- Location

- Stoneleigh

The month of March has brought change and volatility to the vegetable oil and oilseed complex. Throughout March, the May-22 Paris rapeseed futures contract has closed in a range of €190.75/t. The contract peaked at €994.50/t on 22 March. These high prices have provided support for domestic old and new crop rapeseed.

Looking forward there is still an element of unknown around how long the Ukraine-Russia conflict will continue which has provided underlying support. Old crop Ukrainian exports of ag commodities remain limited and planting prospects are under question.

Support for the overall oilseed complex will also come from new crop plantings of Ukrainian sunseed throughout April. UkrAgro Consult suggest the area will mainly reduce in high-risk regions, but these regions are where a significant amount of sunseed is grown.

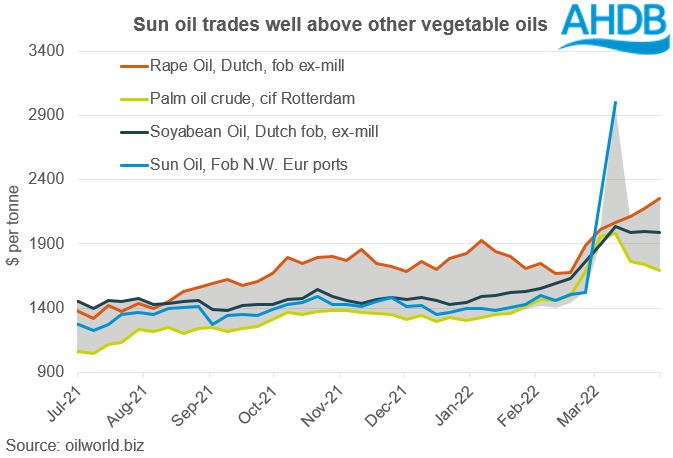

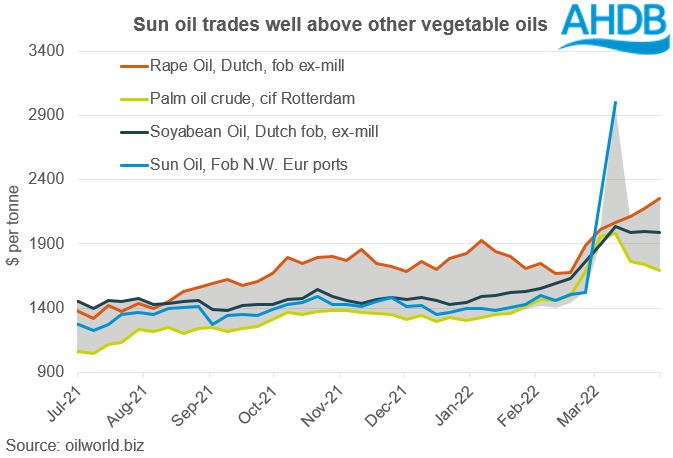

However, recent circumstances have changed this. In March, Oil World’s (oilworld.biz) price index skyrocketed and European vegetable oils were significantly supported, especially for sun oil.

Sun oil was quoted at N.W ports of Europe at $3,000/t on 10 March. Prior to the invasion, sun oil was quoted at $1,525/t, nearly half the price.

Palm oil (cost insurance freight (CIF), Rotterdam) reached a peak of $1,980/t in March, significantly up from $1,685/t quoted in February pre-war. As mentioned, palm would usually act as the floor meaning other oils would usually not drop below this.

Since mid-March, sun oil quotes have been missing from the Oil World price report, but the vegetable oil complex has diverged again. Rape oil is sitting at the top, while Malaysian palm oil is at a relatively large discount again to other edible oils. Palm prices have been reduced in order to attract purchases from big buyers such as China and Pakistan, who have been deterred from high prices.

Other drivers going forward that will be a critical watchpoint in driving your rapeseed price:

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.

Looking forward there is still an element of unknown around how long the Ukraine-Russia conflict will continue which has provided underlying support. Old crop Ukrainian exports of ag commodities remain limited and planting prospects are under question.

Support for the overall oilseed complex will also come from new crop plantings of Ukrainian sunseed throughout April. UkrAgro Consult suggest the area will mainly reduce in high-risk regions, but these regions are where a significant amount of sunseed is grown.

March: the month for high prices

In previous analysis I showed how rape oil for this marketing year sat at the top of the vegetable oil complex. Meanwhile palm is conventionally the floor of vegetable oil prices.However, recent circumstances have changed this. In March, Oil World’s (oilworld.biz) price index skyrocketed and European vegetable oils were significantly supported, especially for sun oil.

Sun oil was quoted at N.W ports of Europe at $3,000/t on 10 March. Prior to the invasion, sun oil was quoted at $1,525/t, nearly half the price.

Palm oil (cost insurance freight (CIF), Rotterdam) reached a peak of $1,980/t in March, significantly up from $1,685/t quoted in February pre-war. As mentioned, palm would usually act as the floor meaning other oils would usually not drop below this.

Since mid-March, sun oil quotes have been missing from the Oil World price report, but the vegetable oil complex has diverged again. Rape oil is sitting at the top, while Malaysian palm oil is at a relatively large discount again to other edible oils. Palm prices have been reduced in order to attract purchases from big buyers such as China and Pakistan, who have been deterred from high prices.

What does the future hold for domestic prices?

Nearby domestic rapeseed prices will likely continue to be elevated until at least northern hemisphere harvest starts. The UK were in tight supply of rapeseed prior to the war and a lack of Black Sea oilseed supplies could exacerbate this. If there is a shortage of sun oil then alternative oils, such as rape oil, could be substituted.Other drivers going forward that will be a critical watchpoint in driving your rapeseed price:

- US soyabean plantings: prospective plantings last week put a slight bearish tone into the market due to larger areas of soyabean predicted. However, US soyabean planting usually commences in May so there is still time for change.

- South America is also a key market driver although much is priced in. The Brazilian 2021/22 crop is nearly confirmed with harvest 81.2% complete (as at 02 April 2022). Argentina’s soyabean harvest is only just underway. The drought hindered crop is somewhat priced into the market but if yields are poorer (or greater) than expected would still likely effect market sentiment.

- A final key watchpoint is surrounding fertiliser. If fertiliser availability issues continue it could constrain Brazil’s expansion in the soyabean acreage for 2022/23. This would have implications for the latter half of the 2022/23 marketing year if production limited.

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.