- Location

- Stoneleigh

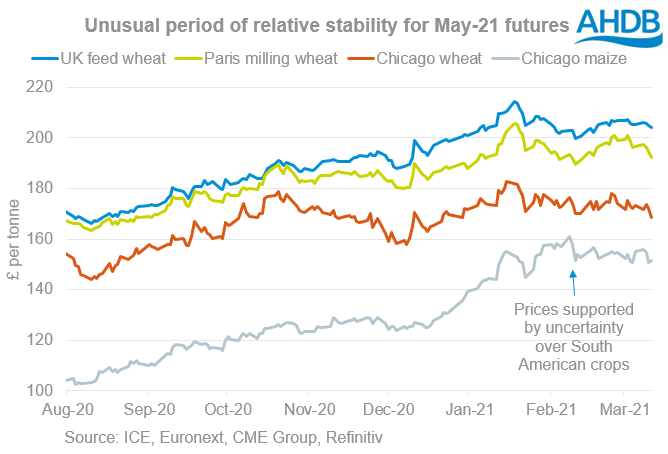

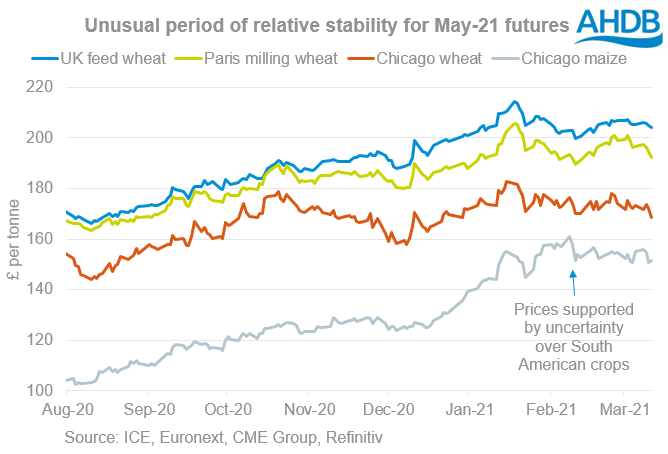

Global grain prices have been relatively stable since mid-January. Markets are waiting for more insight into the South American maize crops. Old crop prices are shown below but new crop prices are following a similar pattern, albeit at a lower level. Despite several estimates being released this week, we’re no closer yet to knowing the size of these crops.

This season, the stocks of wheat and maize in major exporting countries are expected to fall to their lowest levels for several years. These forecasts include relatively large maize crops from South America. If the South American crops are smaller than these forecasts, stocks of both wheat and maize could be even smaller.

What’s the latest?

Yesterday, the Brazilian government agency Conab increased its forecast for the total maize production by 2.6Mt. This is because Brazilian farmers intend to respond to high global prices and plant a larger area to Safrinha maize. The Safrinha or second crop is planted after the soyabean harvest.

At 108.1Mt, the latest Conab estimate is 5.5Mt above last year’s crop. It is also only 0.9Mt behind the latest USDA forecast, released on Wednesday.

But, the Safrinha crops are being planted late because the soyabean harvest is late. So there is a higher risk of dry weather when the Safrinha crops reach their key yield forming growth stages. Crops were also planted very late in 2015 and 2011. In 2015 rainfall during April and May was good and Safrinha yields were high. But, in 2011 lower April rainfall cut yields and crop sizes.

Meanwhile, there are mixed views on the impact of renewed dry weather on maize crops in Argentina.

On Wednesday, the Rosario Grain Exchange kept its forecast at 48.5Mt, 1.0Mt above the latest USDA forecast. Rosario said soil moisture in the west of the country is supporting later sown crops, which are still at critical growth stages. In contrast, the Buenos Aries Grain Exchange (BAGE) cut 1.0Mt from its forecast yesterday, to 45.0Mt due to the dry weather.

Where next?

At higher prices, this sort of stability doesn’t usually last long; it’s more common at lower prices. This unusual stability could last a little longer but I think it’s unlikely to last too long. This is because more and more information will be released as we move through the spring.

Although the Brazilian crops won’t be harvested until the middle of 2021, the results of the Argentinian harvest will soon start to emerge. We’ll also start to focus on Northern Hemisphere planting. The USDA releases the results of its survey of US farmers’ planting intentions on 31 March. The USDA also starts reporting crop progress and conditions weekly from 5 April.

https://ahdb.org.uk/news/grain-markets-waiting-for-direction-grain-market-daily

Join the 3.4K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch

This season, the stocks of wheat and maize in major exporting countries are expected to fall to their lowest levels for several years. These forecasts include relatively large maize crops from South America. If the South American crops are smaller than these forecasts, stocks of both wheat and maize could be even smaller.

What’s the latest?

Yesterday, the Brazilian government agency Conab increased its forecast for the total maize production by 2.6Mt. This is because Brazilian farmers intend to respond to high global prices and plant a larger area to Safrinha maize. The Safrinha or second crop is planted after the soyabean harvest.

At 108.1Mt, the latest Conab estimate is 5.5Mt above last year’s crop. It is also only 0.9Mt behind the latest USDA forecast, released on Wednesday.

But, the Safrinha crops are being planted late because the soyabean harvest is late. So there is a higher risk of dry weather when the Safrinha crops reach their key yield forming growth stages. Crops were also planted very late in 2015 and 2011. In 2015 rainfall during April and May was good and Safrinha yields were high. But, in 2011 lower April rainfall cut yields and crop sizes.

Meanwhile, there are mixed views on the impact of renewed dry weather on maize crops in Argentina.

On Wednesday, the Rosario Grain Exchange kept its forecast at 48.5Mt, 1.0Mt above the latest USDA forecast. Rosario said soil moisture in the west of the country is supporting later sown crops, which are still at critical growth stages. In contrast, the Buenos Aries Grain Exchange (BAGE) cut 1.0Mt from its forecast yesterday, to 45.0Mt due to the dry weather.

Where next?

At higher prices, this sort of stability doesn’t usually last long; it’s more common at lower prices. This unusual stability could last a little longer but I think it’s unlikely to last too long. This is because more and more information will be released as we move through the spring.

Although the Brazilian crops won’t be harvested until the middle of 2021, the results of the Argentinian harvest will soon start to emerge. We’ll also start to focus on Northern Hemisphere planting. The USDA releases the results of its survey of US farmers’ planting intentions on 31 March. The USDA also starts reporting crop progress and conditions weekly from 5 April.

https://ahdb.org.uk/news/grain-markets-waiting-for-direction-grain-market-daily

Join the 3.4K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch