- Location

- Stoneleigh

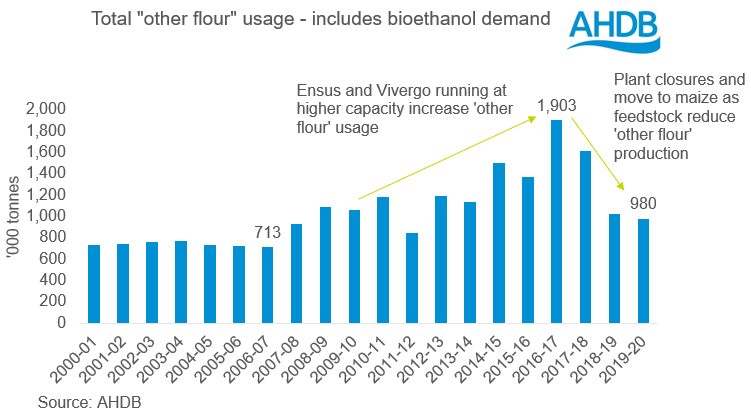

A move to E10 could open up a more profitable avenue for bioethanol production increasing in the UK. With one plant currently mothballed and another running on maize, the incentive to move back to wheat (if competitively priced as a feedstock) to increase production is building.

So, let’s assume that we have two ethanol plants running building capacity in Q4 of 2021 and Q1 of 2022. Firstly, we must consider the overall supply and demand situation. We are likely to have the barest of wheat stocks as we leave the 2020/21 season, as outlined in the release of this week’s supply and demand estimates. Therefore, without a bumper 2021 wheat harvest, the supply and demand picture for 2021/22 is already looking tight. Add in more demand to the market and this tightness grows.

Regionally, this would manifest itself in greater delivered premiums for feed wheat in Yorkshire, and so lift the entire pricing complex of the east coast of England and even Scotland (assuming a tight market). So, there is the potential of good news in terms of ex-farm pricing for sellers.

We would also see a greater level of by-products being produced. Considering we are producing less rape meal due to a smaller crop, an increase in wheat-based distillers dried grains (DDGS) could replace rape meal in animal feed rations.

Given where we are today, an increase in wheat demand from bioethanol production in the UK would only be supportive to the market. Unless we see a significant increase in wheat production from harvest ’21 in both the UK and EU the market could face tightness for many months to come.

https://ahdb.org.uk/news/analyst-insight-green-fuel-what-could-this-mean-for-wheat-prices

Join the 3.4K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch

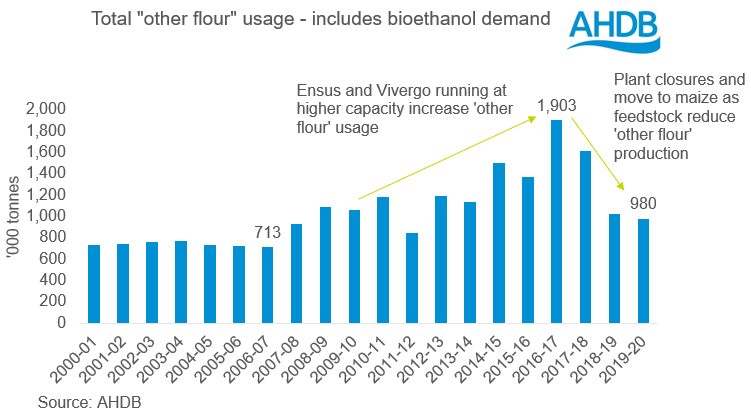

So, let’s assume that we have two ethanol plants running building capacity in Q4 of 2021 and Q1 of 2022. Firstly, we must consider the overall supply and demand situation. We are likely to have the barest of wheat stocks as we leave the 2020/21 season, as outlined in the release of this week’s supply and demand estimates. Therefore, without a bumper 2021 wheat harvest, the supply and demand picture for 2021/22 is already looking tight. Add in more demand to the market and this tightness grows.

Regionally, this would manifest itself in greater delivered premiums for feed wheat in Yorkshire, and so lift the entire pricing complex of the east coast of England and even Scotland (assuming a tight market). So, there is the potential of good news in terms of ex-farm pricing for sellers.

We would also see a greater level of by-products being produced. Considering we are producing less rape meal due to a smaller crop, an increase in wheat-based distillers dried grains (DDGS) could replace rape meal in animal feed rations.

Given where we are today, an increase in wheat demand from bioethanol production in the UK would only be supportive to the market. Unless we see a significant increase in wheat production from harvest ’21 in both the UK and EU the market could face tightness for many months to come.

https://ahdb.org.uk/news/analyst-insight-green-fuel-what-could-this-mean-for-wheat-prices

Join the 3.4K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch