- Location

- Stoneleigh

Tomorrow, the latest 2021/22 UK cereals supply and demand estimates will be published.

Ahead of this, I will be looking at HMRC trade data season-to-date headline figures. With tight domestic grain supply and demand, can an updated view of trade alter this balance?

In the March cereals supply and demand estimates, full season wheat imports were estimated at 1.50Mt. However, since then, global and domestic trading dynamics have changed. As a result, and considering wheat imports have now reached 1.51Mt as explained above, this forecast will likely see an increase.

An outlook for higher wheat imports than originally forecasted could be surprising, considering the tight global supply we find ourselves in.

However, it is important to look at the domestic supply balance. Domestic supply and demand has been tight, with the market understood to be lacking liquidity in domestic wheat selling.

Be sure to look tomorrow at the revised import number and how this may impact on the balance heading into next season.

However, according to customs surveillance data, the EU Commission record that they have imported 112.5Kt from the UK up to 23 May.

Therefore, we may see a change in the oat trade forecasts too as a result in tomorrow’s balance sheet release.

The domestic barley market continues to remain tight, and with wheat and barley at record high prices, maize may look to fulfil some demand.

As such, we have seen changes in trade dynamics whether this be competitive UK grains being exported or imported grains looking to ease the tight supply picture.

Be sure to look at the UK cereals supply and demand estimates, due to be released tomorrow.

Today's Grain Market Daily on the AHDB website - UK trade, shifting the balance of domestic S&D?

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.

Ahead of this, I will be looking at HMRC trade data season-to-date headline figures. With tight domestic grain supply and demand, can an updated view of trade alter this balance?

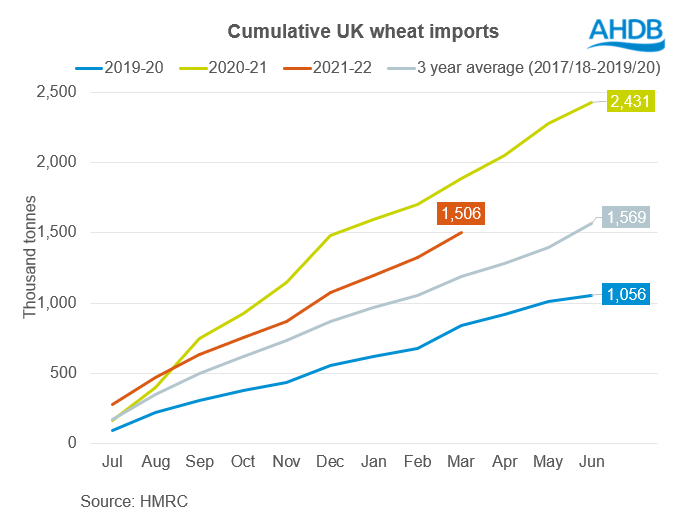

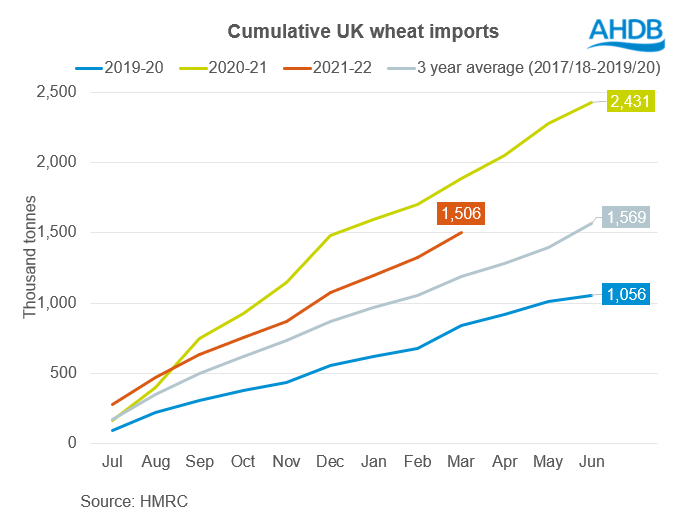

Wheat imports strong

Wheat (including durum) imported season-to-date (July to March) totals 1.51Mt. In March, the HMRC recorded 88.2Kt of wheat arriving from Canada. This brings total Canadian imported wheat this season to 385.2Kt. Consistent imports from the EU continue also.

In the March cereals supply and demand estimates, full season wheat imports were estimated at 1.50Mt. However, since then, global and domestic trading dynamics have changed. As a result, and considering wheat imports have now reached 1.51Mt as explained above, this forecast will likely see an increase.

An outlook for higher wheat imports than originally forecasted could be surprising, considering the tight global supply we find ourselves in.

However, it is important to look at the domestic supply balance. Domestic supply and demand has been tight, with the market understood to be lacking liquidity in domestic wheat selling.

Be sure to look tomorrow at the revised import number and how this may impact on the balance heading into next season.

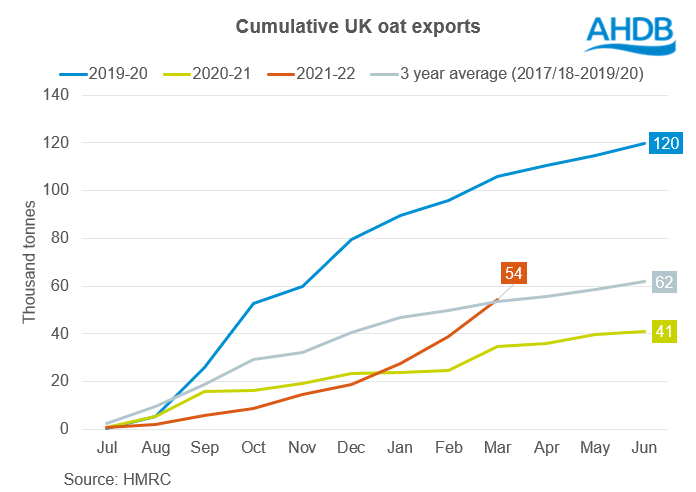

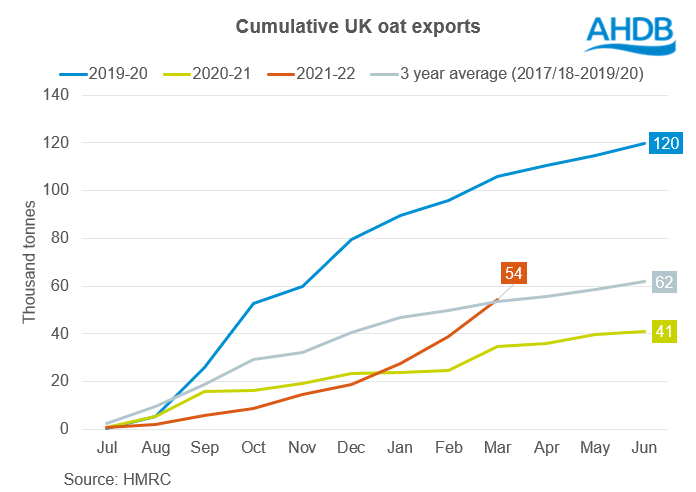

Oat exports, stronger?

Another area I wanted to discuss today is oat exports. In the last forecast, we set oat exports at 100.0Kt due to the price competitiveness of UK oats. Season-to-date HMRC data has recorded that the UK have exported 54.4Kt (July to March), with a pickup in March recording 15.4Kt.

However, according to customs surveillance data, the EU Commission record that they have imported 112.5Kt from the UK up to 23 May.

Therefore, we may see a change in the oat trade forecasts too as a result in tomorrow’s balance sheet release.

Feed grain balance - maize on for a comeback?

Finally, maize imports will be a watchpoint in tomorrow’s update. Considering the current prices for feed wheat and feed barley, maize imports are looking more attractive.The domestic barley market continues to remain tight, and with wheat and barley at record high prices, maize may look to fulfil some demand.

To conclude

A lot has changed to alter the global supply and demand balance in the past few months, with the outbreak of the war between Russia and Ukraine. As a result, we have seen record prices recorded for global and domestic grain.As such, we have seen changes in trade dynamics whether this be competitive UK grains being exported or imported grains looking to ease the tight supply picture.

Be sure to look at the UK cereals supply and demand estimates, due to be released tomorrow.

Today's Grain Market Daily on the AHDB website - UK trade, shifting the balance of domestic S&D?

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.