- Location

- Stoneleigh

Interest rates have steadily been on the rise now for nearly a year, with the current official bank of England rate at 3%. Economist predicting that this figure will peak from early to mid-2023, depending on the depth of this recession and rate of inflation.

Although this rapid inflation is pressuring margins on farms with constant rising costs. But from this we have rising interest rates with some of the best easy-access savings accounts (as at 08 December 2022) offering up to 2.47% to 2.90% on savings (Money Saving Expert).

With money to be made on cash in the bank. Could there be a cost-benefit to selling your harvest-22 crop now instead of continuing to store it until a later date?

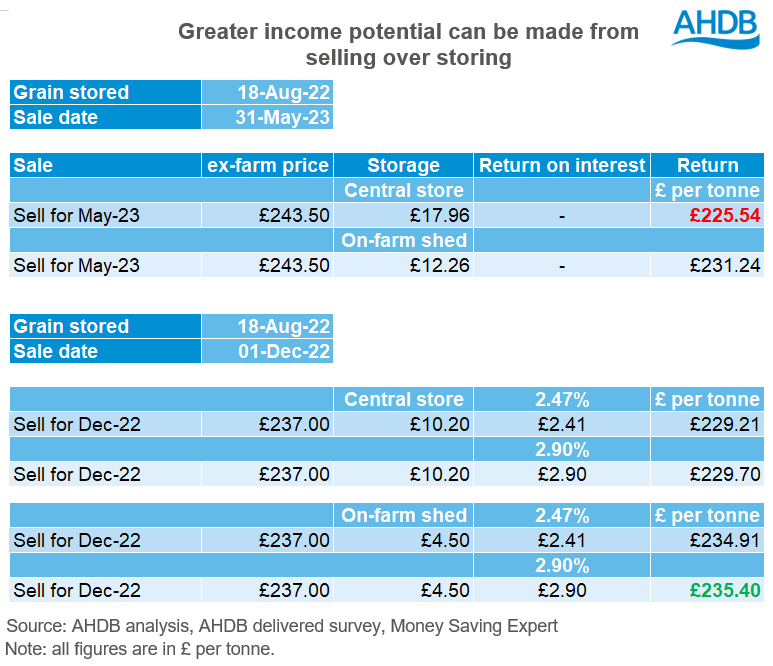

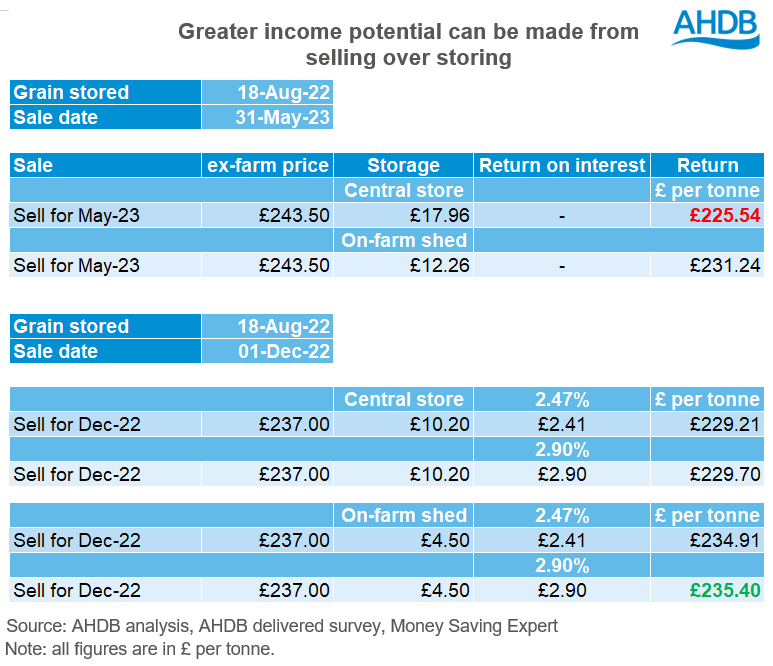

In the analysis below I look into the different scenarios of storing (in both a central store and on farm) or by alternatively selling your grain and gaining from the interest in the bank.

Below is a list of assumptions used in this analysis:

[1] Wheat has been stored from 18 August 2022, to reflect the timely fashion of harvest 2022.

[2] Payment for selling now is assumed that grower receives money in the bank from the start of January – not instantly. Storage until May-23 is an assumed sale of 31 May 2023.

[3] Spot and May 23 feed wheat prices (into East Anglia) are as of 01 December 2022 from the AHDB delivered survey. However, I have taken these values and deducted £7.00/t haulage rate to reflect an ex-farm price, therefore close proximity to both store or feed mill is assumed.

[4] Storage fees are indicative values with an in/out fee of £3.20/t and £2.50/t, respectively. Also, there is a weekly storage cost of £0.30/t a week. Please note that the on-farm storage is the same to reflect depreciation and costs, however, the in/out fee has been deducted.

Fast forward to last week, spot delivered feed wheat into East Anglia was quoted at £244.00/t, very similar to last August. As markets have remain volatile and the continuing of the Black Sea corridor until the end of March 2023, has meant the market has moved down from the highs seen in September and October.

With the market moving down could there be a cost benefit to having cash in the bank instead of storing your grain until May 2023?

As this analysis shows there is potential for greater income opportunities from selling grain now and gaining on the interest in the bank, over continuing to store in the shed until May-2023.

For example, from the scenario and assumptions listed above, selling your grain that has been stored on farm and putting the money in the bank until the end of May 2023 at an interest rate of 2.90% will make the highest income, based on the figures in the introduction. The lowest income is grain in a central store until May 2023.

A large driver of this income ultimately comes down to storage costs and knowing them. With farm margins being squeezed for 2023 taking advantage of cash in the bank over continuing to store harvest-22 crop until May 2023 in some scenarios could be more cost effective and have greater income potential.

Today's Grain Market Daily is now published - Does storing grain peak your interest?

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.

Although this rapid inflation is pressuring margins on farms with constant rising costs. But from this we have rising interest rates with some of the best easy-access savings accounts (as at 08 December 2022) offering up to 2.47% to 2.90% on savings (Money Saving Expert).

With money to be made on cash in the bank. Could there be a cost-benefit to selling your harvest-22 crop now instead of continuing to store it until a later date?

In the analysis below I look into the different scenarios of storing (in both a central store and on farm) or by alternatively selling your grain and gaining from the interest in the bank.

Below is a list of assumptions used in this analysis:

[1] Wheat has been stored from 18 August 2022, to reflect the timely fashion of harvest 2022.

[2] Payment for selling now is assumed that grower receives money in the bank from the start of January – not instantly. Storage until May-23 is an assumed sale of 31 May 2023.

[3] Spot and May 23 feed wheat prices (into East Anglia) are as of 01 December 2022 from the AHDB delivered survey. However, I have taken these values and deducted £7.00/t haulage rate to reflect an ex-farm price, therefore close proximity to both store or feed mill is assumed.

[4] Storage fees are indicative values with an in/out fee of £3.20/t and £2.50/t, respectively. Also, there is a weekly storage cost of £0.30/t a week. Please note that the on-farm storage is the same to reflect depreciation and costs, however, the in/out fee has been deducted.

Do I continue storing my grain?

On August 18 2022, spot feed wheat (into East Anglia) was quoted at £244.50/t, while May-23 was quoted at £258.50/t on the same day. With a £14.00/t premium this would have offered the incentive for farmers to store their grain if their storage costs were under c.£1.50/t per month. Based on the indicative figures above (see, [4]) this carry would have more than covered storing grain on farm but would have not covered grain in a central store.Fast forward to last week, spot delivered feed wheat into East Anglia was quoted at £244.00/t, very similar to last August. As markets have remain volatile and the continuing of the Black Sea corridor until the end of March 2023, has meant the market has moved down from the highs seen in September and October.

With the market moving down could there be a cost benefit to having cash in the bank instead of storing your grain until May 2023?

As this analysis shows there is potential for greater income opportunities from selling grain now and gaining on the interest in the bank, over continuing to store in the shed until May-2023.

For example, from the scenario and assumptions listed above, selling your grain that has been stored on farm and putting the money in the bank until the end of May 2023 at an interest rate of 2.90% will make the highest income, based on the figures in the introduction. The lowest income is grain in a central store until May 2023.

A large driver of this income ultimately comes down to storage costs and knowing them. With farm margins being squeezed for 2023 taking advantage of cash in the bank over continuing to store harvest-22 crop until May 2023 in some scenarios could be more cost effective and have greater income potential.

Today's Grain Market Daily is now published - Does storing grain peak your interest?

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.