- Location

- Stoneleigh

As we close in on the new season, supply concerns have been easing as global weather improved. With low US stocks, the market is sensitive to any ‘new’ news. Yesterday, two big global grain players had ‘new’ news. EU winter crops and US maize worries have eased, though spring wheat conditions are causing concern.

US

Long awaited rain in the US maize belt eased supply concerns last week, as explained in yesterday’s market report.

There were small declines in the latest USDA crop progress ratings for maize and soyabeans, as expected by the trade. Some improvements are expected to crop conditions going forward as long as forecast rains arrive.

Though the talking point this week emerged on spring wheat conditions, with ‘good’ to ‘excellent’ ratings falling 10% points to 27%. This is the worst ratings in 33 years. This time last year this rating was 75%.

EU

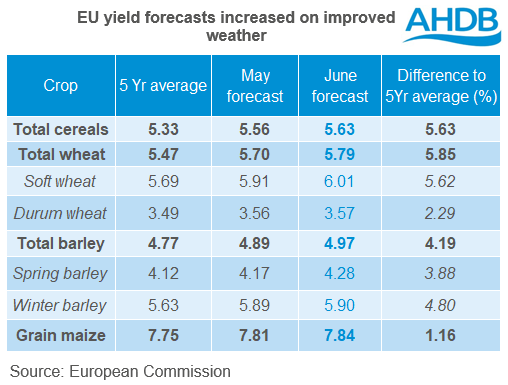

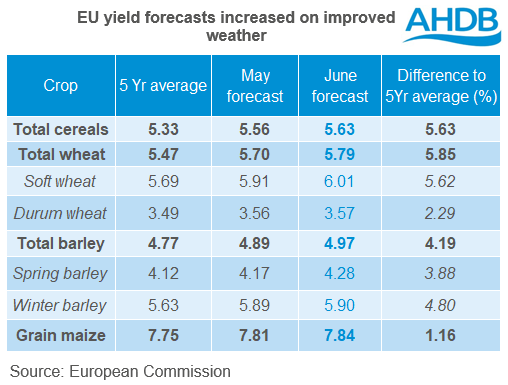

The latest EU crop monitoring (MARS) report increased all EU 2021/22 winter crop yield forecasts, as well as spring barley yield forecasts. This was on account of improved moisture and temperature across the bloc. Forecasts for EU maize continue to be mixed, with cold weather delaying development in some countries. Though overall expected maize yield still above the average.

Using the June MARS yields with Stratégie Grains EU crop area estimates, EU soft wheat production is forecasted as 131.5Mt, up 2.2Mt from last month’s forecast and up 12.1Mt from 2019/20.

Winter crops are looking good, though like the US, concern surrounds spring wheat crops in European Russia. There is worry that dry and warm weather in the spring wheat areas may lead to poorer germination.

What does this mean for new season prices?

Globally, it seems winter crops are looking better than spring crops. Weather will be key in the days ahead as to whether concerns for global spring wheat grow. US northern plains and Canada are forecasted warm and dry for the next 10 days. In Russia, some rain is due over the next week. However, forecasts can change and until quantified, the global wheat picture will stay under review.

Bullish factors

Join the 3.6K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch

US

Long awaited rain in the US maize belt eased supply concerns last week, as explained in yesterday’s market report.

There were small declines in the latest USDA crop progress ratings for maize and soyabeans, as expected by the trade. Some improvements are expected to crop conditions going forward as long as forecast rains arrive.

Though the talking point this week emerged on spring wheat conditions, with ‘good’ to ‘excellent’ ratings falling 10% points to 27%. This is the worst ratings in 33 years. This time last year this rating was 75%.

EU

The latest EU crop monitoring (MARS) report increased all EU 2021/22 winter crop yield forecasts, as well as spring barley yield forecasts. This was on account of improved moisture and temperature across the bloc. Forecasts for EU maize continue to be mixed, with cold weather delaying development in some countries. Though overall expected maize yield still above the average.

Using the June MARS yields with Stratégie Grains EU crop area estimates, EU soft wheat production is forecasted as 131.5Mt, up 2.2Mt from last month’s forecast and up 12.1Mt from 2019/20.

Winter crops are looking good, though like the US, concern surrounds spring wheat crops in European Russia. There is worry that dry and warm weather in the spring wheat areas may lead to poorer germination.

What does this mean for new season prices?

Globally, it seems winter crops are looking better than spring crops. Weather will be key in the days ahead as to whether concerns for global spring wheat grow. US northern plains and Canada are forecasted warm and dry for the next 10 days. In Russia, some rain is due over the next week. However, forecasts can change and until quantified, the global wheat picture will stay under review.

Bullish factors

- Spring wheat conditions poor in US and desperate for rain. Rainfall in Russia needs to arrive as forecast.

- Favourable weather in the US maize belt and EU, global supply looks stronger than a few weeks ago. Higher production year-on-year, especially in the EU, is likely to bring pressure on UK new-crop grain prices.

- Whilst supply is still being formed, long-term demand from China still underpins sentiment.

Join the 3.6K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch