Written by Iain Hoey

The FAO has published its 2021 Food Outlook report this month, which has revealed that after two years of African Swine Fever-driven decline, global meat production is anticipated to expand in 2021, rising by 2.2% to 346 million tonnes.

“This is driven primarily by China, although production in Brazil, Vietnam, the US and the EU is also expected to increase,” commented AHDB analyst Bethan Wilkins. “In contrast, declining production is foreseen for Australia, the Philippines and Argentina.”

The anticipated meat production growth in China reflects likely output expansions across all meat types, especially pig meat, driven by large investments in enhancing meat value chains and biosafety.

However, the large pig meat deficit persists in China, which ha induced production expansions in all animal production systems, including in key supplier regions, especially Brazil and the European Union.

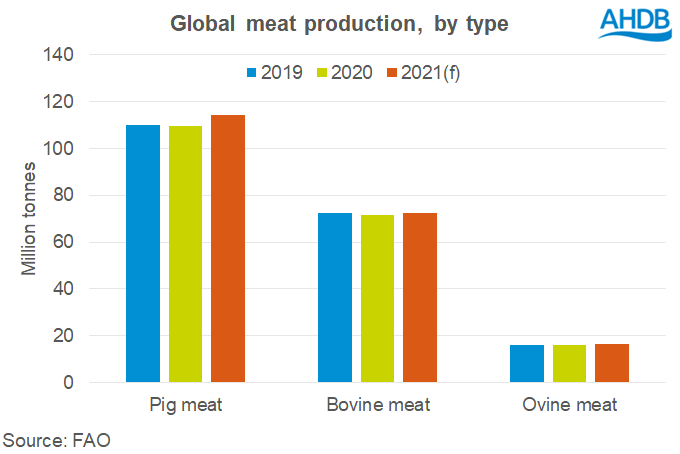

Pig meat output is forecast to expand by 4.2% to 114 million tonnes, which is still 5% below the level before ASF began affecting Chinese production.

Most of the anticipated increase stems from a recovery in Chinese production, expected to reach 46 million tonnes, a 10% increase on 2020 and 85% of the pre-ASF level.

Global production of bovine meat is also forecast to recover slightly, up by 1.2% to 72 million tonnes. Growth is expected in particular from the US, Brazil and China.

Global ovine meat output is forecast to expand by about 1% to 16 million tonnes. China is again expected to be the source of much of this growth.

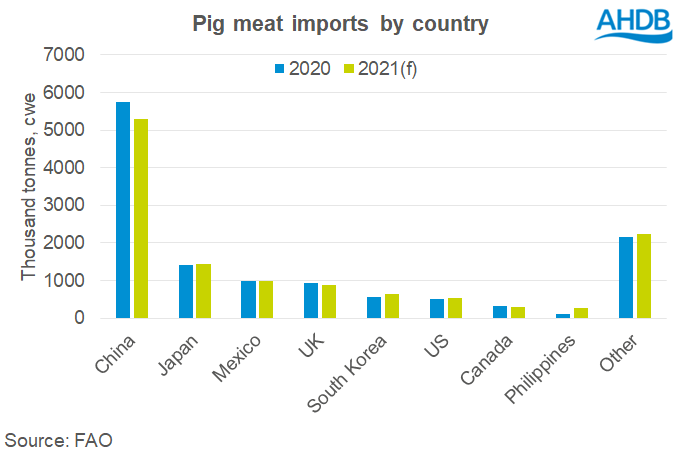

Global meat trade is, however, forecast to stagnate in 2021 as the recovering meat production in China means the demand main driver of trade growth in recent years has waned.

The report predicts that the pig meat trade is to stall, falling by 0.6% to 12.8 million tonnes. An 8% decline in purchases is expected from China, and moderate import drops are also expected from Vietnam, Canada, and here in the UK. In response to the falling demand, exports are expected to fall from the EU, Chile and Canada, as well as the UK.

Global ovine meat trade is also forecast to contract this year, declining by 0.8% to just over 1 million tonnes.

“Supply constraints in New Zealand and here in the UK will lead to falling imports by the Middle East, as well as the US and EU. Chinese imports are still expected to rise,” Ms Wilkins commented.

In contrast, world bovine meat trade is expected to recover this year, rising by 1.1% to 12 million tonnes. This is mainly due to consistent import demand from China. Brazil, the US, Uruguay and Canada are projected to meet much of the additional demand.

To read the full report, click here.

Get Our E-Newsletter - breaking news to your in-box twice a week

See e-newsletter example

Will be used in accordance with our Privacy Policy

Continue reading on the Farm Business Website...