- Location

- Stoneleigh

The UK milling wheat market is historically dependent on imports of high protein wheat. Over the past five seasons, the UK has imported an average of 371Kt of wheat from Canada each period. While trade statistics do not go to the detail of protein, we know anecdotally that these will be primarily high protein grades for the milling industry.

The imports of high protein wheat help to build the gluten required in bread production, complimenting UK wheat in the grist. However, this season is looking to be a challenging one for high protein grades, particularly in North America.

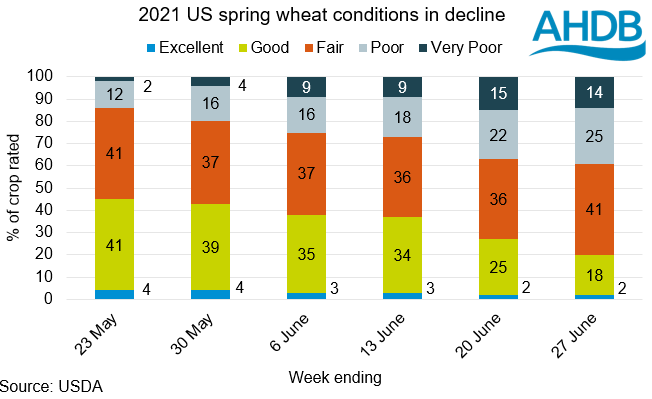

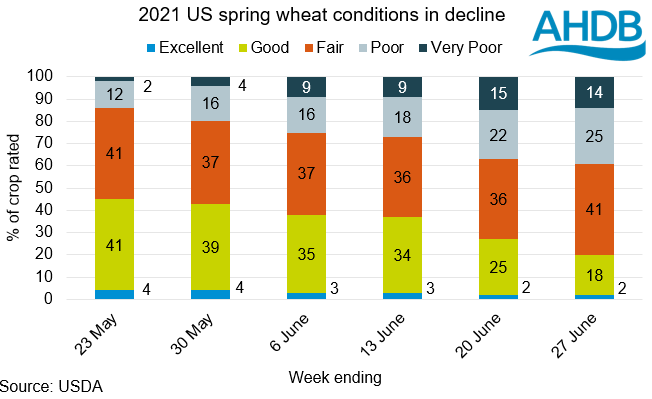

Hot, dry weather across the US plains and Canadian prairies has seen the crop condition of spring wheat deteriorate. In the most recent US crop progress report, released yesterday, the proportion of spring wheat rated “good” or “excellent” was just 20%. This is the lowest for this time of the season since 1988.

Even if we include the proportion of the crop rated as “fair” (41%), conditions remain at their worst point for more than three decades. While the UK imports very little US wheat, prices for the crop act as a benchmark on which Canadian wheat is priced.

Minneapolis spring wheat futures have rocketed over recent weeks. The premium to Chicago wheat futures ended during early trading this morning at $77.16/t. This is the highest premium since November 2017.

The outlook for spring wheat continues to look challenging, with another fortnight of limited rains in the high plains and Canadian prairies.

What does this mean for the UK market?

If availability of high protein wheat is lacking from North America, we are likely to be more dependent on German E wheat, to support domestic crops. The focus on the German crop is likely to be amplified, given flour containing too high a proportion of non-EU wheat is subject to a tariff when entering the EU, under Rules of Origin legislation.

For UK pricing, the increased premium for high protein wheat may support domestic milling wheat premiums.

Yesterday, imported German E milling wheat (14% protein) was quoted at £229.50/t for August delivery. On Friday, UK group 1 milling wheat delivered into the North West was quoted at £198.00/t for harvest delivery.

Protein premiums push higher

Join the 3.6K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch

The imports of high protein wheat help to build the gluten required in bread production, complimenting UK wheat in the grist. However, this season is looking to be a challenging one for high protein grades, particularly in North America.

Hot, dry weather across the US plains and Canadian prairies has seen the crop condition of spring wheat deteriorate. In the most recent US crop progress report, released yesterday, the proportion of spring wheat rated “good” or “excellent” was just 20%. This is the lowest for this time of the season since 1988.

Even if we include the proportion of the crop rated as “fair” (41%), conditions remain at their worst point for more than three decades. While the UK imports very little US wheat, prices for the crop act as a benchmark on which Canadian wheat is priced.

Minneapolis spring wheat futures have rocketed over recent weeks. The premium to Chicago wheat futures ended during early trading this morning at $77.16/t. This is the highest premium since November 2017.

The outlook for spring wheat continues to look challenging, with another fortnight of limited rains in the high plains and Canadian prairies.

What does this mean for the UK market?

If availability of high protein wheat is lacking from North America, we are likely to be more dependent on German E wheat, to support domestic crops. The focus on the German crop is likely to be amplified, given flour containing too high a proportion of non-EU wheat is subject to a tariff when entering the EU, under Rules of Origin legislation.

For UK pricing, the increased premium for high protein wheat may support domestic milling wheat premiums.

Yesterday, imported German E milling wheat (14% protein) was quoted at £229.50/t for August delivery. On Friday, UK group 1 milling wheat delivered into the North West was quoted at £198.00/t for harvest delivery.

Protein premiums push higher

Join the 3.6K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch