- Location

- Stoneleigh

Over the course of the week so far grain markets have felt pressure. This is despite some stronger demand for European wheat with French wheat sales to China and talk of Polish or German wheat being booked in the US.

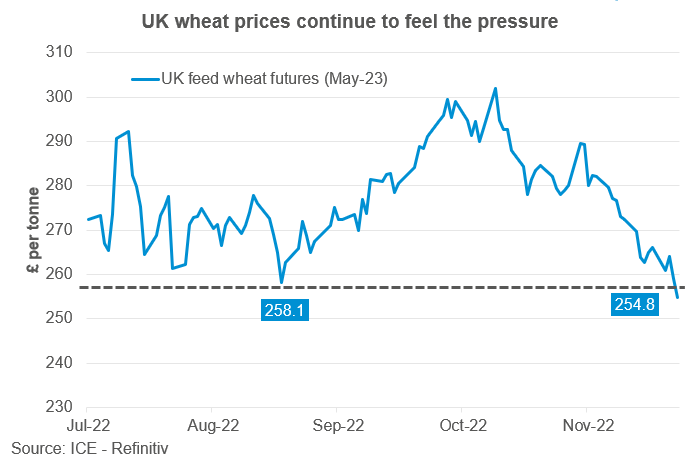

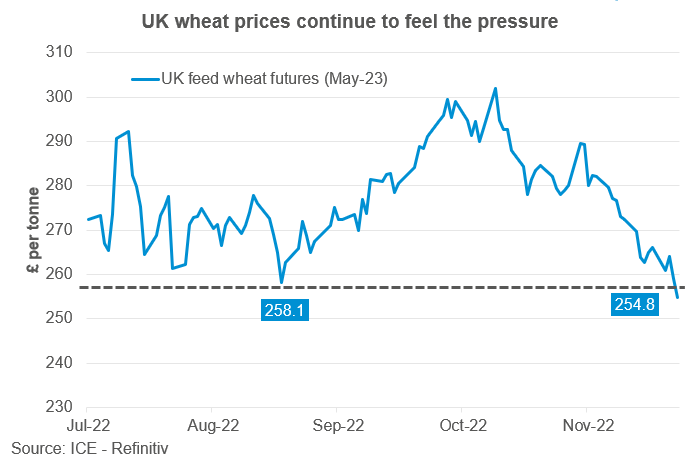

UK wheat futures (May-23) closed at £254.80/t yesterday, down £11.30/t since last Friday’s close. Interestingly yesterday this contract broke its previous support level in August where the contract closed at a low of £258.10/t.

UK wheat prices have followed the global wheat markets down so far this week. Sterling strengthening against both the US dollar and euro has meant domestic prices have been pressured further.

It appears that over this week the agreed extension to the Black Sea grain corridor last week for another 120 days has weighed on the market.

Other factors pressuring grain markets has been the rise in COVID-19 cases in China. In some areas lockdown restrictions have been tightened, which is expected to reduce demand for ag commodities, especially soyabeans.

Despite this soyabeans are currently maintaining elevated support due to demand for soya oil and further potential weather problems in Argentina. As mentioned in the market commentary, Argentina’s current soyabean planting campaign is facing delays with plantings currently below the 5-year-average of 40.2% (Buenos Aires Grain Exchange). Weather in Argentina is a key watchpoint in the coming weeks to ensure there isn’t a reduction to this soyabean area. Fortunately, scattered rains are again forecast from the start of next week, but this is a key focus currently.

For rapeseed, there has been continued pressure so far this week with Paris rapeseed futures closing at €588.75/t yesterday, down €21.25/t from last Friday. This is largely following pressure in Canadian canola markets, which have come down following speculators selling positions. Also, pressure in crude oil markets which are down due to limited Chinese demand, larger than expected U.S. gasoline inventories and the price cap on Russian oil being considered by the G7 may be above the current market level, which may not impact global supply much.

Although the US markets have been closed for some of this week due to public holiday, it appears that the signing of the Black Sea corridor seems to have pressured wheat markets, although volatility will remain going forward. Key watch points over these next couple of weeks are the plantings of maize and soyabean crops in Argentina and Brazil.

Today's Grain Market Daily is now published - What has been driving my ex-farm wheat price?

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.

UK wheat futures (May-23) closed at £254.80/t yesterday, down £11.30/t since last Friday’s close. Interestingly yesterday this contract broke its previous support level in August where the contract closed at a low of £258.10/t.

UK wheat prices have followed the global wheat markets down so far this week. Sterling strengthening against both the US dollar and euro has meant domestic prices have been pressured further.

It appears that over this week the agreed extension to the Black Sea grain corridor last week for another 120 days has weighed on the market.

Other factors pressuring grain markets has been the rise in COVID-19 cases in China. In some areas lockdown restrictions have been tightened, which is expected to reduce demand for ag commodities, especially soyabeans.

Despite this soyabeans are currently maintaining elevated support due to demand for soya oil and further potential weather problems in Argentina. As mentioned in the market commentary, Argentina’s current soyabean planting campaign is facing delays with plantings currently below the 5-year-average of 40.2% (Buenos Aires Grain Exchange). Weather in Argentina is a key watchpoint in the coming weeks to ensure there isn’t a reduction to this soyabean area. Fortunately, scattered rains are again forecast from the start of next week, but this is a key focus currently.

For rapeseed, there has been continued pressure so far this week with Paris rapeseed futures closing at €588.75/t yesterday, down €21.25/t from last Friday. This is largely following pressure in Canadian canola markets, which have come down following speculators selling positions. Also, pressure in crude oil markets which are down due to limited Chinese demand, larger than expected U.S. gasoline inventories and the price cap on Russian oil being considered by the G7 may be above the current market level, which may not impact global supply much.

Although the US markets have been closed for some of this week due to public holiday, it appears that the signing of the Black Sea corridor seems to have pressured wheat markets, although volatility will remain going forward. Key watch points over these next couple of weeks are the plantings of maize and soyabean crops in Argentina and Brazil.

Today's Grain Market Daily is now published - What has been driving my ex-farm wheat price?

For information on price direction make sure to subscribe to Grain Market Daily and Market Report from our team.