- Location

- Stoneleigh

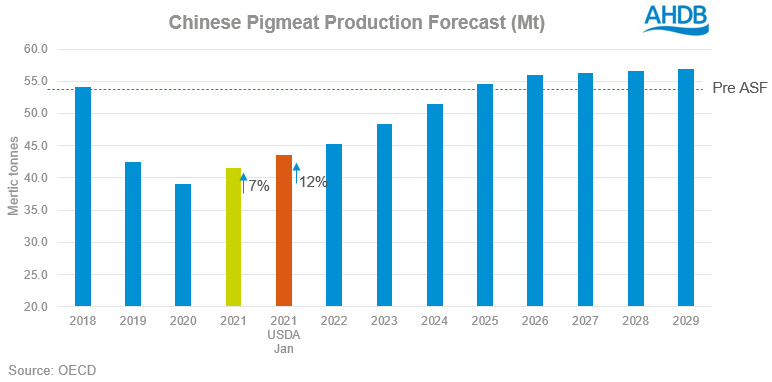

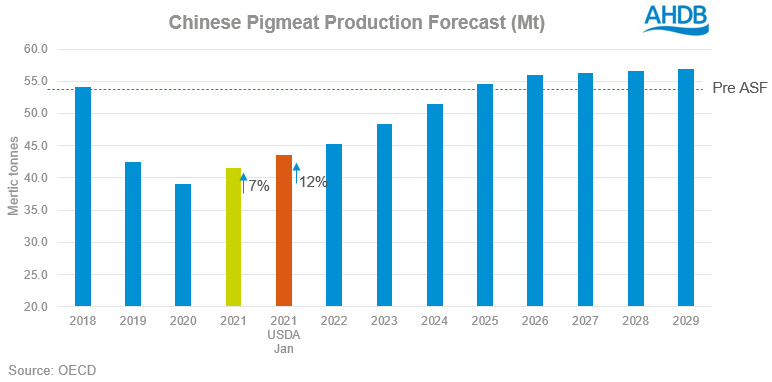

The rally in the price of feed grains in 2021 has largely been driven by an aggressive import campaign from China. This is because African Swine Fever (ASF) decimated their pig herd, and they are now actively rebuilding it.

The price support looks set to continue with Chinese demand for feed likely to remain into the new crop.

That said, it is important to remember that there are a number of factors that could influence the strength of any price support. Including South American crop development and US plantings.

With a small domestic carry over and likely average production in the UK next season, we are going to be net importers. This means we will have to price at import parity and therefore our prices will be largely influenced by what happens on the global market.

This article will look at the impact of this strong import demand on grain prices so far, and how it could affect prices going into the new crop, and beyond.

Overview of ASF in 2019

China rebuilding its herd

In December 2020, China announced that their pig herd had grown faster than anticipated, reaching 90% of pre-ASF levels.

However, it is anticipated that China won’t have to fully re-build their breeding herd. China are importing sows from Denmark with better genetics. These more prolific sows will increase the average litter size, with less sows needed to achieve the same number of offspring.

In 2020, China imported 1,483t of live breeding sows, compared to 51t in 2019. The previous 5-year average (2014-18) was 436t.

Can we believe data around the rebuild?

There are question marks over the reliability of figures from China. In September, the Chinese Ministry of Agriculture posted a notice flagging issues they have in gathering statistics on animals.

Further to this, the high price of Chinese pork at present, the strong level of Chinese protein imports and the resurgence of ASF, also raise questions about how big the Chinese pig herd truly is.

Read more on the situation for Chinese feed demand in today's Analyst Insight

Join the 3.4K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch

The price support looks set to continue with Chinese demand for feed likely to remain into the new crop.

That said, it is important to remember that there are a number of factors that could influence the strength of any price support. Including South American crop development and US plantings.

With a small domestic carry over and likely average production in the UK next season, we are going to be net importers. This means we will have to price at import parity and therefore our prices will be largely influenced by what happens on the global market.

This article will look at the impact of this strong import demand on grain prices so far, and how it could affect prices going into the new crop, and beyond.

Overview of ASF in 2019

China rebuilding its herd

In December 2020, China announced that their pig herd had grown faster than anticipated, reaching 90% of pre-ASF levels.

However, it is anticipated that China won’t have to fully re-build their breeding herd. China are importing sows from Denmark with better genetics. These more prolific sows will increase the average litter size, with less sows needed to achieve the same number of offspring.

In 2020, China imported 1,483t of live breeding sows, compared to 51t in 2019. The previous 5-year average (2014-18) was 436t.

Can we believe data around the rebuild?

There are question marks over the reliability of figures from China. In September, the Chinese Ministry of Agriculture posted a notice flagging issues they have in gathering statistics on animals.

Further to this, the high price of Chinese pork at present, the strong level of Chinese protein imports and the resurgence of ASF, also raise questions about how big the Chinese pig herd truly is.

Read more on the situation for Chinese feed demand in today's Analyst Insight

Join the 3.4K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch