- Location

- Stoneleigh

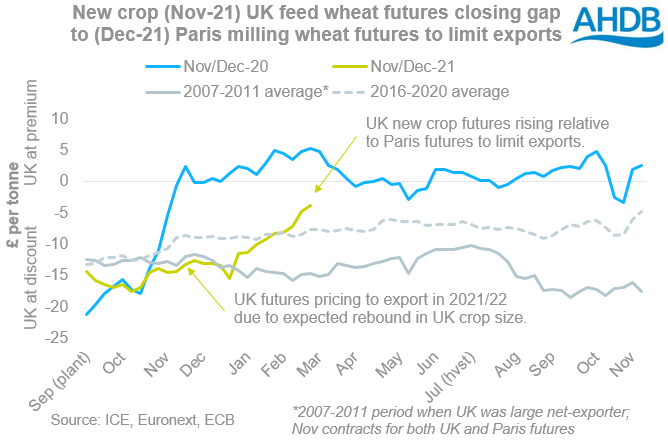

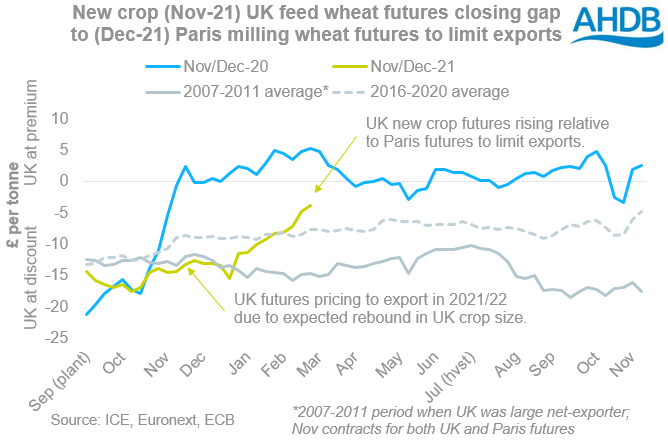

New crop UK feed wheat futures are now pricing to limit exports in the 2021/22 season. This is because UK supply and demand could be tight again next season unless we get bumper yields.

At present, UK feed wheat (Nov-21) is currently pricing at a much narrower discount to Paris milling wheat (Dec-21) than normal. Before 2012, when the UK routinely exported larger volumes of wheat, a discount of around £15/t was ‘normal’. This is because the UK futures are based on a feed wheat specification, but Paris futures are based on a milling wheat specification.

Last autumn, the Nov-21 contract was pricing around £12-18/t below new crop (Dec-21) Paris futures. This reflected expectations of a rebound in wheat planting in the UK, plus uncertainty about the UK’s ability to export to the EU after 1 January 2021.

Since January, the discount has narrowed. Yesterday, Nov-21 UK feed wheat futures closed at £171.10/t, approximately £3.55/t below the Dec-21 Paris milling wheat futures contract (Refinitiv). Several reasons are behind this:

Nov-21 UK feed wheat futures will likely remain at a narrow discount (or small premium) to new crop Paris futures until we know about the UK crop. Our next report on UK crop conditions will be released in early April.

If the UK has a bumper crop next season, the UK discount may need to widen again to incentivise exports. But, if UK yields are average or lower, UK prices will likely need to rise to a premium to Paris futures to attract imports. This is the case regardless of if the global market rises or falls.

https://ahdb.org.uk/news/new-crop-wheat-pricing-to-limit-exports-grain-market-daily

Join the 3.4K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch

At present, UK feed wheat (Nov-21) is currently pricing at a much narrower discount to Paris milling wheat (Dec-21) than normal. Before 2012, when the UK routinely exported larger volumes of wheat, a discount of around £15/t was ‘normal’. This is because the UK futures are based on a feed wheat specification, but Paris futures are based on a milling wheat specification.

Last autumn, the Nov-21 contract was pricing around £12-18/t below new crop (Dec-21) Paris futures. This reflected expectations of a rebound in wheat planting in the UK, plus uncertainty about the UK’s ability to export to the EU after 1 January 2021.

Since January, the discount has narrowed. Yesterday, Nov-21 UK feed wheat futures closed at £171.10/t, approximately £3.55/t below the Dec-21 Paris milling wheat futures contract (Refinitiv). Several reasons are behind this:

- Carry-over stocks from this season are likely to be very thin, increasing reliance on the 2021 crop.

- Meanwhile, ethanol demand seems set to return in 2021/22. If animal feed demand also rebounds, UK wheat demand will be higher next season.

- There’s still uncertainty about the 2021 crop size. AHDB’s Early Bird Survey showed that the area may rise by 28% from 2020 to 1.78Mha for harvest 2021. This is in line with the 2016-2020 average. The area includes spring planting. But, the range in yields is 7.0t/ha (2020) to 9.0t/ha (2015) over the past five years. So, even if this area is realised, we can’t be certain what the crop size will be.

Nov-21 UK feed wheat futures will likely remain at a narrow discount (or small premium) to new crop Paris futures until we know about the UK crop. Our next report on UK crop conditions will be released in early April.

If the UK has a bumper crop next season, the UK discount may need to widen again to incentivise exports. But, if UK yields are average or lower, UK prices will likely need to rise to a premium to Paris futures to attract imports. This is the case regardless of if the global market rises or falls.

https://ahdb.org.uk/news/new-crop-wheat-pricing-to-limit-exports-grain-market-daily

Join the 3.4K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch