- Location

- Stoneleigh

Global wheat prices over the last week have continued to see pressure. Dominating the news this week has been the discussion and negotiation around the renewal of the UN-brokered Black Sea export corridor. This morning, the renewal of the corridor has been confirmed for another 120 days from 18 November, allowing exports to leave from three Ukrainian ports.

Last week, Russia said the on-going agreement on the grain deal depends on provisions ensuring that it can export its own grain and fertiliser. Within this agreement this morning, the UN has announced that it is fully committed to removing the remaining obstacles to exporting good and fertiliser from Russia (Refinitiv). Though specifics have not yet been finalised and discussions are expected to be ongoing.

Talks reportedly had been progressing last week, shown in the agreement come to today. At the G20 summit this week in Bali, Russia was speaking in favour of extending the Black Sea grain deal, providing more grain was sent to countries in greatest need.

As of yesterday, of all the 517 vessels that have left Ukraine via this corridor only 16% have been destined for nations classed as “low income” and “lower middle income”, while over 45% alone have been heading to “high income” countries (Black Sea Initiative Vessel Movements, United Nations). Something to consider to the future movement of grain.

The May-23 contract is edging to the low seen in the middle of 2022 quarter 3 at £258.10/t. As of right now, is hovering around this point. Could prices go further down from point? Could we see some bargain buying from North Africa and Middle East that might support levels back again?

There are a lot of supply factors that continue to drive prices. Global grain and oilseed prices are still feeling support from the uncertainty of the on-going war, and tight global supply and demand balance. Fuel and input costs specifically, are significantly higher than pre-February 2022, squeezing margins and keeping some price support in grain and oilseed markets.

It is also critical to note this deal has only been renewed for 120 days, not the full year the UN and Ukraine were hoping for. Therefore, at the end of March, the situation and conflict could have changed so we can expect volatility to continue.

Today's Grain Market Daily is now published - Black Sea grain corridor renewed for 120 days

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.

Last week, Russia said the on-going agreement on the grain deal depends on provisions ensuring that it can export its own grain and fertiliser. Within this agreement this morning, the UN has announced that it is fully committed to removing the remaining obstacles to exporting good and fertiliser from Russia (Refinitiv). Though specifics have not yet been finalised and discussions are expected to be ongoing.

Talks reportedly had been progressing last week, shown in the agreement come to today. At the G20 summit this week in Bali, Russia was speaking in favour of extending the Black Sea grain deal, providing more grain was sent to countries in greatest need.

As of yesterday, of all the 517 vessels that have left Ukraine via this corridor only 16% have been destined for nations classed as “low income” and “lower middle income”, while over 45% alone have been heading to “high income” countries (Black Sea Initiative Vessel Movements, United Nations). Something to consider to the future movement of grain.

So, what could this mean for prices?

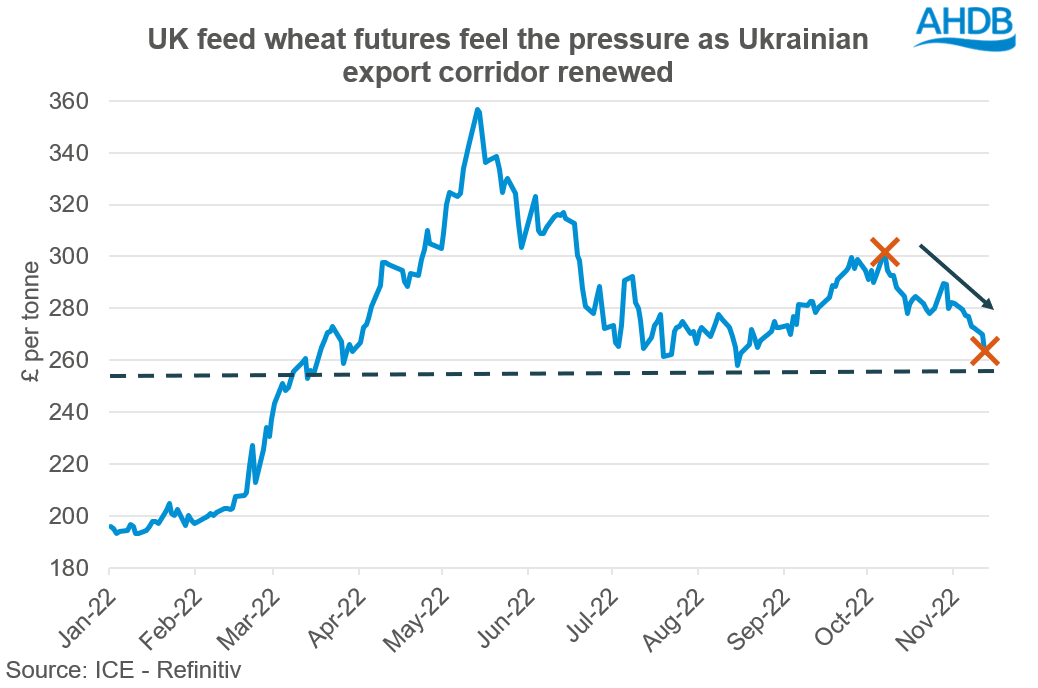

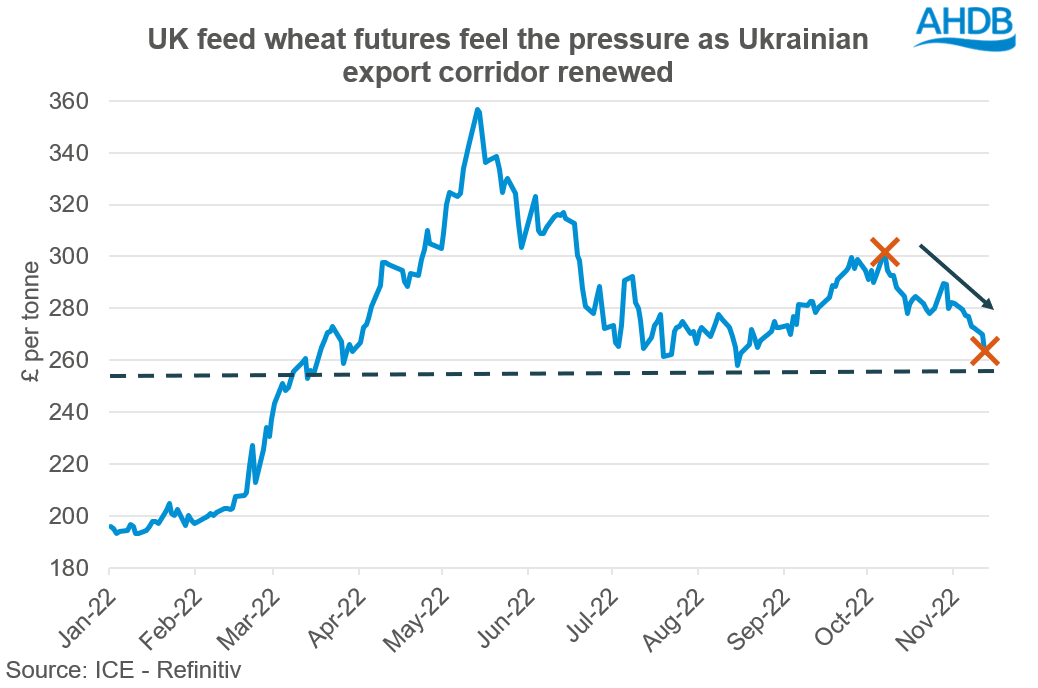

Well, we have had on-going pressure on domestic prices from this renewal. Since the last “peak” at the start October, UK feed wheat futures (May-23) have come down over £39.00/t over this period to close yesterday at £262.75/t.

The May-23 contract is edging to the low seen in the middle of 2022 quarter 3 at £258.10/t. As of right now, is hovering around this point. Could prices go further down from point? Could we see some bargain buying from North Africa and Middle East that might support levels back again?

There are a lot of supply factors that continue to drive prices. Global grain and oilseed prices are still feeling support from the uncertainty of the on-going war, and tight global supply and demand balance. Fuel and input costs specifically, are significantly higher than pre-February 2022, squeezing margins and keeping some price support in grain and oilseed markets.

It is also critical to note this deal has only been renewed for 120 days, not the full year the UN and Ukraine were hoping for. Therefore, at the end of March, the situation and conflict could have changed so we can expect volatility to continue.

Today's Grain Market Daily is now published - Black Sea grain corridor renewed for 120 days

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.