- Location

- Stoneleigh

Weather and crop conditions continue to drive day-to-day movements in grain markets.

Stocks of grain held by major exporting countries are thin. Last week’s USDA report showed more potential for stocks to recover next season than some in the industry expected, pushing prices lower. But, that potential for recovery is still only small, so any threat to global crops is still causing swings in market sentiment and so prices.

Slow planting bolstered maize futures…

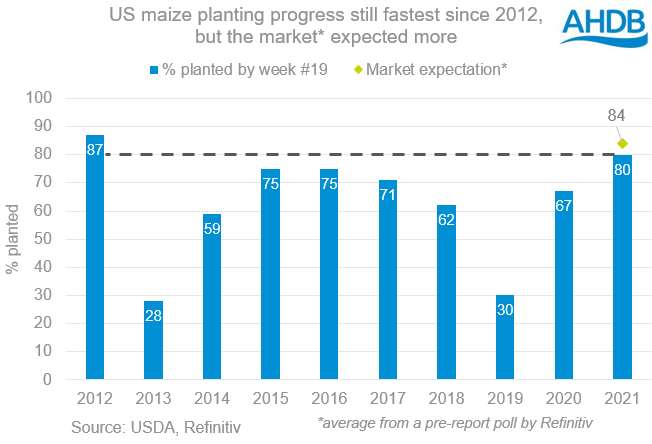

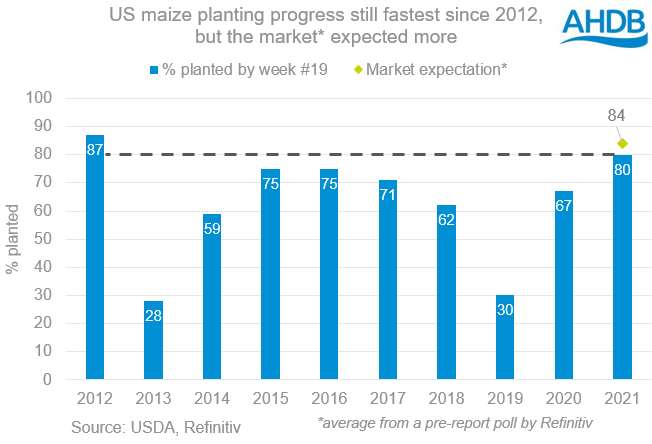

US farmers planted less maize than the market expected by 16 May. Any delays to the US crop will have implications for US supplies in the last days of the season because of low stocks. The planting progress data, and new export demand, offered some support to old crop maize prices. Chicago maize futures for Jul-21 rose $3.45/t to $256.89/t yesterday.

Private exporters reporting another 1.7Mt of sales of maize to China for 2021/22 delivery. This reminded the market of that Chinese demand remains historically strong. So although, the Dec-21 contract declined by $2.16/t yesterday to $211.52/t, it is trading higher today (as at midday).

…while wet weather weighed on wheat

Wheat futures prices on both sides of the Atlantic fell yesterday due to rain in key wheat growing areas. Paris wheat Dec-21 futures fell €3.75/t to €214.00/t, while Chicago wheat futures fell $2.57/t to $258.19/t.

Northern US states and parts of Canada are expecting rain this week. Soil moisture is low in these areas, which grow mainly spring wheat, so rain would be very welcome. Spring wheat planting is well ahead of average in the US and the top Canadian wheat growing province, Saskatchewan. However, cold temperatures are slowing planting progress in the other Canadian Prairie provinces, Manitoba and Alberta.

Rain also fell over the weekend in Germany, and more is expected this week. Crops are behind typical development and the rain may help them to catch up. Rain is also forecast for France.

However, it’s not one-sided for wheat. Over half (53%) the US winter wheat crop is now at ear emergence (5 percentage points back on the 5-year average) and so more sensitive to adverse weather. Coupled with this, the proportion of the crop rated as good or excellent slipped slightly from 49% last week to 48% as at 16 May.

With demand remaining strong, fundamentals and the sentiment surrounding these may well continue to cause price swings as the season continues. As such, they will remain key watch points for all major grain exporters.

Sentiment and weather driving grain markets

Join the 3.5K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch

Stocks of grain held by major exporting countries are thin. Last week’s USDA report showed more potential for stocks to recover next season than some in the industry expected, pushing prices lower. But, that potential for recovery is still only small, so any threat to global crops is still causing swings in market sentiment and so prices.

Slow planting bolstered maize futures…

US farmers planted less maize than the market expected by 16 May. Any delays to the US crop will have implications for US supplies in the last days of the season because of low stocks. The planting progress data, and new export demand, offered some support to old crop maize prices. Chicago maize futures for Jul-21 rose $3.45/t to $256.89/t yesterday.

Private exporters reporting another 1.7Mt of sales of maize to China for 2021/22 delivery. This reminded the market of that Chinese demand remains historically strong. So although, the Dec-21 contract declined by $2.16/t yesterday to $211.52/t, it is trading higher today (as at midday).

…while wet weather weighed on wheat

Wheat futures prices on both sides of the Atlantic fell yesterday due to rain in key wheat growing areas. Paris wheat Dec-21 futures fell €3.75/t to €214.00/t, while Chicago wheat futures fell $2.57/t to $258.19/t.

Northern US states and parts of Canada are expecting rain this week. Soil moisture is low in these areas, which grow mainly spring wheat, so rain would be very welcome. Spring wheat planting is well ahead of average in the US and the top Canadian wheat growing province, Saskatchewan. However, cold temperatures are slowing planting progress in the other Canadian Prairie provinces, Manitoba and Alberta.

Rain also fell over the weekend in Germany, and more is expected this week. Crops are behind typical development and the rain may help them to catch up. Rain is also forecast for France.

However, it’s not one-sided for wheat. Over half (53%) the US winter wheat crop is now at ear emergence (5 percentage points back on the 5-year average) and so more sensitive to adverse weather. Coupled with this, the proportion of the crop rated as good or excellent slipped slightly from 49% last week to 48% as at 16 May.

With demand remaining strong, fundamentals and the sentiment surrounding these may well continue to cause price swings as the season continues. As such, they will remain key watch points for all major grain exporters.

Sentiment and weather driving grain markets

Join the 3.5K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch