Written by Iain Hoey

An extra £1.4 billion was spent on food and drink in the four weeks to 22 March 2020, compared to the same period last year, according to the latest numbers from Kantar.

Households spend an average of £62.62 more on shopping over the four weeks. The uplift is the equivalent of an extra £21.08 spend per person, a rise of almost 22%.

Consumer spend was driven by several key categories, including red meat, which outperformed the total grocery market, strong growth in cheese and spreads, and fresh and frozen potato volumes up by 27% and 30% respectively.

The four days covering Monday 16 to Thursday 19 of March, the week in which social distancing was initially advised by the Government and ended with the closure of all pubs, restaurants and cafes, saw the sharpest uplift, with households making an extra 42 million shopping trips. The research from Kantar estimates suggest that the rise in grocery spend is to make up for the 503 million meals per week which occur out of home now taking place at home.

A three-week lockdown came into force on 23 March, the day after this data period, 4 weeks to March 22, ended. This immediately resulted in reduced footfall to stores but the extent to which this has impacted MFP sales will be seen in next month’s data.

Meat

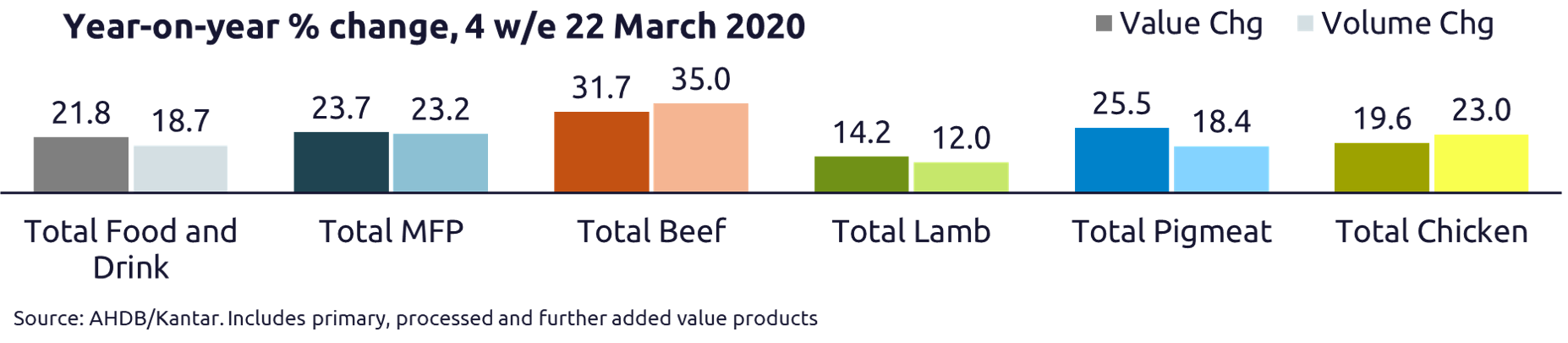

Meat, fish and poultry (MFP) grew ahead of the market, with spend up nearly 24%. The main uplift came during the final week of the data period (16-22 March) when social distancing came into force.

During the four weeks to 22 March, fresh meat made up the bulk of shoppers’ MFP purchases, accounting for 77% of volume. Sales of fresh meat rose 20% in volume terms. Frozen and canned meat products grew by 31% and 73% respectively, indicating shoppers are stockpiling items with a longer shelf life.

For the beef category, shoppers bought more mince, with volumes up 45% over the four week period. All primary beef cuts experienced signficant increases in volume, with roasting up 51% and steaks up 20%. Burgers were also up 38%.

In contrast, steak shares have pared back as they are more often eaten out of home, which could have a negative long term effects in balancing the carcase.

Bacon and sausage volumes were up 22% and 33% respectively during the 4-week period. Sliced cooked meat volumes grew 10%. Primary pork volumes were also up 10%. Leg and shoulder joints actually experienced a loss of volume, however loin roasting and chops grew 52% and 36% respectively.

Lamb volumes were up 12% during the month, although this was the smallest uplift in sales out of the key proteins. Leg steaks, the most expensive cut on average, declined by 18% in volume. Mince volumes, the most affordable cut, rose 28% and roasting joints were also in strong growth, especially shoulder, which was up 19% in volume.

Dairy

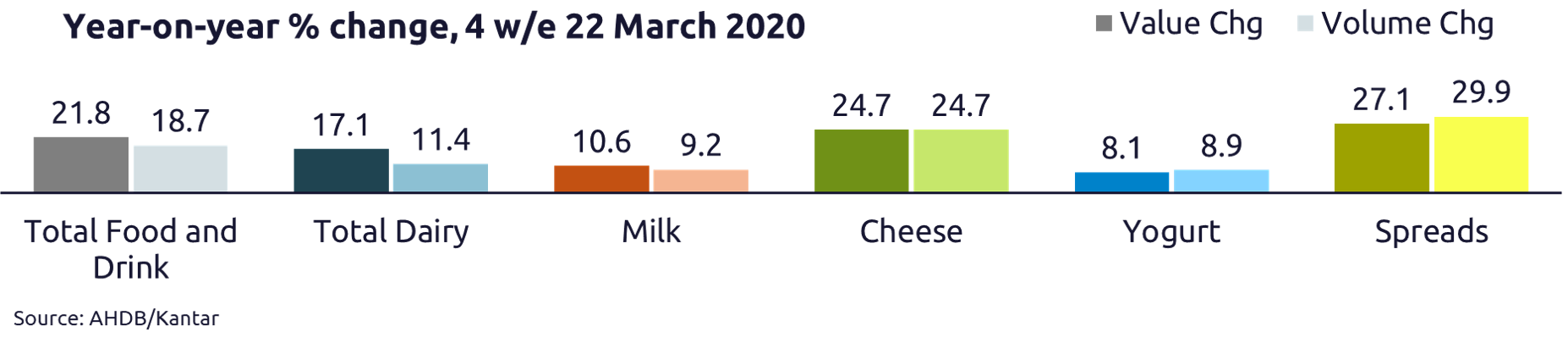

An additional £131m was spent on dairy products in March 2020 compared to March 2019. This is an increase of 17%, with increases seen across all major dairy categories.

Milk, which typically accounts for 32% of spend on dairy, saw a growth of 11% in spend and 9.2% in volume.

Cheese and spreads saw the greatest increase in sales, with cheese volumes up 25% and spreads up 30%. Yogurt saw the smallest increase, growing by 9% in volume.

Potatoes

Fresh potato sales in the latest 4 week period have exceeded even the usual peak seen at Christmas. In total, 130,321 tonnes were sold in the four weeks to 22 March, an increase of 26.6% compared to the same period last year, adding £17.9 million in spend. The majority of growth came from maincrop potatoes where volumes were up by a third on last year.

Sales of chilled potato products grew by almost a fifth compared to March last year, while volumes of frozen potato products sold increased by over 30%. With freezer space now at a premium, this peak is unlikely to be sustained.

Get Our E-Newsletter - breaking news to your in-box twice a week

See e-newsletter example

Will be used in accordance with our Privacy Policy

Continue reading on the Farm Business Website...