- Location

- Stoneleigh

Black Sea maize is a common sight in UK import programmes, especially in tight supply seasons. With maize markets enjoying a high-price season, will this carry on to new-crop and reduce the pressure that more “typical” maize prices have had on feed markets?

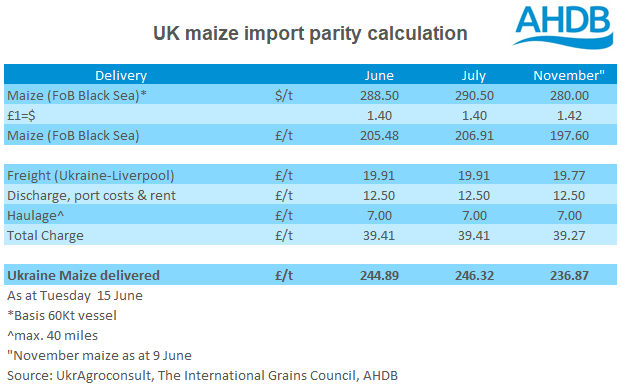

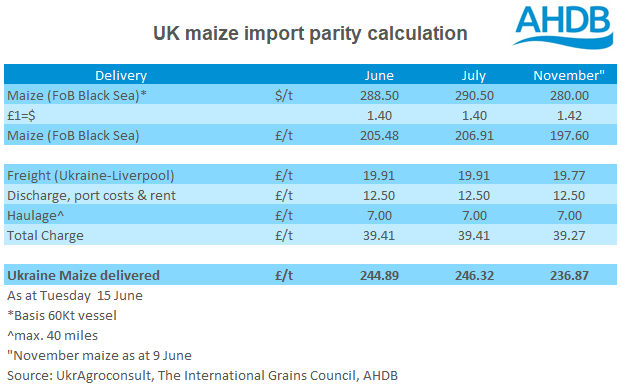

Forward FOB prices for Black Sea maize were quoted at $280.00/t (£198.42/t) for Oct – Nov shipment as of 09 June. Though a forward price, this does set a high ‘price floor’ for domestic feed prices to potentially base off. For context, feed wheat delivered into East Anglia was quoted at £175.00/t for November delivery as at 10 June.

Forecasts for the Ukrainian maize crop sit at 37.50Mt, 22% above the 5-year average, according to the USDA. Of this, 30.50Mt is signposted as an export figure, 25% above the five-year average. If realised, this could be a bumper year for the Ukrainian maize crop.

Due to an initial setback to the planting campaign, it is estimated maize crop development is 25-35% behind last season, according to UkrAgroConsult. Weather forecasts as always will be a key watch point to determine if crop yields have been affected.

The Ukrainian Grain Association recently signed a memorandum with China for ‘co-operation and agricultural development’. This positive relationship is a likely factor in increased Chinese imports of Ukrainian grain. Ukrainian maize shipments to China for Oct-April were at 7.34Mt, significantly higher than the 5.5Mt shipped for the entire 2019/20 marketing year.

Increased Chinese maize demand will likely account for a larger proportion of Ukraine’s maize exports, especially with the recent memorandum enhancing the relationship between the two countries.

From a UK perspective, this could be somewhat beneficial for grain prices, but perhaps less so for feed purchasers. Reduced UK imports of Ukrainian maize could lend support for new-crop barley prices, but only if other options are tight. With wheat making a return to feed rations next season, barley and imported maize demand could waiver should there not be the price incentive to maintain inclusion.

Ukrainian maize situation for UK feed markets next season

Join the 3.6K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch

Forward FOB prices for Black Sea maize were quoted at $280.00/t (£198.42/t) for Oct – Nov shipment as of 09 June. Though a forward price, this does set a high ‘price floor’ for domestic feed prices to potentially base off. For context, feed wheat delivered into East Anglia was quoted at £175.00/t for November delivery as at 10 June.

Forecasts for the Ukrainian maize crop sit at 37.50Mt, 22% above the 5-year average, according to the USDA. Of this, 30.50Mt is signposted as an export figure, 25% above the five-year average. If realised, this could be a bumper year for the Ukrainian maize crop.

Due to an initial setback to the planting campaign, it is estimated maize crop development is 25-35% behind last season, according to UkrAgroConsult. Weather forecasts as always will be a key watch point to determine if crop yields have been affected.

The Ukrainian Grain Association recently signed a memorandum with China for ‘co-operation and agricultural development’. This positive relationship is a likely factor in increased Chinese imports of Ukrainian grain. Ukrainian maize shipments to China for Oct-April were at 7.34Mt, significantly higher than the 5.5Mt shipped for the entire 2019/20 marketing year.

Increased Chinese maize demand will likely account for a larger proportion of Ukraine’s maize exports, especially with the recent memorandum enhancing the relationship between the two countries.

From a UK perspective, this could be somewhat beneficial for grain prices, but perhaps less so for feed purchasers. Reduced UK imports of Ukrainian maize could lend support for new-crop barley prices, but only if other options are tight. With wheat making a return to feed rations next season, barley and imported maize demand could waiver should there not be the price incentive to maintain inclusion.

Ukrainian maize situation for UK feed markets next season

Join the 3.6K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch