- Location

- Stoneleigh

The March world supply and demand estimates report (WASDE) released yesterday was met with a passing glance by grain markets. The report was slightly bearish in its sentiment with minor changes made ahead of the April WASDE and the US grain stocks report at the end of the month. Data this morning from FranceAgriMer has had a bearish effect on European wheat markets.

The few alterations made were to an extent known, and so offered little change for markets. Australian wheat figures was one such change, with production bumped to a record 33Mt, to match ABARES estimates. Recently, ABARES released a forecast of 25Mt for next season, reflecting more average yields expected.

China's wheat import figure increased 500Kt to 10.5Mt, reflecting the well-known demand China has for feed commodities this season. This import figure is 158% higher than the five-year average and is the largest wheat import level since the 1995/96 season. Chinese maize and soyabean import estimates are 467% and 11% respectively above five-year averages, but were left unchanged from the February report.

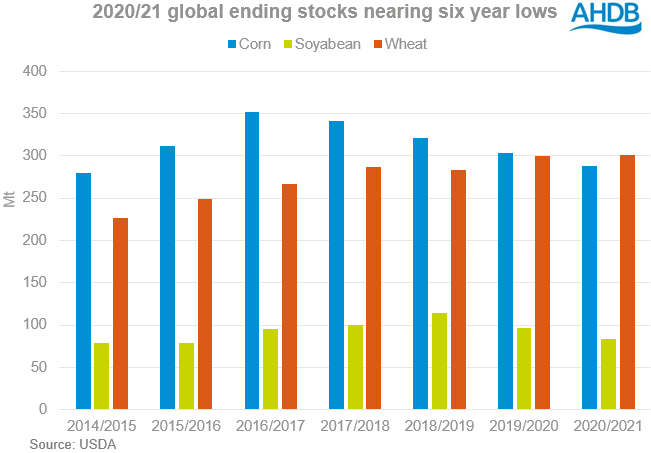

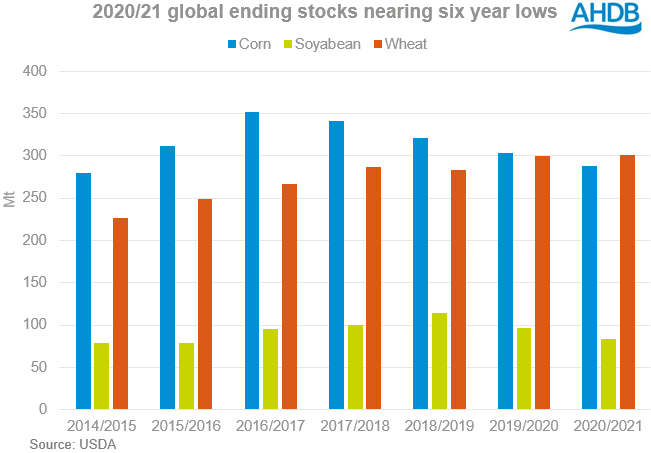

In the report, US ending stocks of maize and soyabeans were left unchanged at seven year lows. Pre-report polls had expected further cuts. Low stocks in the US pushes emphasis onto US weather forecasts in the run-up to planting programmes in April.

This morning, FranceAgriMer increased French soft wheat ending stocks to 2.7Mt, up 0.2Mt last month. French barley and maize ending stocks were also raised 0.1Mt each to 1.1Mt and 2.0Mt respectively. Paris milling wheat futures (May-21) had fallen €0.5/t as of 11.15am this morning to €228.75/t (£195.93/t).

From a UK perspective, the report was relatively unassuming. European grain markets will focus more on wider fundamentals, including the present Russian export tariffs and continuing strong Chinese feed purchases. It is likely the April WASDE will be of greater importance with figures probable to change more after the US grain stocks report release.

https://ahdb.org.uk/news/impact-domestically-from-the-march-wasde-grain-market-daily

Join the 3.4K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch

The few alterations made were to an extent known, and so offered little change for markets. Australian wheat figures was one such change, with production bumped to a record 33Mt, to match ABARES estimates. Recently, ABARES released a forecast of 25Mt for next season, reflecting more average yields expected.

China's wheat import figure increased 500Kt to 10.5Mt, reflecting the well-known demand China has for feed commodities this season. This import figure is 158% higher than the five-year average and is the largest wheat import level since the 1995/96 season. Chinese maize and soyabean import estimates are 467% and 11% respectively above five-year averages, but were left unchanged from the February report.

In the report, US ending stocks of maize and soyabeans were left unchanged at seven year lows. Pre-report polls had expected further cuts. Low stocks in the US pushes emphasis onto US weather forecasts in the run-up to planting programmes in April.

This morning, FranceAgriMer increased French soft wheat ending stocks to 2.7Mt, up 0.2Mt last month. French barley and maize ending stocks were also raised 0.1Mt each to 1.1Mt and 2.0Mt respectively. Paris milling wheat futures (May-21) had fallen €0.5/t as of 11.15am this morning to €228.75/t (£195.93/t).

From a UK perspective, the report was relatively unassuming. European grain markets will focus more on wider fundamentals, including the present Russian export tariffs and continuing strong Chinese feed purchases. It is likely the April WASDE will be of greater importance with figures probable to change more after the US grain stocks report release.

https://ahdb.org.uk/news/impact-domestically-from-the-march-wasde-grain-market-daily

Join the 3.4K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch