- Location

- Stoneleigh

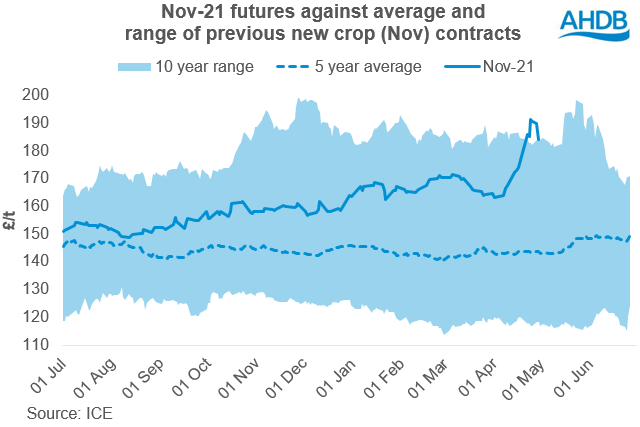

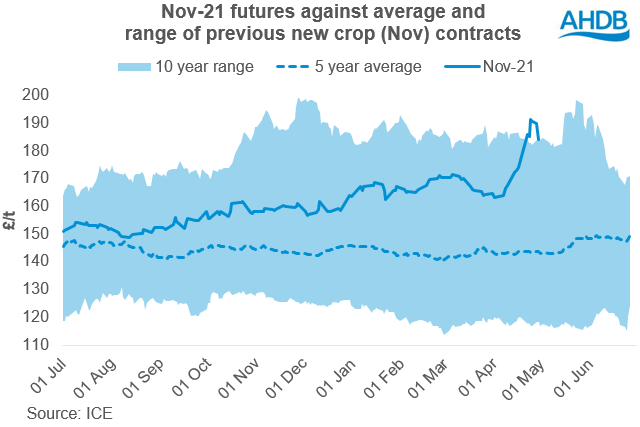

The global weather market pushed the UK November futures contract to its highest point in ten years, for this week of the year. However, weather markets always bring a level of volatility to prices.

From 22 April open, the Nov-21 contract jumped £15.00/t in four trading days to a life-of-contract high of £195.00/t, then dropped to £184.25/t by yesterday’s close. Attempting to trade a bullish weather event brings the inherent risk of a potential bearish weather system developing and ceasing the rally. This brings the potential for a ‘stairs up, elevator down’ price direction.

How can we take advantage of this rally?

New-crop prices rallying before harvest give the opportunity for tonnage to be sold forward. Selling forward is a relatively simple marketing strategy on the surface, but dive deeper and there is the choice of futures contracts or options contracts too. These enable growers to take advantage of current market drivers that are likely to change in the short term. This is despite having no physical new-crop tonnage in store yet.

Selling forward and futures contracts give an obligation for stated tonnage and quality to be delivered on a specific date. This can bring monetary charges if the tonnage or quality requirement is not able to be met. So it is important to remain under-exposed to the market if selling forward. Selling a proportion of your budgeted tonnage per hectare for Nov delivery could provide a starting point for sales, whilst leaving plenty of scope for changes.

Selling grain forward over the course of the season can also help mitigate price volatility. Using Thursday’s East Anglia basis to futures from our delivered survey, minus a theoretical haulage cost, gives an indicative East Anglia ex-farm value of £185.80/t for Nov delivery. So even if markets rise further, present prices aren’t a bad ‘worst price’ for the 2021 crop.

A wheat cost of production figure on a per tonne basis is largely determined by the crop yield. Hence it is important to get a marketing strategy in place to maximise returns, especially if yields are below desired levels.

Could an options contract help me?

At the start of the month, I covered an in-depth look at what options contracts are and how they can be used. In this case, with forward prices near record highs, a put option can be a method of ‘insurance’ for physical tonnage against prices tailing off.

An ‘Out of the Money’ (OTM) €190/t put option on Paris Dec-21 wheat futures cost €2.40 per contract yesterday. A minimum purchase requirement of 50 contracts means the total cost is €120. This type of option means the holder expects the Dec-21 futures contract (closed at €218.25/t yesterday) to fall below €190/t at some point before expiry. If this occurs, then profit is made when selling the options contracts. This profit would help offset any loss from selling the physical grain tonnage at a reduced domestic price.

High new-crop UK wheat prices, what can be done?

Join the 3.5K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch

From 22 April open, the Nov-21 contract jumped £15.00/t in four trading days to a life-of-contract high of £195.00/t, then dropped to £184.25/t by yesterday’s close. Attempting to trade a bullish weather event brings the inherent risk of a potential bearish weather system developing and ceasing the rally. This brings the potential for a ‘stairs up, elevator down’ price direction.

How can we take advantage of this rally?

New-crop prices rallying before harvest give the opportunity for tonnage to be sold forward. Selling forward is a relatively simple marketing strategy on the surface, but dive deeper and there is the choice of futures contracts or options contracts too. These enable growers to take advantage of current market drivers that are likely to change in the short term. This is despite having no physical new-crop tonnage in store yet.

Selling forward and futures contracts give an obligation for stated tonnage and quality to be delivered on a specific date. This can bring monetary charges if the tonnage or quality requirement is not able to be met. So it is important to remain under-exposed to the market if selling forward. Selling a proportion of your budgeted tonnage per hectare for Nov delivery could provide a starting point for sales, whilst leaving plenty of scope for changes.

Selling grain forward over the course of the season can also help mitigate price volatility. Using Thursday’s East Anglia basis to futures from our delivered survey, minus a theoretical haulage cost, gives an indicative East Anglia ex-farm value of £185.80/t for Nov delivery. So even if markets rise further, present prices aren’t a bad ‘worst price’ for the 2021 crop.

A wheat cost of production figure on a per tonne basis is largely determined by the crop yield. Hence it is important to get a marketing strategy in place to maximise returns, especially if yields are below desired levels.

Could an options contract help me?

At the start of the month, I covered an in-depth look at what options contracts are and how they can be used. In this case, with forward prices near record highs, a put option can be a method of ‘insurance’ for physical tonnage against prices tailing off.

An ‘Out of the Money’ (OTM) €190/t put option on Paris Dec-21 wheat futures cost €2.40 per contract yesterday. A minimum purchase requirement of 50 contracts means the total cost is €120. This type of option means the holder expects the Dec-21 futures contract (closed at €218.25/t yesterday) to fall below €190/t at some point before expiry. If this occurs, then profit is made when selling the options contracts. This profit would help offset any loss from selling the physical grain tonnage at a reduced domestic price.

High new-crop UK wheat prices, what can be done?

Join the 3.5K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch