- Location

- Stoneleigh

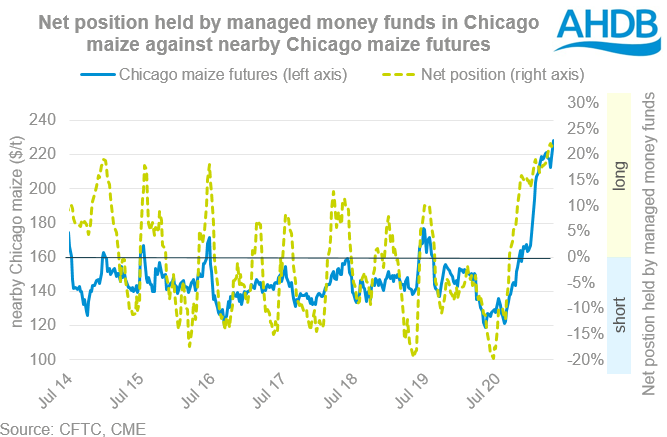

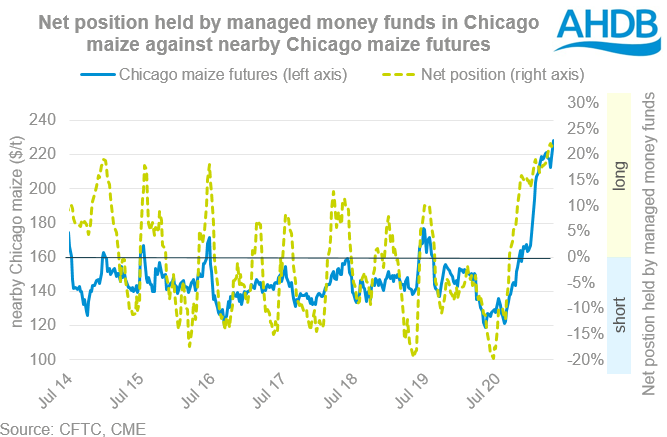

Over the past year, we have seen the strong influence of funds in the global grain trade. The recent rally in markets is proving no different. New crop weather worries, be it frosts in the US or cuts to Brazilian maize forecasts, are driving prices higher, multiplied by the huge long position held by managed money funds.

In the latest data, published by the Commodity Futures Trading Commission (CFTC), the net long position held by managed money funds in Chicago maize futures reached 22.2%.

In layman's terms, the number of long positions (bullish) held by managed money is almost 18 times greater than the number of short positions (bearish).

In the last few days futures have moved into overbought territory, so we could see a slight degree of profit taking over the next week. However, there is still a longer term bullish sentiment, particularly for maize.

This is no great surprise, as we’ve mentioned before the supply and demand situation is incredibly tight globally. As such, prices need to continue to work in order to ration demand. Further, crop concerns as mentioned above, continue to support the view that prices need to rise.

However, at present there is a large element of the price rise which is driven purely by uncertainty. At the moment, and as we see practically every season, there are a lot of unknowns;

https://ahdb.org.uk/news/funds-are-mental-driving-prices-higher-grain-market-daily

Join the 3.5K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch

In the latest data, published by the Commodity Futures Trading Commission (CFTC), the net long position held by managed money funds in Chicago maize futures reached 22.2%.

In layman's terms, the number of long positions (bullish) held by managed money is almost 18 times greater than the number of short positions (bearish).

In the last few days futures have moved into overbought territory, so we could see a slight degree of profit taking over the next week. However, there is still a longer term bullish sentiment, particularly for maize.

This is no great surprise, as we’ve mentioned before the supply and demand situation is incredibly tight globally. As such, prices need to continue to work in order to ration demand. Further, crop concerns as mentioned above, continue to support the view that prices need to rise.

However, at present there is a large element of the price rise which is driven purely by uncertainty. At the moment, and as we see practically every season, there are a lot of unknowns;

- How much maize will the US plant?

- How big will the Brazilian maize crop be?

- How will Northern Hemisphere wheat develop?

- How will the Russian export tax play out?

- How much grain does China actually need?

https://ahdb.org.uk/news/funds-are-mental-driving-prices-higher-grain-market-daily

Join the 3.5K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch

Last edited: