- Location

- Stoneleigh

Rapeseed prices have continued to rally over the past couple of weeks. Old crop rapeseed (May-21) closed yesterday at €525.75/t, €0.50/t off the recent highs. Strong vegetable oil values continue to be one of the predominant drivers of prices.

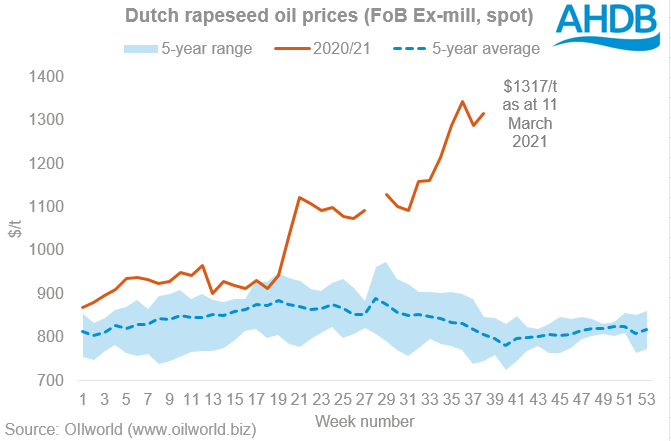

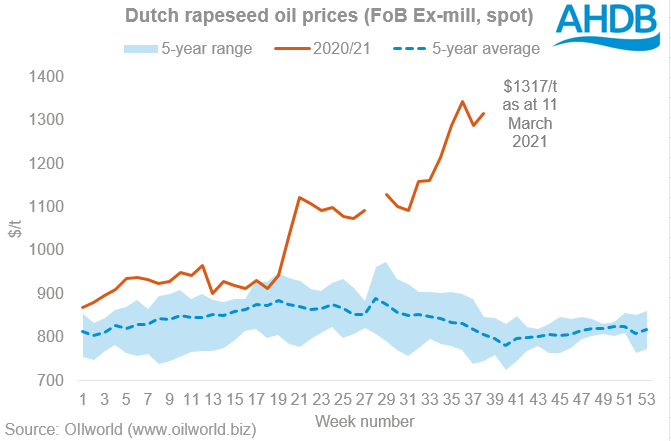

Values for physical rapeseed oil have been well above historic prices of late. with OIlworld quoting Dutch rape oil (fob Ex-mill) at $1317/t, in the week ending 11 March (www.oilworld.biz), 63% ahead of the five-year average.

Strong values for vegetable oils are in turn driving strong crush margins. With crude oil prices also climbing, the demand for oilseeds is firm.

When prices are high, it can often be difficult to see an end to the rally. However, we can look ahead to a number of key factors and commodities which could change the trajectory for rapeseed prices.

Soyabeans

We have talked a lot in recent weeks about the key drivers for soyabeans, most notably harvest pace in South America and US area trends. As we discussed in Monday’s market report, the harvesting progress for soyabeans remains behind average. That said, attractive crush margins for soyabeans are reportedly increasing availability of soyameal, and pressuring prices. Shipments of Argentinian soyameal have also reportedly increased. All things being equal this would weaken the crush margin for soya.

Rapeseed plantings

The picture for EU rapeseed is tight as we move towards the new season. Stratégie Grains estimate ending stocks of rapeseed to be relatively unchanged, despite firmer production. This will keep EU prices towards the top of market. Similarly, reductions in the winter rapeseed area in Ukraine are seen.

For future direction, we need to look to Canada and Australia. Canada are moving towards the canola planting window (May-Jun). With Australian canola also being planted shortly, strong acreages in these two regions could pressure rapeseed prices.

Palm oil

Palm prices have been a key component of the oil rally. Stocks were expected to grow in February following lower exports. However that didn’t happen, further supporting values. Palm production is expected to increase in the coming months, which may pressure prices although the labour situation in relation to coronavirus will need watching closely.

Yes, the outlook for prices is firm at present. Nevertheless, we need to monitor the above factors impact on availability for the entire oilseed complex and their effect on future price direction.

https://ahdb.org.uk/news/supply-side-watch-points-for-rapeseed-prices-grain-market-daily

Join the 3.5K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch

Values for physical rapeseed oil have been well above historic prices of late. with OIlworld quoting Dutch rape oil (fob Ex-mill) at $1317/t, in the week ending 11 March (www.oilworld.biz), 63% ahead of the five-year average.

Strong values for vegetable oils are in turn driving strong crush margins. With crude oil prices also climbing, the demand for oilseeds is firm.

When prices are high, it can often be difficult to see an end to the rally. However, we can look ahead to a number of key factors and commodities which could change the trajectory for rapeseed prices.

Soyabeans

We have talked a lot in recent weeks about the key drivers for soyabeans, most notably harvest pace in South America and US area trends. As we discussed in Monday’s market report, the harvesting progress for soyabeans remains behind average. That said, attractive crush margins for soyabeans are reportedly increasing availability of soyameal, and pressuring prices. Shipments of Argentinian soyameal have also reportedly increased. All things being equal this would weaken the crush margin for soya.

Rapeseed plantings

The picture for EU rapeseed is tight as we move towards the new season. Stratégie Grains estimate ending stocks of rapeseed to be relatively unchanged, despite firmer production. This will keep EU prices towards the top of market. Similarly, reductions in the winter rapeseed area in Ukraine are seen.

For future direction, we need to look to Canada and Australia. Canada are moving towards the canola planting window (May-Jun). With Australian canola also being planted shortly, strong acreages in these two regions could pressure rapeseed prices.

Palm oil

Palm prices have been a key component of the oil rally. Stocks were expected to grow in February following lower exports. However that didn’t happen, further supporting values. Palm production is expected to increase in the coming months, which may pressure prices although the labour situation in relation to coronavirus will need watching closely.

Yes, the outlook for prices is firm at present. Nevertheless, we need to monitor the above factors impact on availability for the entire oilseed complex and their effect on future price direction.

https://ahdb.org.uk/news/supply-side-watch-points-for-rapeseed-prices-grain-market-daily

Join the 3.5K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch