- Location

- Stoneleigh

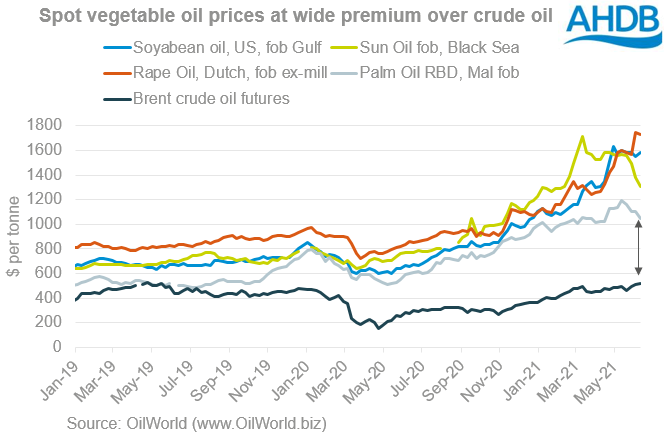

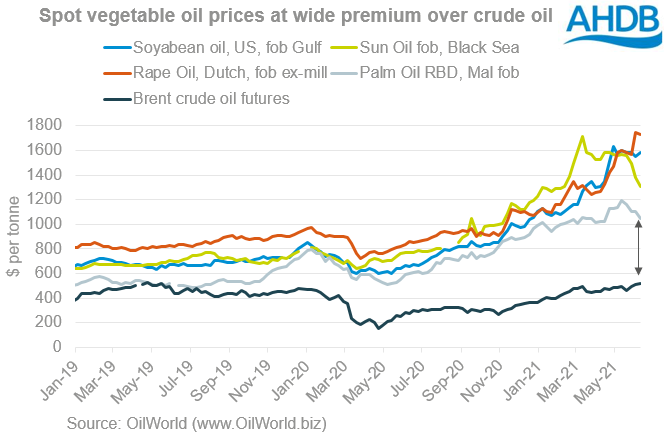

A key factor in pushing up rapeseed prices in 2020/21 was insufficient vegetable oil production to meet demand. This had two causes:

Bigger crops on the way

Current forecasts show bigger supplies of rapeseed and sunflower seed in 2021/22, along with a recovery in palm oil output. If confirmed, these could be enough to move the market back into surplus and enable some stock rebuilding and could dent prices once crops are harvested.

- Rapeseed supplies to stay tight

- Bigger sunflower crops on the way

- Bigger soyabean crops expected too – eyes on the US area

- Potential rise in palm oil output dependent on COVID

Stocks of rapeseed and sunflower seed are very low, so the market is very sensitive to any threat to yields. This is arguably keeping a fair amount risk premium in the market. The risk is if good crops are harvested, prices could come under more pressure.

Appetite destruction?

The world needs even more vegetable oil in 2021/22. The USDA forecasts consumption to rise by 4.1% to 213.0Mt, with more needed for both food and industrial uses.

But, there are a few things which could reduce this demand:

- Could there be exemptions to biodiesel mandates?

- A slower Indian COVID recovery

- Crude oil production catches up with demand

Lower vegetable oil demand, would reduce vegetable prices and so likely the crush margins for oilseeds. This would in turn reduce demand for oilseeds, including rapeseed, leading to lower prices. But, until there is evidence that these will occur, the forecasts continue to point to a rise in vegetable oil demand next season.

Final thoughts

Rapeseed prices could face pressure from higher palm oil, sunflower seed and soyabean production later this year, with global output set to rise in 2021/22. There is a lot of uncertainty at present around demand and the world economic recovery from COVID-19.

The forecasts point to vegetable oil production slightly exceeding demand in 2021/22. Yet with a small surplus expected, and low stocks globally, it seems likely that there will still be underlying support in the market.

Rapeseed could ease if palm oil and sunflower supplies rise

Join the 3.6K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch

- Smaller sunflower seed crops following challenging weather in Ukraine, Russia, and parts of the EU-27. The global crop shrank by 9% in 2020/21.

- Palm oil production continued to be constrained. Measures to combat COVID-19 caused labour shortages in the top two producing countries in 2019/20. This reduced palm oil production by 2% from 2019/20 levels. The ongoing pandemic measures, along with heavy rain in the early part of 2021, meant global production only recovered by 1% in 2020/21.

Bigger crops on the way

Current forecasts show bigger supplies of rapeseed and sunflower seed in 2021/22, along with a recovery in palm oil output. If confirmed, these could be enough to move the market back into surplus and enable some stock rebuilding and could dent prices once crops are harvested.

- Rapeseed supplies to stay tight

- Bigger sunflower crops on the way

- Bigger soyabean crops expected too – eyes on the US area

- Potential rise in palm oil output dependent on COVID

Stocks of rapeseed and sunflower seed are very low, so the market is very sensitive to any threat to yields. This is arguably keeping a fair amount risk premium in the market. The risk is if good crops are harvested, prices could come under more pressure.

Appetite destruction?

The world needs even more vegetable oil in 2021/22. The USDA forecasts consumption to rise by 4.1% to 213.0Mt, with more needed for both food and industrial uses.

But, there are a few things which could reduce this demand:

- Could there be exemptions to biodiesel mandates?

- A slower Indian COVID recovery

- Crude oil production catches up with demand

Lower vegetable oil demand, would reduce vegetable prices and so likely the crush margins for oilseeds. This would in turn reduce demand for oilseeds, including rapeseed, leading to lower prices. But, until there is evidence that these will occur, the forecasts continue to point to a rise in vegetable oil demand next season.

Final thoughts

Rapeseed prices could face pressure from higher palm oil, sunflower seed and soyabean production later this year, with global output set to rise in 2021/22. There is a lot of uncertainty at present around demand and the world economic recovery from COVID-19.

The forecasts point to vegetable oil production slightly exceeding demand in 2021/22. Yet with a small surplus expected, and low stocks globally, it seems likely that there will still be underlying support in the market.

Rapeseed could ease if palm oil and sunflower supplies rise

Join the 3.6K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch