been downward movements in crude oil prices, the continuation of the Black Sea corridor and the German environment minister proposing an end to production of crop-based biofuels in stages, by 2030.

Since the low recorded last Monday (23 Jan), Paris rapeseed futures have gained 4%, with the May-23 contract closing yesterday at €544.75/t.

Driving this support over recent days is further dry conditions across parts of Argentina’s soyabean growing regions, as well as flooding in parts of Malaysia, which has the potential to impact palm oil yields.

Will this continue?

With rapeseed’s premium converging with soyabean futures and trading at near parity to them, any support to soyabean prices will inherently filter into rapeseed prices. Momentarily, the persistent dry weather in Argentina will likely keep prices elevated, with rains looking patchy over the next week in areas that need it.However, what is critical to note and are key watchpoints for domestic rapeseed prices over the next month are:

- Brazilian harvesting their record soyabean crop, with 5.2% harvested (as of 28 Jan), down from 11.6% from the same point last year (Conab). The market seems very fixated on these marginal losses to the Argentinian soyabean crops. However, Brazil is estimated to produce an extra 27.2Mt on the year, with several consultancies estimating their crop at over 150Mt. With Brazil’s soyabean harvest now underway, the demand origin will switch from US to Brazil. Brazilian prices of soyabeans are being quoted at a consistent discount to US origin. When Brazil’s export campaign starts, this could weigh on prices and give rapeseed the room to move lower.

- There is a virtual OPEC+ meeting being held tomorrow at 11:00GMT to discuss output. The last meeting was in October when OPEC+ agreed to cut its production target by 2 million barrels per day, c.2% of world demand, from November 2022 until the end of 2023. In the coming meeting, there will be discussions over the economic outlook and the scale of Chinese demand. However, these discussions aren’t anticipated to change the policy in place. The outcome and decisions made in this meeting will likely influence crude oil prices and in turn have an impact on the oilseed complex, including rapeseed.

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.