- Location

- Stoneleigh

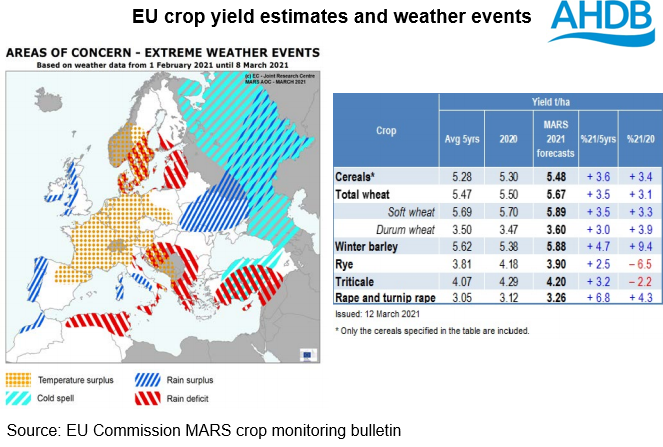

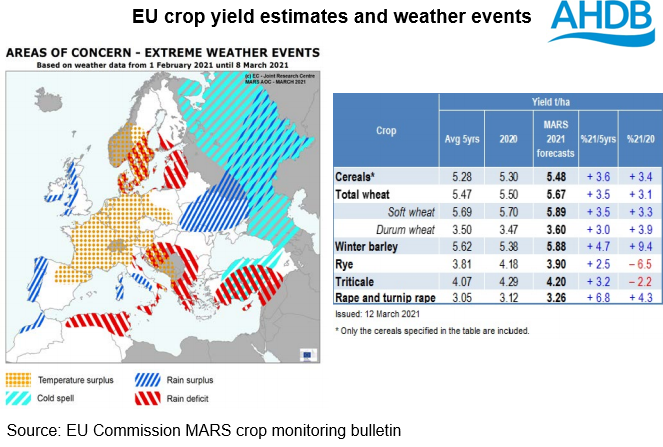

Yesterday, the EU Commission published its latest crop condition bulletin. The report covers the EU crop situation through to 8 March. With the UK likely be a net importer of both wheat and rapeseed next season. As such, conditions in the EU will go a long way to setting UK prices.

Conditions in the EU are largely seen as positive, both against last year’s poor crops and against longer-term trends. But, it remains too early to give a true yield indication.

In France, crops had a good start to the season. That said, recent wet conditions and low temperatures are thought to have had some limited impact on yield potential nationally. Rapeseed conditions are a bigger concern, with weevil pressure high.

For Germany, crops are considered to be in a “fair” condition. Soil moisture levels in Germany benefitted from a large swing in temperatures; snow cover on crops melted rapidly to improve soil moisture. The German association of Farm Cooperatives’ latest estimates peg wheat production up 0.9% on last year at 22.3Mt. Meanwhile, the rapeseed crop is seen falling by 0.7%, to 3.48Mt.

East European crops are generally seen to be in fair to good condition. As with much of Europe, weather patterns were mixed over winter. But, snow cover was generally adequate, and has helped to replenish soil moisture levels.

European Russia and Ukraine are also expected to have seen limited impacts from frost damage through to 8 March. However, some snow melt occurred after 8 March. This melt and the subsequent low temperatures could still have a negative effect on crops.

Strong crops will be needed in the EU in 2021/22 season. The increased interest in EU wheat exports this season has seen carry out stocks forecasts reduced. The latest USDA supply and demand estimates peg EU wheat stocks down 3.7Mt from 20219/20, at 10.6Mt. Whilst the EU commission balance sheets suggest ending stocks will be the tightest since 2018/19, it should be noted that these forecasts have not been updated since 25 February. Since then we have seen strong EU competition in global wheat tenders, which may tighten the current forecast further.

European trade association Coceral estimate EU-27 wheat production at 126.6Mt, up 7.9Mt on the year. While conditions currently support the view of larger crops in the EU, there is still plenty of time before the forecast is realised. Conditions will need monitoring closely for their impact on market sentiment.

https://ahdb.org.uk/news/eu-crop-conditions-fair-so-far-grain-market-daily

Join the 3.5K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch

Conditions in the EU are largely seen as positive, both against last year’s poor crops and against longer-term trends. But, it remains too early to give a true yield indication.

In France, crops had a good start to the season. That said, recent wet conditions and low temperatures are thought to have had some limited impact on yield potential nationally. Rapeseed conditions are a bigger concern, with weevil pressure high.

For Germany, crops are considered to be in a “fair” condition. Soil moisture levels in Germany benefitted from a large swing in temperatures; snow cover on crops melted rapidly to improve soil moisture. The German association of Farm Cooperatives’ latest estimates peg wheat production up 0.9% on last year at 22.3Mt. Meanwhile, the rapeseed crop is seen falling by 0.7%, to 3.48Mt.

East European crops are generally seen to be in fair to good condition. As with much of Europe, weather patterns were mixed over winter. But, snow cover was generally adequate, and has helped to replenish soil moisture levels.

European Russia and Ukraine are also expected to have seen limited impacts from frost damage through to 8 March. However, some snow melt occurred after 8 March. This melt and the subsequent low temperatures could still have a negative effect on crops.

Strong crops will be needed in the EU in 2021/22 season. The increased interest in EU wheat exports this season has seen carry out stocks forecasts reduced. The latest USDA supply and demand estimates peg EU wheat stocks down 3.7Mt from 20219/20, at 10.6Mt. Whilst the EU commission balance sheets suggest ending stocks will be the tightest since 2018/19, it should be noted that these forecasts have not been updated since 25 February. Since then we have seen strong EU competition in global wheat tenders, which may tighten the current forecast further.

European trade association Coceral estimate EU-27 wheat production at 126.6Mt, up 7.9Mt on the year. While conditions currently support the view of larger crops in the EU, there is still plenty of time before the forecast is realised. Conditions will need monitoring closely for their impact on market sentiment.

https://ahdb.org.uk/news/eu-crop-conditions-fair-so-far-grain-market-daily

Join the 3.5K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch