- Location

- Stoneleigh

Argentina’s weather critical stages - market watchpoint

South American weather is currently at critical stages of the southern hemisphere cropping cycle. Argentina and Brazil combined are going to account for 48% of maize and 57% of soyabean exports for this current marketing year (USDA, 2022/23) and will be key for balancing the supply for the second half of this year.We are currently in the midst of a La Niña weather event; in Brazil atypical weather patterns associated with the event have not been followed despite expectations.

However, in Argentina, dryness has been ongoing and weather is at a critical watchpoint for both their maize and soyabean plantings. If we see significant revisions downwards to both area and yield potential this is something that could definitely keep elevated support for global grain and oilseeds prices to some extent.

Below is an overview of the current situation for both Argentina and Brazil weather and plantings.

Brazil

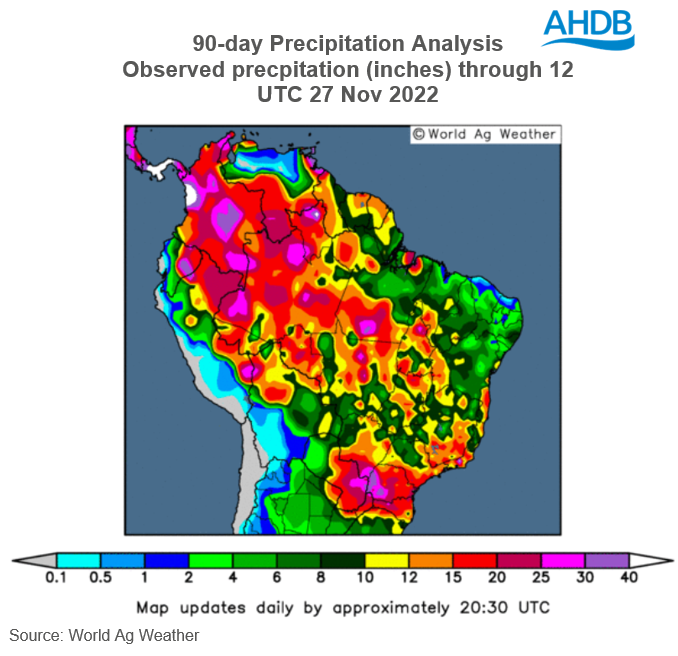

Usually this La Niña weather event brings dryness to parts of Brazil. However, in this year’s cropping cycle southern parts of Brazil have not been as dry as anticipated. With parts of Rio Grande do Sul receiving over 30 inches of rain in the last 90-days.

This on-going rain has replenished soil moisture in Brazil and has not particularly hampered their sowing campaign with soyabean plantings (as at 27 Nov, Conab) currently estimated at 86.1% complete, only slightly behind the same point last year when this was at 91.5%. Further to that, the first season maize crop is estimated at 68.6% complete, slightly behind last year when this was 75.3%.

Currently, there is no huge cause for concern for weather issues in Brazil and for the minute it’s looking likely these anticipated large soyabean and maize crops will in the most part come to market.

However, what is critical to note that this first season maize crop accounts for just over a mere 20% of the total production expected from this record Brazil maize crop. So therefore, going into 2023 plantings of the other 80% of this crop will be a focus, but the current on-going rain in soyabean regions will not be doing much harm as the second maize crop will be planted into this.

Argentina

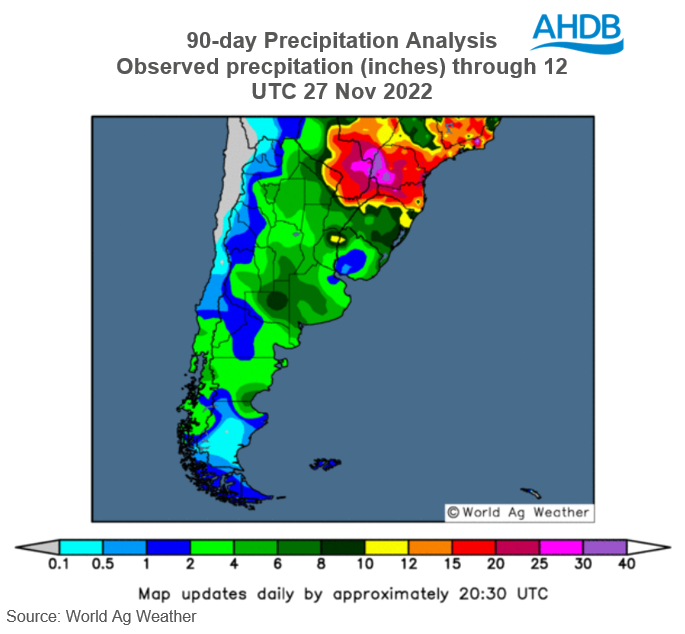

For Argentina, weather news is not as positive, the La Niña weather event is having huge implications for their cereal and oilseeds production. Firstly, it has impacted their wheat crop, which has seen large revisions downwards and now the lack of rain is impeding their sowing campaign for maize and soyabeans.

The lack of rain over the last 90-days and on-going dryness means that soyabean plantings are at just 19.4% (as at 24 Nov, Buenos Aires Grain Exchange), 19.9 percentage points behind this time last year, and below the five-year average of 40.2%. If this persists, we could see the area of soyabeans reduce.

For maize, Argentina’s plantings are estimated at 23.8% (as at 24 Nov, Buenos Aires Grain Exchange) 6.2 percentage points behind last year and down on the five-year average of 36.9% at this point in the year. It’s expected now that three quarters of maize will be planted later, which typically yields 10-15% less than that planted earlier. Rains are expected over the next seven days but these are minimal and there are still regions that will not receive any rain.

Today's Grain Market Daily is now published - Argentina’s weather critical stages - market watchpoint

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.

Farmer-led