- Location

- Stoneleigh

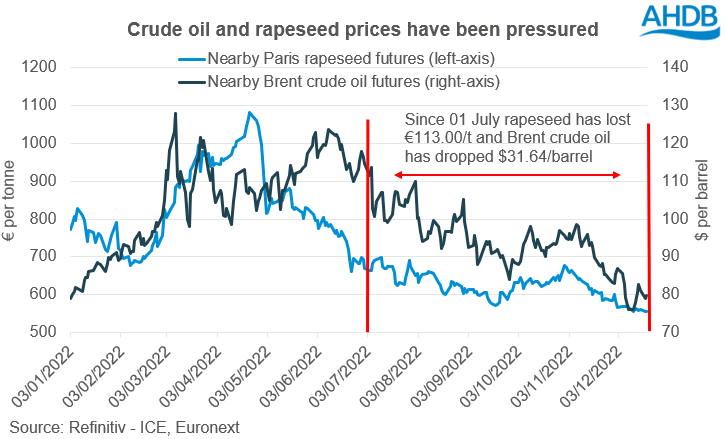

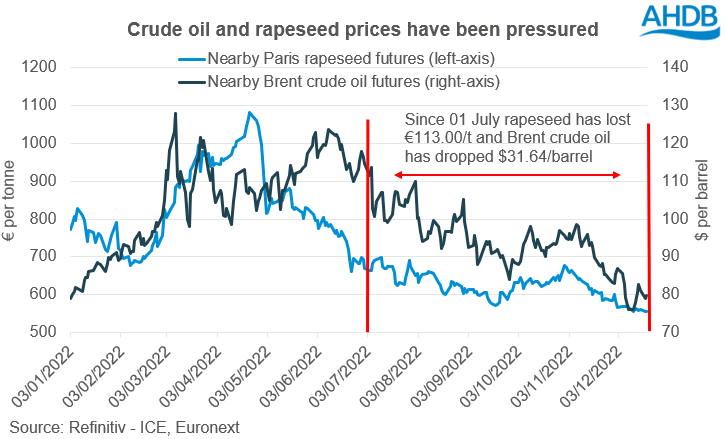

This year crude oil prices have been historically high following the war in Ukraine. Nearby Brent crude oil futures were $127.98/barrel as at 08 March, the highest close since 2008. This was one factor that has been supporting the oilseed complex along with reduced Black Sea vegetable oil supplies. From this Paris rapeseed futures (nearby) hit €1,081.25/t on 22 April.

However, in recent weeks crude oil prices have been falling from these highs in March and current prices are trading at $80.82/barrel (as at 11:00), which has been weighing on rapeseed prices as well to some extent.

Further adding to this pressure is the fact that at the start of December OPEC+ agreed not to reduce crude oil output despite concerns over global demand. Also, in recent weeks G7 countries and Australia have imposed a $60/barrel price cap on Russian oil. Further to this, the EU have banned imports of Russian oil as the embargo agreed in June has now come into effect.

Moreover, there are many uncertainties surrounding crude oil markets, and much of the forecasts for demand growth are assuming A) successful containment of COVID-19 in China, with resumption of pre-pandemic growth. B) Resolution of the war in Ukraine. Both of these events are very hard to predict.

Further to all this, what potentially bears on the market is globally reduced demand going into Q1 2023 from the potential recession.

Crude oil is just one of many factors that will drive ex-farm rapeseed prices but has been one of the contributors to rapeseed price pressure in recent weeks. Going into 2023, there are many global affairs that could drive crude oil prices, which could filter into rapeseed prices.

Today's Grain Market Daily is now published - Reduced demand pressuring crude oil

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.

However, in recent weeks crude oil prices have been falling from these highs in March and current prices are trading at $80.82/barrel (as at 11:00), which has been weighing on rapeseed prices as well to some extent.

What has been impacting crude oil?

Recently much of crude oil’s pressure has been from weakening demand from China due to COVID-19 lockdowns. Also the UK, EU and US central banks have been raising interest rates to tackle inflation, increasing fears of recession.Further adding to this pressure is the fact that at the start of December OPEC+ agreed not to reduce crude oil output despite concerns over global demand. Also, in recent weeks G7 countries and Australia have imposed a $60/barrel price cap on Russian oil. Further to this, the EU have banned imports of Russian oil as the embargo agreed in June has now come into effect.

What could happen to crude oil?

Going into 2023 there are some estimates that average annual crude oil prices could drop from the highs we have seen this year. This is from the potential for weaker annual demand growth in comparison to 2022, and ample supplies from OPEC+ and Russia. However, it is worth noting that in February 2023 there will be the next review of OPEC+ outputs which could change market sentiment if cut drastically.Moreover, there are many uncertainties surrounding crude oil markets, and much of the forecasts for demand growth are assuming A) successful containment of COVID-19 in China, with resumption of pre-pandemic growth. B) Resolution of the war in Ukraine. Both of these events are very hard to predict.

Further to all this, what potentially bears on the market is globally reduced demand going into Q1 2023 from the potential recession.

Crude oil is just one of many factors that will drive ex-farm rapeseed prices but has been one of the contributors to rapeseed price pressure in recent weeks. Going into 2023, there are many global affairs that could drive crude oil prices, which could filter into rapeseed prices.

Today's Grain Market Daily is now published - Reduced demand pressuring crude oil

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.