Beaureucrats "massaging" the figures in order to get the result they want. Look at the current official inflation rate, out in the real world it's a lot higher.In a global market place place raising or falling standards of living are are not down to absolute productivity but related to how domestic productivity is performing compared relative to other economies. The UK was once a leader in productivity which made us one of the wealthiest nations but we are going backwards which can only result in a decline in living standards over time.

View attachment 1046922

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

When will everything stop going up ?.

- Thread starter Boomerang

- Start date

Exactly 90 % were far poorer than the rich the poor didnt own their house, they didnt go on holiday or 9wn a car, standards of living are far far higher if you tax more you tax far more people and even Gordon Brown admitted the 50 % tax rate reduced tax taken in. The way to increase tax intake is to tax voluntary spending more, ie booze, fags, holidays, certain types of cars, TVs etc people can then choose to be taxed or notNo it isnt

Basic economics havent changed

In 1914 the wealthy lived like kings and 90% lived in poverty

Various revolutions showed what could happen, and the govt taxed the rich to pay for the war

Covid has resulted in war type debt, and brexit has made it worse, and now we have war with mad vlad.

This winter could be explosive if electricity and fuel costs are not curbed. Boris beware

farmerm

Member

- Location

- Shropshire

keeping printing money and it doesnt run out....That doesn’t follow. Look at some of the countries where they havr currently run out of money. Sri Lanka, Turkey and Argentina, where they have no money left to import fuel, fertiliser or food. These have massive inflation as their currency devalues from day to day.

Another words comparing apples and pears, it's like comparing a 50 acre dairy farm in wales to a 10,000 cow one in the states.In a global market place place raising or falling standards of living are are not down to absolute productivity but related to how domestic productivity is performing compared relative to other economies. The UK was once a leader in productivity which made us one of the wealthiest nations but we are going backwards which can only result in a decline in living standards over time.

View attachment 1046922

2wheels

Member

- Location

- aberdeenshire

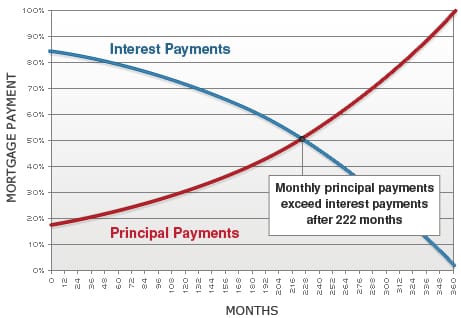

it's the same with all the pcp deals on cars, farm machinery on drip feed so just a natural progression.No, it's a con. you've basically paid Fck all capital back but plenty of interest to fill the bankers pockets. Rent and then at least you don't have to maintain or insure etc the property.

Courier

Member

- Location

- M62 - M1 - M18 triangle

To use an analogy with electricity supply - peoples “base load” expenditure is now many times higher than it was …. And that’s before feeding themselves.

farmerm

Member

- Location

- Shropshire

Where resources are competed for on global world markets it is all relative, no country is an (economic) island aside from N Korea perhaps. The farm in the states was once claimed from the wild by a migrant that may have arrived with little more than the clothes he wore, his productivity and the productivity of those that followed him have provided his descendants are far greater standard of living....Another words comparing apples and pears, it's like comparing a 50 acre dairy farm in wales to a 10,000 cow one in the states.

- Location

- LINCOLNSHIRE/KENYA

That’s the simplest answer. It’s basic economics really not so much supply and demand which is how the Government is telling it but more price elasticity basically how high can prices be pushed until people stop buying. 18 months of Covid stagnation means businesses need something to stimulate demand a booming economy might be one way or fear of shortage might be another. Unfortunately labour shortages and declining populations in the western world mean it’s hard to stimulate the economy so a manufactured shortage is the next option. Note the Government isn’t telling people to be shrifty and wise with their money it’s very happy to take in the fuel taxes and other taxes thanks to inflation."When will everything stop going up ?."

- when the money runs out.....

I'm not sure you got what I meant, comparing productivity to me is the output of product per person per year not the profit gained from that, to me it can be measured by sector or by a country as a whole those with a bloated public sector such as the UK will suffer if done on a country basis, then of course how do you measure the output of a teacher or doctor? As we often see on this site stats can be used to show anything you like if taken out of context, the MSM love to do thisWhere resources are competed for on global world markets it is all relative, no country is an (economic) island aside from N Korea perhaps. The farm in the states was once claimed from the wild by a migrant that may have arrived with little more than the clothes he wore, his productivity and the productivity of those that followed him have provided his descendants are far greater standard of living....

A government minister did say people could save money by putting a pullover on instead of the heating, the press tore him to shreds,That’s the simplest answer. It’s basic economics really not so much supply and demand which is how the Government is telling it but more price elasticity basically how high can prices be pushed until people stop buying. 18 months of Covid stagnation means businesses need something to stimulate demand a booming economy might be one way or fear of shortage might be another. Unfortunately labour shortages and declining populations in the western world mean it’s hard to stimulate the economy so a manufactured shortage is the next option. Note the Government isn’t telling people to be shrifty and wise with their money it’s very happy to take in the fuel taxes and other taxes thanks to inflation.

Minister is forced to deny wearing a JUMPER will be guidance in winter

The controversial advice was said to be part of a doomsday scenario plan from the Cabinet Office to help people cope with sky high bills and, potentially, shortages.

Why leaders won’t tell Europeans to put on a sweater to beat Putin

National and international agencies, but few politicians, are calling for people to cut their energy use.

2wheels

Member

- Location

- aberdeenshire

ours has been static for 14yrs.They don’t have to actually fall per se, merely stagnate for years and years. Price falls would be more purging for the system but govts don’t seem to even find static prices palatable.

Why?might be the only way the next generation can get a mortgage

Bingo. Base load being the money they spend servicing their mortgage/rent. Their base load has been creeping up and up for decades. Now things have got a little "difficult" and the penny is finally starting to drop. For some …To use an analogy with electricity supply - peoples “base load” expenditure is now many times higher than it was …. And that’s before feeding themselves.

The only way out is rising wage demands, which we’re starting to see now. This time it’s different though

- Location

- somerset

l should think the treasury is pleased as punch, with its tax take from fuel, it will interfere, but not to quickly, to much debt to repay.That’s the simplest answer. It’s basic economics really not so much supply and demand which is how the Government is telling it but more price elasticity basically how high can prices be pushed until people stop buying. 18 months of Covid stagnation means businesses need something to stimulate demand a booming economy might be one way or fear of shortage might be another. Unfortunately labour shortages and declining populations in the western world mean it’s hard to stimulate the economy so a manufactured shortage is the next option. Note the Government isn’t telling people to be shrifty and wise with their money it’s very happy to take in the fuel taxes and other taxes thanks to inflation.

The consumer, only has x amount of money to spend, the problem is the way, they spend that money, could be that they think leisure, or material goods, are more important than essentials, like food.

That is their choice. Guv policy has been cheap food, more spent on taxable goods. The vast majority of people in the UK, have never experienced anything other than cheap food. Not even sure many fully realise, how vital to their lives, food is, that is down to educations failure to teach that vital requirement.

The basic requirements of life, are simple, food and shelter, they are the top of the list, and both are rapidly increasing in price, they also come before anything else. So those two vitals, have moved from the bottom, to the top, of life's ladder. Food, affects us, as farmers, in how we farm, and what we farm, and we need to second guess, how the consumer will react to increasing prices. @Lowland1, is exporting veg from Kenya, to here (apologies if incorrect), because they can grow them cheaper there, than here, and no doubt are supplying out of season veg, all the year round. Good for him, but its pretty stupid, by carbon measures.

Again, he's spot on, when he says, there is a limit, to what people, can/prepared to spend on any item. Food is a fundamental requisite of life, so they have to buy it. But, with other bills to pay, there is a limit on price.

I get peed off, by being told, we have to diversify, to maintain an income, a guv spin, so food stays cheap, income flows from outside ag. Great on paper, but if we all diversified, the job will be overdone. Ideas, like farm shops, niche foods, luxury camping etc, have a limited following, that will shrink, on price reason.

We need to concentrate on producing the basic food stuffs, the 'exotic/niche' foods, will be to dear, for many, basic camping, might increase though. The recession will end, when is not known, but as farmers, we produce a vital product, we need to follow the policy, based on what, the silent majority, need, and can afford, not what some jumped up twatt tells us, what he thinks they want.

Cowabunga

Member

- Location

- Ceredigion,Wales

It actually does. Before you know it you will be printing £100million notes which will buy you a cup of tea the day before it costs £500millon. Basically the amount means nothing because it becomes near worthless.keeping printing money and it doesnt run out....

Are we heading for recession?

House price crash?

Where is the ceiling? or does everyone have a bottom less pocket ?

Or just keep borrowing.

Is financial armageddon around the corner ?

It's going to get messy I think. In preparation we've fixed two largish loans back in March before rates rose so sitting pretty now at under 4% total rate. We put off a cottage renovation for 18 months but just starting it now as materials have come back a bit and we now have tradesmen looking for work back at realistic rates. We ordered a kitchen and has now dropped by 30% in price since a year ago and instead of being an 8 month wait is now only 6 weeks. We've plumbed the houses on the farm into a straw boiler so have stopped buying kerosene and just using straw out the fields. Got a house rented in a local town that has gone up by £100k in 6 years so probably going to sell it over the next few weeks as my gut feeling is house prices are going to collapse by Q1 in 2023. Talking to our bank last week and they won't now lend a business money to buy domestic property to rent out. Happy to give a personal montage though. Got land lined up to rent out for potatoes and possibly carrots as well as some maize for AD. Ws going to change the loader and buy anther used tractor but we've shelved both those ideas as well. Talking to a local dealer about both those items they said things had cooled off a bit. Lead times on new stuff is still mad but they have noticed a drop in interest of both new and used equipment over the last few weeks. Interestingly they mentioned a very large outfit who I know farm about 6000 ac as well as run a big contracting outfit specialising in AD work and they normally are replacing stuff regularly but have decided to run stuff out of warranty and take the risk instead of changing and staying on the never ending finance treadmill. I just feel things are going to take a turn for the worst unless we get a new government which may just stall it a bit. I hate to say this but I think if we had an election I would be voting labour as I think they at the moment would do a better job than the current bunch who quite frankly are a disaster under Boris. Even if Boris went I don't think they can turn it around.

Hindsight

Member

- Location

- Lincolnshire

l should think the treasury is pleased as punch, with its tax take from fuel, it will interfere, but not to quickly, to much debt to repay.

The consumer, only has x amount of money to spend, the problem is the way, they spend that money, could be that they think leisure, or material goods, are more important than essentials, like food.

That is their choice. Guv policy has been cheap food, more spent on taxable goods. The vast majority of people in the UK, have never experienced anything other than cheap food. Not even sure many fully realise, how vital to their lives, food is, that is down to educations failure to teach that vital requirement.

The basic requirements of life, are simple, food and shelter, they are the top of the list, and both are rapidly increasing in price, they also come before anything else. So those two vitals, have moved from the bottom, to the top, of life's ladder. Food, affects us, as farmers, in how we farm, and what we farm, and we need to second guess, how the consumer will react to increasing prices. @Lowland1, is exporting veg from Kenya, to here (apologies if incorrect), because they can grow them cheaper there, than here, and no doubt are supplying out of season veg, all the year round. Good for him, but its pretty stupid, by carbon measures.

Again, he's spot on, when he says, there is a limit, to what people, can/prepared to spend on any item. Food is a fundamental requisite of life, so they have to buy it. But, with other bills to pay, there is a limit on price.

I get peed off, by being told, we have to diversify, to maintain an income, a guv spin, so food stays cheap, income flows from outside ag. Great on paper, but if we all diversified, the job will be overdone. Ideas, like farm shops, niche foods, luxury camping etc, have a limited following, that will shrink, on price reason.

We need to concentrate on producing the basic food stuffs, the 'exotic/niche' foods, will be to dear, for many, basic camping, might increase though. The recession will end, when is not known, but as farmers, we produce a vital product, we need to follow the policy, based on what, the silent majority, need, and can afford, not what some jumped up twatt tells us, what he thinks they want.

The extra tax take from fuel offsets the tax loss from increasing number electric cars which if an correct pay no fuel tax and no road fund licence. And the benefit in kind is advantageous as well. Soon be time these EV folk paid to mend the roads!

- Location

- Northumberland

I see that local beef is now ‘too expensive’ for school meals, and that caterers are switching to ‘cheaper imported meats’….

Well, I do hope it’s all Red Tractor assured; I believe I read that it’s ‘what the customer wants’..

Well, I do hope it’s all Red Tractor assured; I believe I read that it’s ‘what the customer wants’..

School dinners: Beef off the menu as costs rise

Menus have fewer options and some schools are switching to cheaper meat from abroad, caterers say.

www.bbc.co.uk

towbar

Member

- Location

- Louth, Ireland

I’m curious do you expect to get it debt free? Why should your parents clear all debt? With inflation quite possible that debt is insignificant in terms of the value of the property. If you do find yourself burdened with a 50 yr mortgage half or more paid off I’d say there would be plenty of takers to help you out of it!Let’s face it, multi generational debt is fairly common in agriculture. That said I don’t know how happy I’d be if my folks died leaving me a mortgage to pay. Even if you do sell there are usually significant costs to incur coming out of a mortgage

toquark

Member

Debt is a burden. Worse than that, debt on a mortgage is a personal burden, which is not generally serviced by the asset. I have no real issue with debt being heritable on a business, assuming the business has the means of servicing it. Houses generally don't, so therefore you're passing on that burden to the next generation which they are obliged to service with personal income.I’m curious do you expect to get it debt free? Why should your parents clear all debt? With inflation quite possible that debt is insignificant in terms of the value of the property. If you do find yourself burdened with a 50 yr mortgage half or more paid off I’d say there would be plenty of takers to help you out of it!

May Event: The most profitable farm diversification strategy 2024 - Mobile Data Centres

Apr

02

- 2,554

- 49

With just a internet connection and a plug socket you too can join over 70 farms currently earning up to £1.27 ppkw ~ 201% ROI

Register Here: https://www.eventbrite.com/e/the-mo...2024-mobile-data-centres-tickets-871045770347

Tuesday, May 21 · 10am - 2pm GMT+1

Location: Village Hotel Bury, Rochdale Road, Bury, BL9 7BQ

The Farming Forum has teamed up with the award winning hardware manufacturer Easy Compute to bring you an educational talk about how AI and blockchain technology is helping farmers to diversify their land.

Over the past 7 years, Easy Compute have been working with farmers, agricultural businesses, and renewable energy farms all across the UK to help turn leftover space into mini data centres. With...

Register Here: https://www.eventbrite.com/e/the-mo...2024-mobile-data-centres-tickets-871045770347

Tuesday, May 21 · 10am - 2pm GMT+1

Location: Village Hotel Bury, Rochdale Road, Bury, BL9 7BQ

The Farming Forum has teamed up with the award winning hardware manufacturer Easy Compute to bring you an educational talk about how AI and blockchain technology is helping farmers to diversify their land.

Over the past 7 years, Easy Compute have been working with farmers, agricultural businesses, and renewable energy farms all across the UK to help turn leftover space into mini data centres. With...