- Location

- Stoneleigh

As we head into spring, at AHDB we are starting data collection for the Planting and Variety Survey.

The survey provides an estimate of the area and variety breakdown of cereals and oilseed rape to be harvested in Great Britain.

Data accuracy and transparency is key to markets. As such, accuracy in data collection is vital. To that end, it is critical that as AHDB, we produce accurate, unbiased data which the industry can trust.

But, we can only do this with your input!

With that in mind, we would ask for 5 minutes of your time to complete the planting survey form which will be live next week.

What is in it for me?

Knowing your domestic market is a key part of forming marketing strategies. The regional breakdown of GB crop area and varieties can help with this.

The survey results inform GB and regional supply and demand. This helps to determine local prices and identify opportunities for selling.

Having independent, impartial data behind your strategy is more crucial than ever in a post-subsidy world.

Accurate data before harvest 2021

AHDB is the only source of independent and impartial area and variety data pre-Harvest. This allows us to give an early indication of cereal and oilseed output.

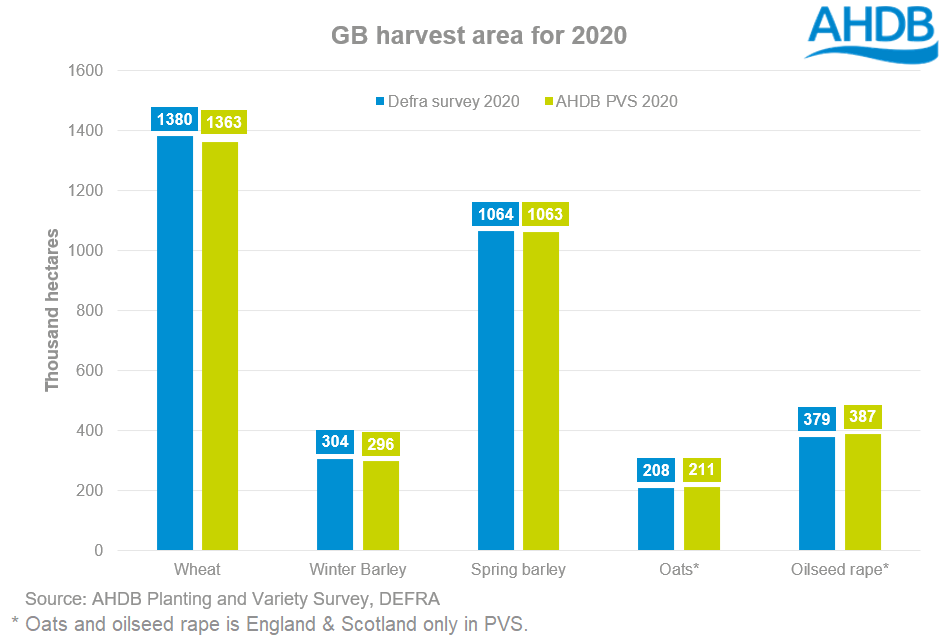

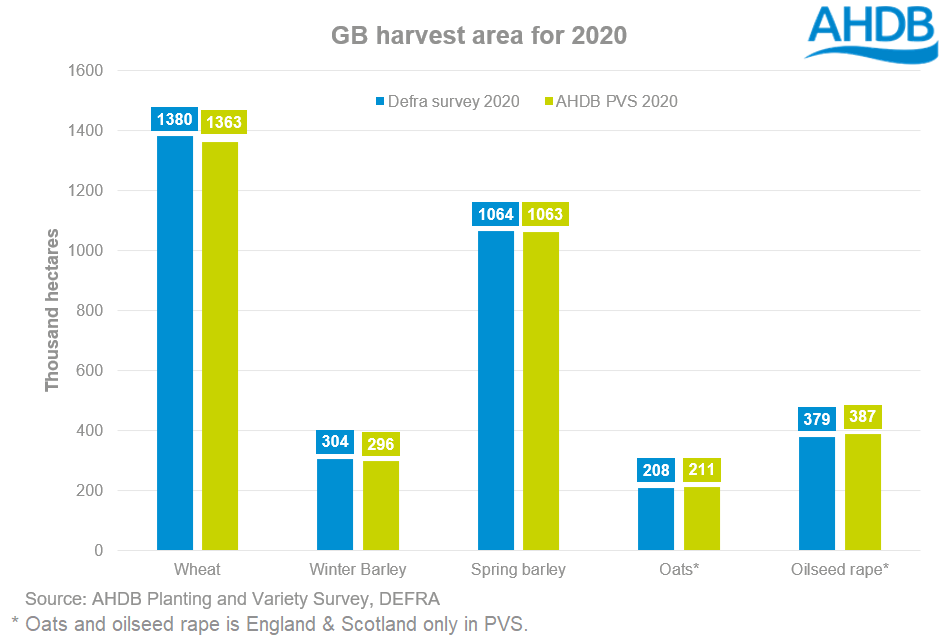

In the past our data has aligned with Defra outputs, which are published several months after harvest.

Further, our independent data confirms that Defra outputs are aligned and correct.

The graph shows last year’s AHDB Planting & Variety Survey results against the Defra June survey results.

The AHDB Planting and Variety Survey was published in July 2020.The final Defra figures were not published until December 2020.

Quantifying our domestic production

The Planting and Variety Survey can provide indicative insight into production for the upcoming Harvest. This can be done by applying 5-year-low, average and high yields to the area figure.

This production figure can be used in balance sheet estimates to confirm the stock situation as we head into the 2021/22 marketing year. This aids transparency and informs price direction during the season, helping you in making selling decisions.

Delivered premiums & regional markets

The supply and demand of grain directly influences delivered premiums. The premium is the value of wheat paid by an end user, over the value of futures. This value, less haulage determines your ex-farm price.

The regional breakdowns in the survey help to formulate regional supply and demand. This, in turn, influences local delivered premiums. Tightness in a region means that premiums need to rise to attract supply.

In the North East, the balance of supply and demand, especially when both bioethanol plants are running, is tight. If supply were to be tighter than expected, this premium would need to extend, albeit limited by the value of imports.

The survey also gives a regional breakdown of wheat by UK Flour group (formerly nabim), if data validation is met. This helps to inform milling premiums and allows you to take advantage of specific markets.

Conclusions

In a post-subsidy world agriculture is going to go through a seismic wave of change. Gross margins, cost of production and marketing strategies are going to be the foundation of any flourishing agri-business.

To aid market transparency and help with marketing decisions, the industry needs accurate, impartial data.

You can help by spending a moment filling out the Planting and Variety Survey, which goes live next week.

https://ahdb.org.uk/news/analyst-in...-to-fill-out-the-ahdb-planting-variety-survey

Join the 3.5K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch

The survey provides an estimate of the area and variety breakdown of cereals and oilseed rape to be harvested in Great Britain.

Data accuracy and transparency is key to markets. As such, accuracy in data collection is vital. To that end, it is critical that as AHDB, we produce accurate, unbiased data which the industry can trust.

But, we can only do this with your input!

With that in mind, we would ask for 5 minutes of your time to complete the planting survey form which will be live next week.

What is in it for me?

Knowing your domestic market is a key part of forming marketing strategies. The regional breakdown of GB crop area and varieties can help with this.

The survey results inform GB and regional supply and demand. This helps to determine local prices and identify opportunities for selling.

Having independent, impartial data behind your strategy is more crucial than ever in a post-subsidy world.

Accurate data before harvest 2021

AHDB is the only source of independent and impartial area and variety data pre-Harvest. This allows us to give an early indication of cereal and oilseed output.

In the past our data has aligned with Defra outputs, which are published several months after harvest.

Further, our independent data confirms that Defra outputs are aligned and correct.

The graph shows last year’s AHDB Planting & Variety Survey results against the Defra June survey results.

The AHDB Planting and Variety Survey was published in July 2020.The final Defra figures were not published until December 2020.

Quantifying our domestic production

The Planting and Variety Survey can provide indicative insight into production for the upcoming Harvest. This can be done by applying 5-year-low, average and high yields to the area figure.

This production figure can be used in balance sheet estimates to confirm the stock situation as we head into the 2021/22 marketing year. This aids transparency and informs price direction during the season, helping you in making selling decisions.

Delivered premiums & regional markets

The supply and demand of grain directly influences delivered premiums. The premium is the value of wheat paid by an end user, over the value of futures. This value, less haulage determines your ex-farm price.

The regional breakdowns in the survey help to formulate regional supply and demand. This, in turn, influences local delivered premiums. Tightness in a region means that premiums need to rise to attract supply.

In the North East, the balance of supply and demand, especially when both bioethanol plants are running, is tight. If supply were to be tighter than expected, this premium would need to extend, albeit limited by the value of imports.

The survey also gives a regional breakdown of wheat by UK Flour group (formerly nabim), if data validation is met. This helps to inform milling premiums and allows you to take advantage of specific markets.

Conclusions

In a post-subsidy world agriculture is going to go through a seismic wave of change. Gross margins, cost of production and marketing strategies are going to be the foundation of any flourishing agri-business.

To aid market transparency and help with marketing decisions, the industry needs accurate, impartial data.

You can help by spending a moment filling out the Planting and Variety Survey, which goes live next week.

https://ahdb.org.uk/news/analyst-in...-to-fill-out-the-ahdb-planting-variety-survey

Join the 3.5K people who subscribe to our Grain Market Daily publication here - https://ahdb.org.uk/keeping-in-touch