- Location

- Stoneleigh

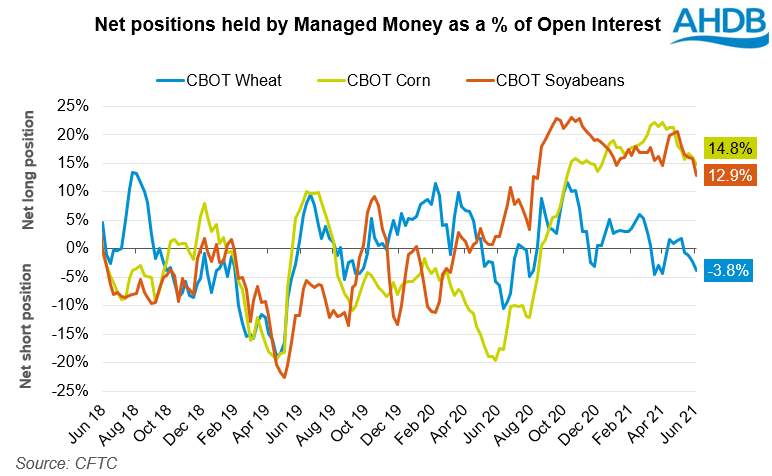

Alongside the fundamental drivers in markets over recent months driving prices higher, funds have also played a pivotal role. At their peak, managed money funds in corn and soyabeans reached their largest long position since December 2012 and March 2018, respectively.

The net-long position held by managed money funds, is essentially funds holding futures in expectation that the market will move higher. However, over the past few weeks the net long position has been reducing.

As of 15 June, the net long position held by managed money funds in Chicago corn futures was 14.8% of open interest, a fall of 7.5% from the peak at the end of March. Similarly for Chicago soyabeans, the net long position has reduced by 10.2% to 12.9% since its peak of 27 October.

This reduction in positions has acted as an accelerant in the fall in futures seen in recent weeks. While funds remain long, the rate of change in their position is something that we need to watch closely.

Yesterday, we highlighted how positive weather conditions have been a key bearish factor for prices. This has moved prices lower over recent weeks and driven funds to move away from long positions. This move away from long positions has not been limited to agricultural commodities and with economic positivity in the US, we need to continue to monitor the appetite for commodities in investment across the board. A more positive outlook in the US may cause a further fall in speculative interest for commodities.

Over the next week, rainfall is forecast for key states in the US. The Dakotas continue to look dry, but rain will be well received in the Midwest. Should this weather arrive next week, aiding crop conditions, we could see further reductions in the long position of funds.

Next week also sees the release of updated acreage data from the USDA. This will also be pivotal to market direction, adding further clarity to the size of the crop.

Funds continue to trim positions

Join the 3.6K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch

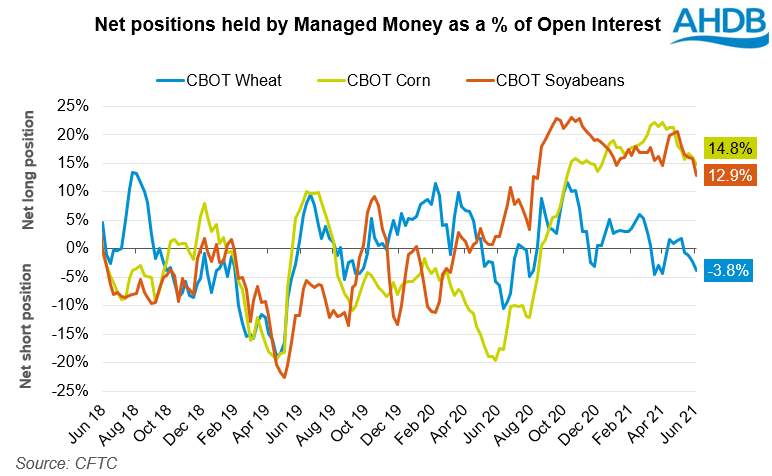

The net-long position held by managed money funds, is essentially funds holding futures in expectation that the market will move higher. However, over the past few weeks the net long position has been reducing.

As of 15 June, the net long position held by managed money funds in Chicago corn futures was 14.8% of open interest, a fall of 7.5% from the peak at the end of March. Similarly for Chicago soyabeans, the net long position has reduced by 10.2% to 12.9% since its peak of 27 October.

This reduction in positions has acted as an accelerant in the fall in futures seen in recent weeks. While funds remain long, the rate of change in their position is something that we need to watch closely.

Yesterday, we highlighted how positive weather conditions have been a key bearish factor for prices. This has moved prices lower over recent weeks and driven funds to move away from long positions. This move away from long positions has not been limited to agricultural commodities and with economic positivity in the US, we need to continue to monitor the appetite for commodities in investment across the board. A more positive outlook in the US may cause a further fall in speculative interest for commodities.

Over the next week, rainfall is forecast for key states in the US. The Dakotas continue to look dry, but rain will be well received in the Midwest. Should this weather arrive next week, aiding crop conditions, we could see further reductions in the long position of funds.

Next week also sees the release of updated acreage data from the USDA. This will also be pivotal to market direction, adding further clarity to the size of the crop.

Funds continue to trim positions

Join the 3.6K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch